您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

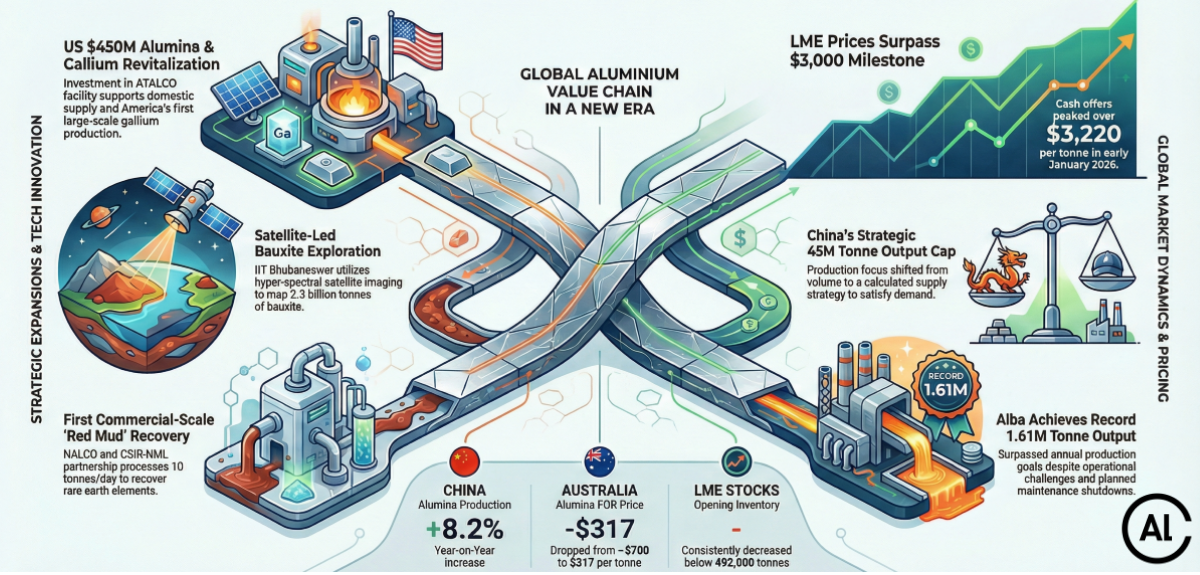

At the beginning of 2026 and in the first half of January, 2026, the global upstream aluminium value chain is stepping into a new era where projects are ramping up, capital is being mobilised, leadership roles are shifting and price signals are becoming more pronounced, all at once. The industry is now at a juncture where it is seeing critical resource movements and explorations, which are driven by technology and calculated partnerships, setting different production achievements and altering market dynamics. The year started with beneficial expansions, which redirected significant structural shifts taking place in the industry.

{alcircleadd}Projects beyond limits

Jushen Logistics Group, via its indirectly held subsidiaries, has secured a three-year contract worth USD 134 million. This deal focuses on moving the bauxite from the port to the ships which are already in queue in Guinea offshore. The contract with customers, which remained unnamed, has been inked by Hong Kong Shenrui Shipping. A dip of 12 per cent year-on-year in the net profit has been reported by the firm, valued at USD 8.5 million. However, the firm's operating revenue showed a good outcome with a good rise of 82 per cent, reaching USD 186 million.

Upstream Weekly Recap by AL Circle Pvt Ltd

VBX Limited updated its Wuudagu bauxite project in northern Western Australia to have stronger assay results from the previously unexplored Wuudagu E and F plateaus, with 96 holes showing consistently thicker and higher-grade bauxite. This new bauxite features elevated aluminium oxide levels and lower silica compared to earlier deposits. The results, which are completely outside the current 95.9 Mt resource, are anticipated to support both an expansion and an increase in confidence across the wider Wuudagu resource base.

IIT Bhubaneswar, India, innovated a satellite-led exploration method using hyper-spectral imaging along with fieldwork, geochemical studies and lab analyses for carefully mapping out potential bauxite deposits in key districts of Odisha. This region of India is deemed to be rich in bauxite, with nearly 2.3 billion tonnes, essential for India’s aluminium production. This approach, which utilises remote sensing technology, has gained recognition from the Odisha government and has been published in a peer-reviewed journal.

The US set up a USD 450 million public-private funding initiative aimed at revitalising ATALCO’s facility in Gramercy, Louisiana. This site is deemed the last alumina refinery to be in operation within the country and the investment marks a steady domestic supply of alumina feedstock. It is also what could be America’s first large-scale gallium production circuit supporting defence, aerospace, semiconductor and advanced technology supply chains. Get into the complete scoop here.

To know more about the global primary aluminium industry 2026 outlook, pre-book the report “Global Aluminium Industry Outlook 2026” at a special price.

Working hand-in-hand in the AL industry

NALCO partnered with the CSIR-National Metallurgical Laboratory (CSIR-NML) to develop a pilot plant which would be capable of processing nearly 10 tonnes per day, making it the first one for India concerning the commercial-scale efforts to recover valuable materials like scandium, alumina, iron and titania from bauxite residue. This partnership was officially inked on January 6, 2026, in Bhubaneswar and is directly related to the growing demand for essential minerals and the challenges of red mud rehabilitation. The collaboration aims towards boosting sustainable aluminium production, fortifying the supply chain for rare earth elements and contributing to the goals of a circular economy.

The Nyinahin bauxite project, in Ghana’s Ashanti Region, secured a medium-term facility agreement of USD 60 million to a consortium that includes The GIADEC, Metalloïd Resources Investment and Ghana Integrated Bauxite Development Limited Company. This way, the firm is able to achieve a financing milestone, aiding in starting the mining activities at Hills 1–3 and gradually expanding operations. The announcement was made in Abu Dhabi on January 14, 2026, aiming to support immediate extraction efforts and set the stage for a fully operational bauxite mine.

Leadership changes are reshaping the AL industry globally

Canyon Resources welcomed Ernst & Young on its board as its new external auditor, taking over from HLB Mann Judd after a thorough review by the board and approval from regulators. The leadership change comes as the company moves into the first phase of bauxite production and aims to bolster its corporate governance and financial reporting practices. By choosing one of the Big Four audit firms, the company is securing growth and its commitment to transparency, which will be formally approved at the upcoming Annual General Meeting.

NALCO made some changes to its board, where it appointed Shri Anil Kumar Singh as the new Commercial Director, starting January 7, 2026. This strategic decision is part of NALCO’s efforts to enhance its commercial leadership as the Navratna aluminium producer, aiming to boost export growth, find the right balance between domestic and international sales in the face of fluctuating global aluminium prices and speed up its digital transformation across commercial operations.

Don’t miss out- Buyers are looking for your products on our B2B platform

Production, price & what not

China, in 2025, saw alumina production of nearly 88.2 million tonnes and primary aluminium output at 44 million tonnes. This closely matches the country’s two-to-one production ratio and the unofficial aluminium cap of 45 million tonnes, showcasing a well-thought-out supply strategy rather than just chasing volume. Alumina production saw a year-on-year increase of about 8.2 per cent, while aluminium output grew by roughly 2 per cent. Refineries and smelters aided in this by balancing their operations to satisfy both domestic demand and export requirements.

Australia’s alumina FOB price, throughout 2025, dropped from nearly USD 700 per tonne in Q4 2024 to about USD 317 per ton by Q4 2025 due to a growing surplus, as production and shipments ramped up against a backdrop of weaker demand in major consuming markets. Additionally, factors like freight costs, currency fluctuations and investor sentiment added to the market’s volatility. As the world’s second-largest alumina supplier, Australia’s pricing serves as a global benchmark. With production and exports expected to increase into the 2025-26 financial year, the pressure on prices highlights a wider supply-demand imbalance that market players will be keeping a close eye on as we move into 2026.

Alba, in 2025, achieved its production goal by surpassing the annual record output of primary aluminium at around 1.61 million tonnes. This impressive feat was accomplished despite facing operational challenges and planned maintenance shutdowns, showcasing the company’s remarkable resilience and commitment to execution. This success highlights ongoing enhancements in smelter efficiency and asset performance, solidifying Alba’s competitive edge in the global aluminium market and ensuring it can meet long-term customer commitments, even in tough macro-operational conditions.

LME price trend to focus

In the first half of January 2026, LME aluminium cash and offer prices showed a generally positive trend, due to a steady decline in exchange stocks. Cash offers climbed from about USD 3,092 per tonne to over USD 3,220 per tonne, before experiencing a slight dip below USD 3,180 per tonne by mid-month. This movement reflects a tightening in physical availability and the underlying fundamentals on the LME. Opening stocks consistently decreased, falling from over 504 thousand tonnes to below 492 thousand tonnes, which supported the price momentum. Even though intraday and forward contract signals were mixed at times, it can be stated that the ongoing supply constraints are a significant factor keeping near-term price support strong in the aluminium market.

The three-month LME aluminium contract crossed the USD 3 thousand per tonne threshold, closing at about USD 3,015.50 per tonne. This shift is largely due to a growing global supply deficit that changed the market landscape. Some of the key factors include China’s 45 million tonne cap on primary aluminium capacity, smelter shutdowns caused by energy limitations and ongoing US tariff barriers. All in all, these elements have tightened the available supply compared to demand. As a result, these structural challenges are boosting short-term price momentum, with strong demand fueling expectations of a widening supply gap, which helps maintain price stability even amid broader uncertainties in the base metal market.

Also read: Aluminium Vision 2047 vs Reality in 2025: Ambition, progress and the gaps in between

Share price movement

Vedanta's stock performance in early January 2026 was a surge in price movement due to strong operational momentum, driven by record production levels of aluminium, alumina and zinc in Q3 FY26, along with an NCLT-approved demerger plan that really boosted investor confidence. However, things took a turn when the unexpected passing of Agnivesh Agarwal, the son of Chairman Anil Agarwal, led to a nearly 3 per cent drop in intraday trading. This incident highlighted how sensitive investors can be to leadership stability, especially in a family-run business.

NALCO saw an increase of 6 per cent in its share price, reaching an all-time high as aluminium prices on LME ramped up past USD 3 thousand per tonne, a milestone achieved after a long time since 2022. This surge reflects tightening global supply dynamics, driven by limited inventories, smelting restrictions and strong demand from end-users. The stock’s impressive rally highlights the close relationship between high commodity prices and investor confidence in primary aluminium producers, putting NALCO in a strong position in today’s market, where elevated metal prices are boosting earnings expectations across the industry.

Century Aluminium's stock jumped to USD 42.85 at the open, inching closer to its 52-week high. This surge reflects the strong demand for primary aluminium and a tightening supply situation. Analysts have responded positively, raising their price targets and maintaining buy or hold ratings, which has boosted overall expectations even after recent earnings miss. The impressive rally, fuelled by increased institutional ownership and a positive market atmosphere, indicates a renewed faith in Century’s strategic position in the aluminium industry, mirroring the broader optimism for producers who are thriving amid solid commodity prices.

Must read: Key industry individuals share their thoughts on the trending topics

Responses