您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

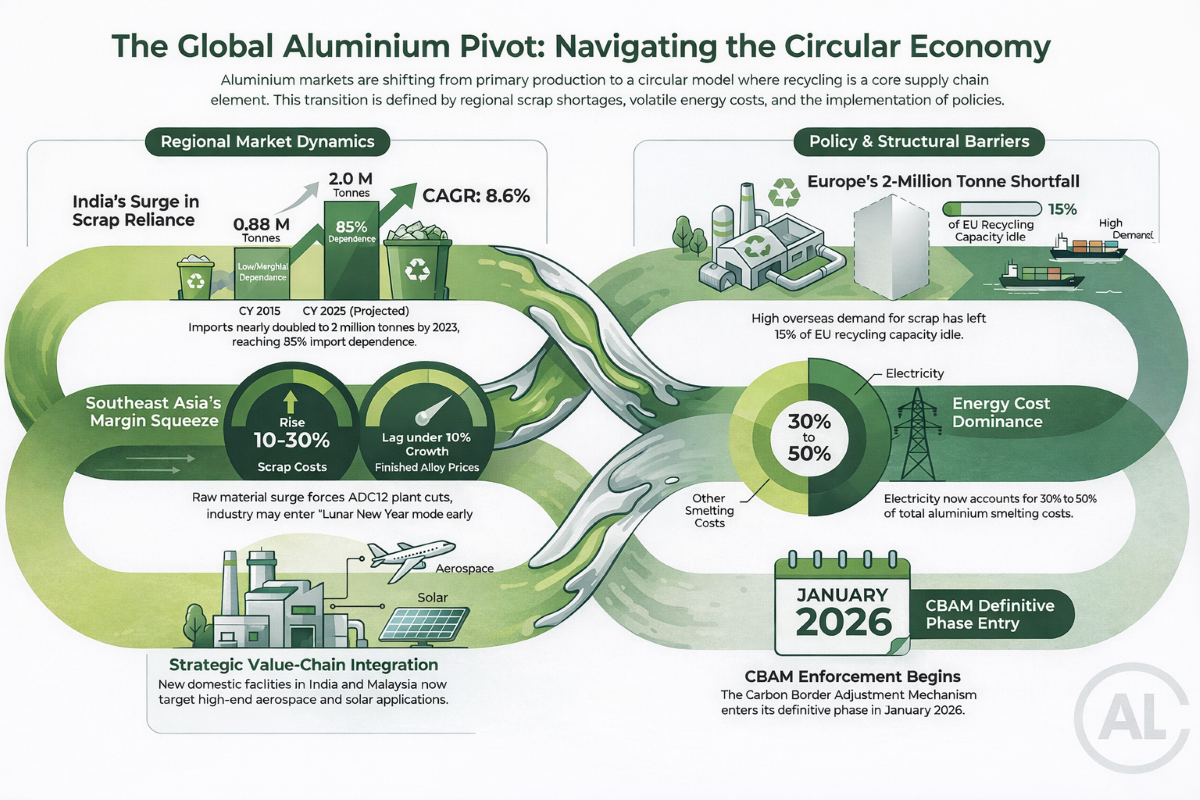

Recycling and sustainability are increasingly shaping aluminium markets. Scrap availability, energy costs and carbon rules are influencing where metal is produced, how it is processed and which regions gain or lose competitiveness. Developments across India, Europe and Southeast Asia show how recycling has shifted from an environmental objective to a core element of aluminium supply chains.

{alcircleadd}India’s aluminium scrap market has undergone a structural shift over the past decade, with scrap moving from a marginal input to the backbone of secondary aluminium and alloy production. Imports nearly doubled from 0.88 million tonnes in CY’15 to around 2 million tonnes in CY’25, pushing import dependence to about 85 per cent. Growth has been steady, delivering a decade-long CAGR of roughly 8.6 per cent, with imports expected to remain firm into Q1 CY’26 amid constrained domestic availability and sustained downstream demand. To know the accurate data click here.

That dependence became more visible in 2025 as global disruptions forced Indian buyers to rework sourcing strategies. Scrap inflows increasingly shifted toward Europe, the Middle East and Oceania, with Europe - including the UK - now supplying close to 30 per cent of India’s aluminium scrap imports, underscoring India’s growing exposure to overseas scrap markets.

At the same time, India made a strategic move up the materials value chain. Runaya Metsource and ECKART launched the country’s first facility for gas-atomised aluminium powders in Jharsuguda, Odisha, enabling domestic production of green, spherical powders previously fully imported. The plant targets high-end applications across aerospace, solar technology, catalysts and effect pigments, aligning circular-economy ambitions with advanced manufacturing. For more details here.

Weekly Recap: Recycled AL & Sustainability by AL Circle Pvt Ltd

Downstream integration also gathered pace during the week. Premier Energies secured domestic solar cell and module orders worth INR 23.07 billion (USD 255.84 million) in Q3 FY2026, providing revenue visibility through FY2027–FY2028. The orders support capacity expansion plans and the commissioning of an aluminium frame manufacturing plant, tightening linkages between aluminium inputs and India’s fast-growing solar sector. For full details read here.

Europe: Circular economy ambitions face tightening constraints

While India is absorbing more scrap, Europe is struggling to retain it. The bloc’s push to build a circular aluminium economy is under strain as rising overseas demand pulls scrap out of the region. High energy costs have already weakened primary aluminium production, making recycling essential to net-zero ambitions, yet scrap exports to markets such as the US and China have left around 15 percent of EU recycling furnace capacity idle and created an annual shortfall of roughly 2 million tonnes. For the complete story, click here.

Also read: Aluminium Vision 2047 vs Reality in 2025: Ambition, progress and the gaps in between

In response, industry groups are attempting to plug systemic gaps in recycling performance. European aluminium and packaging bodies launched a new alliance to improve recovery of small aluminium packaging formats -such as coffee capsules, foil lids and confectionery wraps -that often escape existing waste systems. The initiative aims to bridge the gap between available sorting technology and uneven on-ground performance as deposit-return schemes reshape waste flows. View the whole story here.

Alongside policy coordination, capital investment is also accelerating. Emirates Global Aluminium announced a major expansion of its German subsidiary, EGA Leichtmetall, committing about USD 170 million to build a next-generation recycling hub near Hannover. The six-fold capacity expansion, due online in 2028, will integrate advanced scrap sorting, melting, casting and salt recovery to supply high-quality secondary aluminium to automotive and aviation customers. click here.

To know more about the global primary aluminium industry 2026 outlook, pre-book the report “Global Aluminium Industry Outlook 2026” at a special price.

Southeast Asia: Recycling margins buckle under price pressure

Further along the supply chain, Southeast Asia is facing a different challenge -rising costs. Since Q4 2025, higher LME aluminium prices have driven scrap costs sharply upward, while finished ADC12 alloy prices have lagged. Scrap prices in Malaysia and Thailand surged by 10–30 per cent, but ADC12 prices rose by less than 10 per cent, creating a severe cost–price mismatch across the value chain. For more details, click here.

As downstream die-casting and automotive customers resist higher alloy prices and demand weakens ahead of the Lunar New Year, producers have been forced to react defensively. Many ADC12 plants are cutting output or bringing forward holiday shutdowns, pushing the regional industry into an early seasonal slowdown until market conditions stabilise after the festival.

Still, longer-term positioning continues despite near-term stress. Malaysia advanced its recycling ambitions through a joint venture between Paragon Union Bhd and Japan’s Asahi Seiren, targeting the fast-growing global recycled aluminium market. The partnership aims to supply low-carbon secondary aluminium to Southeast Asia’s automotive, construction and packaging sectors, aligning industrial growth with sustainability goals. The whole story is here.

Don’t miss out- Buyers are looking for your products on our B2B platform

Carbon, power and policy: the sustainability backdrop

Threading through these regional shifts is a common constraint: energy and carbon policy. Electricity already accounts for roughly 30 – 50 per cent of aluminium smelting costs, and scenario outlooks from the International Energy Agency suggest that only a net-zero pathway decisively shifts aluminium economics toward regions with scalable, low-cost renewable power. Stabilising energy prices in 2025 and a surge in clean-energy investment reinforced the strategic push toward renewables-linked production. Click here.

India’s energy transition provided another anchor point. Battery energy storage capacity additions are expected to jump nearly tenfold to around 5 GWh in 2026, according to the India Energy Storage Alliance, following a record tendering year in 2025. Execution in 2026 will be critical, supported by large solar-plus-storage projects and grid-scale battery commissioning. Read the whole outlook here.

Policy pressure is also tightening in Europe. The Carbon Border Adjustment Mechanism entered its definitive phase in January 2026, though near-term aluminium supply disruption is expected to remain muted through Q1 as traders draw down pre-cleared inventories. More meaningful shifts are anticipated from April as inventories normalise and CBAM’s expanded scope covering aluminium-intensive downstream products begins to influence trade flows and pricing. For more details click here.

Thailand’s experience highlights the adjustment curve. While aluminium exports to the EU have fallen sharply since 2023 due to higher compliance costs and shifting scrap and energy dynamics, gains in steel and iron lifted overall CBAM-covered metal exports in 2025. In response, Thailand is moving to align domestic climate policy with EU rules through planned carbon pricing, emissions reporting and greener supply chains aimed at preserving long-term export competitiveness. Read the whole story here.

Responses