您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

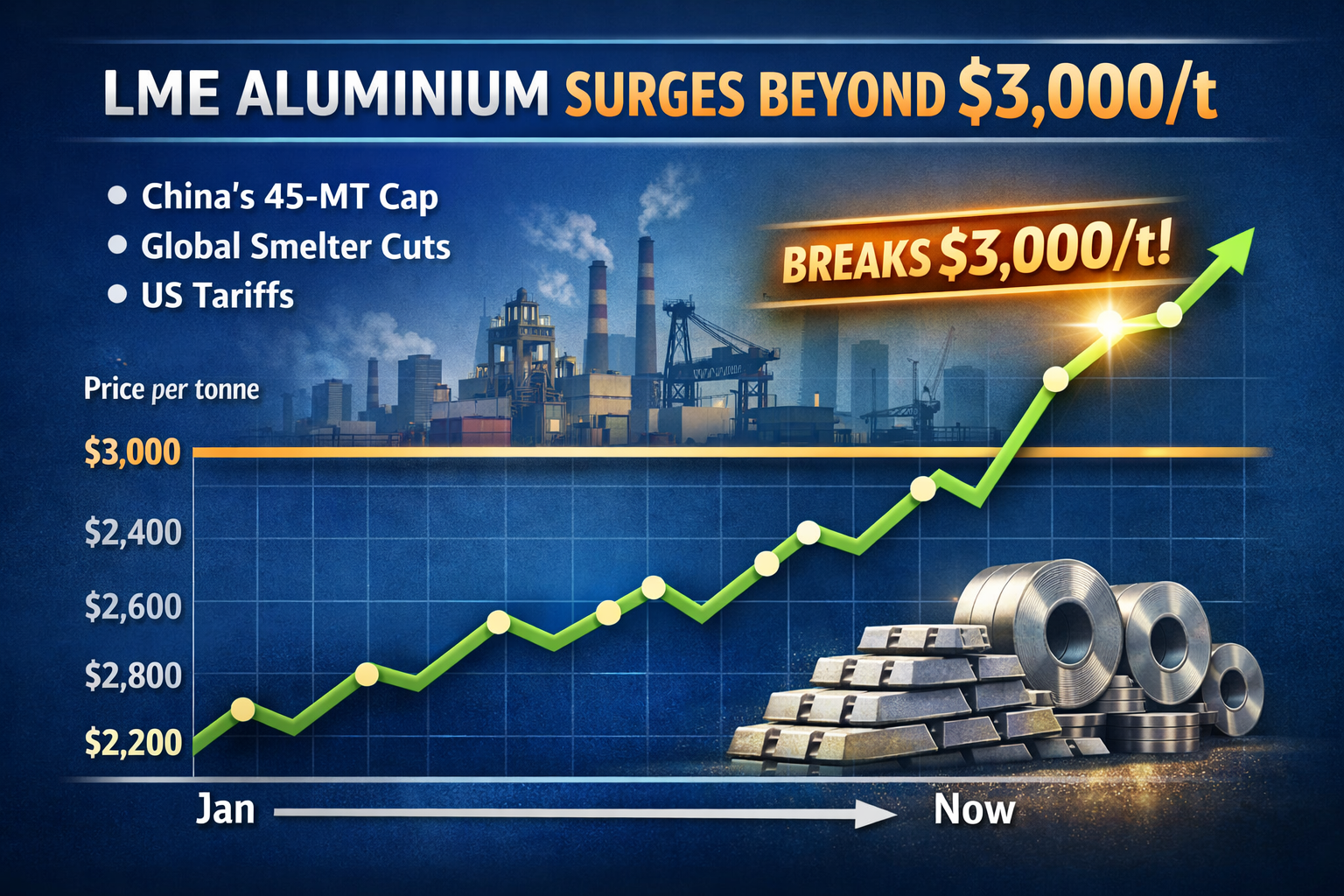

Tightened supply outlook and long-term demand bets have taken the three-month LME aluminium contract to USD 3,015.50 per tonne for the first time in more than three years, as of Friday, January 2, 2026. Perhaps, this is the beginning of price rally as projected by many market analysts for 2026. China’s self-imposed 45-million-tonne cap on primary aluminium production, trade restrictions driven by tariffs, and smelter shutdowns caused by prolonged energy crises have constrained global supply of the metal. Meanwhile, demand remains resilient, creating a widening gap that has set the stage for a price surge.

{alcircleadd}Global deficit outlook strengthens price momentum

Market intelligence projects a global deficit of around 2 million tonnes in 2026, sending the aluminium prices to an average of USD 2,900 per tonne. The price may further uptick if global industrial activity picks up creating more demand for aluminium in the market. However, the production growth is unlikely to keep pace with demand as China nears its cap and energy crises still loom in many parts of the world limiting production. Although Indonesia is adding new primary aluminium capacities of 705,000 tonnes, raising total output to 1.4 million tonnes, yet this expansion is unlikely to offset the deficit or bring a global balance until later 2026.

Until October 2025, Indonesia’s year-to-date primary aluminium exports were 414,600 tonnes, up by 71 per cent Y-o-Y from 243,000 tonnes during the corresponding period of the previous year. A balance can be struck only if this momentum continues. However, it is also to be noted that Indonesia exports 70 per cent of its shipments to China as the latter has a significant share in Indonesia’s alumina and aluminium production. In 2024, China secured a total of 325,000 tonnes of unwrought aluminium from Indoneisa.

Also read: LME throwback 2025: Aluminium vs copper price and inventory movement

…and so much more!

SIGN UP / LOGINResponses