您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

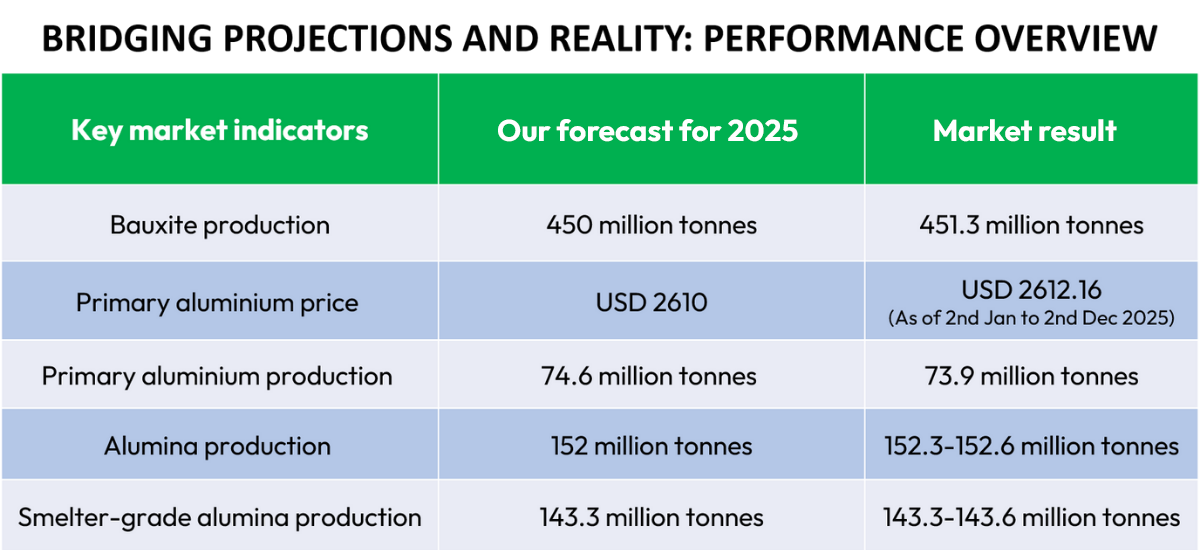

The Global Aluminium Industry Outlook 2026 delivers targeted, data-driven insight into the global aluminium value chain—covering bauxite mining, alumina refining, primary aluminium, downstream products, and secondary aluminium. It clearly details aluminium demand in key sectors, highlights major trends such as sustainability and decarbonisation, and presents actionable forecasts, regional outlooks, and competitive intelligence. Positioned as an essential guide, this report equips industry stakeholders to navigate global aluminium market dynamics through 2026 and beyond.

The global aluminium industry is entering a decisive phase where innovation, sustainability, and structural market shifts are redefining the competitive landscape. As we move toward 2026 & beyond, evolving supply chains, energy transitions, rising downstream demand, and tightening sustainability requirements are reshaping how aluminium is produced, consumed, and traded worldwide. AL Circle’s strategic intelligence report, Global Aluminium Industry Outlook 2026, provides a deeply analytical, data-backed perspective on these transformations—empowering industry leaders, investors, and policymakers to anticipate risks, identify growth opportunities, and make informed decisions in a rapidly changing market environment.

Who should read this report & why?

Whether you seek a comprehensive view of the global aluminium market or in-depth insights into specific segments, the Global Aluminium Industry Outlook 2026 delivers actionable intelligence and strategic guidance to drive smarter decisions across the entire aluminium value chain.

Frequently asked questions

.jpg/500/0)