您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

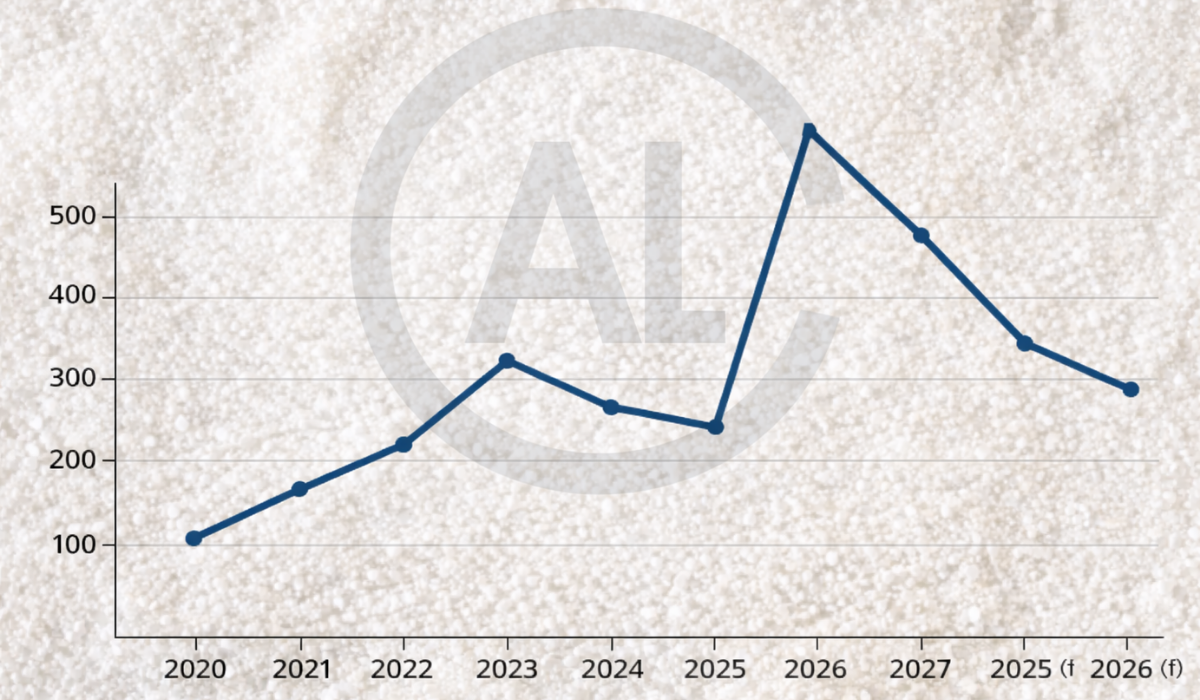

For over a year now, the Australian alumina market has rarely stayed out of the headlines. Sometimes due to capacity curtailment at refineries and sometimes because of the volatile Free On Board (FOB) price, which swung dramatically within a span of a year from as high as USD 700 per tonne in Q4 2024 to USD 317 per tonne in Q4 2025. Factors like freight rates and currency movements to investor sentiment pull at the price lever, yet the fundamental triad of production, demand, and supply plays the most critical role in directing the price movement.

{alcircleadd}Australia’s benchmark role in the global alumina trade

For being the world’s second-largest supplier of alumina after Guinea, Australia’s alumina FOB price is widely treated as a benchmark for long-term contracts, hedging strategies, and spot trade, making it a reliable barometer of broader market health. For instance, the deflating Australian alumina FOB price through 2025 signals a mounting surplus in the market due to increased production and shipments amidst subdued demand in key consuming regions.

According to Australia’s financial year estimates, the country’s alumina production is likely to stand at 17.4 million tonnes by June 30, 2026, while exports are projected to amount to 15.66 million tonnes. This reflects a year-on-year increase of 3.26 per cent in production and 6.4 per cent in exports, up from 16.85 million tonnes and 14.72 million tonnes respectively in the previous year.

To know about the Australia alumina market projection for 2026 and beyond, prebook our report: Global Aluminium Industry Outlook 2026

…and so much more!

SIGN UP / LOGINResponses