您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

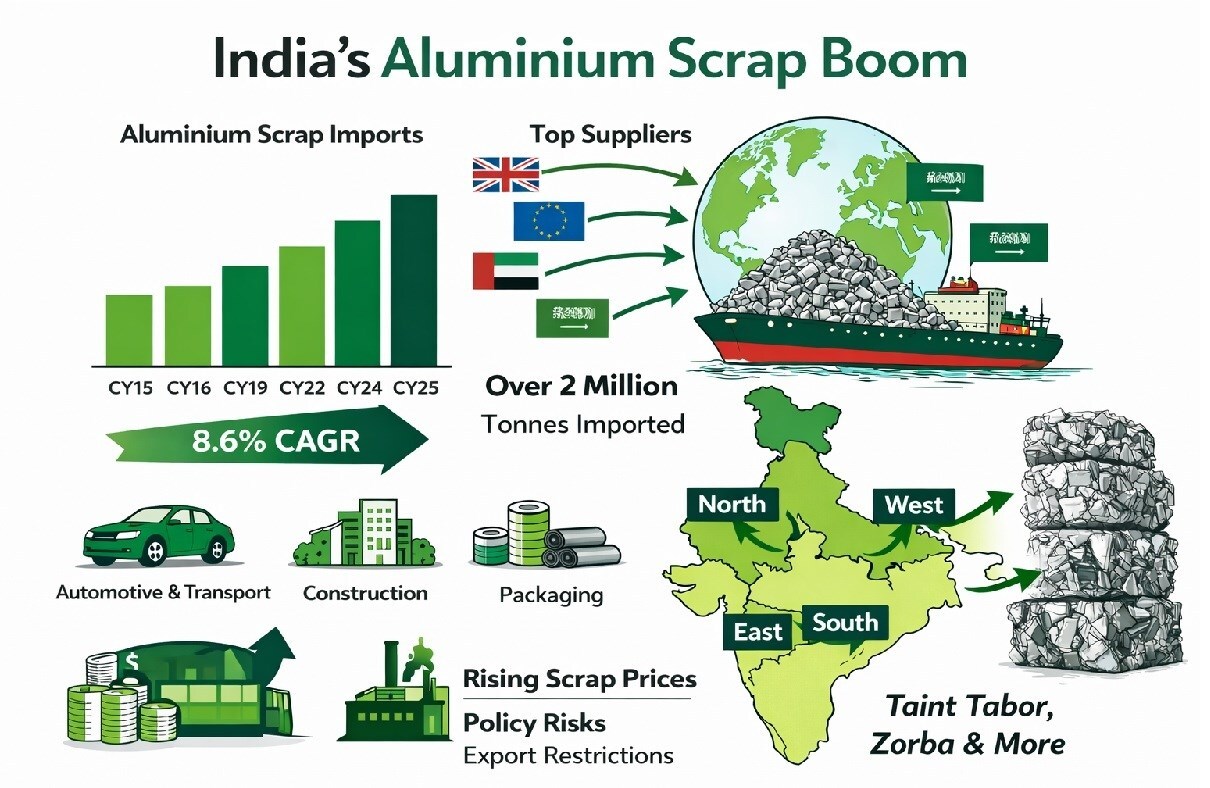

A decade ago, aluminium scrap accounted for a relatively small share of India’s metals trade, with primary aluminium forming the backbone of supply for most downstream applications. But that hierarchy no longer holds. By 2025, aluminium scrap had moved from the sideline to the centre of India’s secondary aluminium and alloy production. Imports crossed the 2 million tonne mark for the first time, and the country remained nearly 85 per cent dependent on overseas scrap. What was once a supplementary input had quietly become indispensable.

{alcircleadd}India’s aluminium scrap imports rose steadily over the past decade, almost doubling from 0.88 million tonnes in CY’15 to nearly 2 million tonnes in CY’25. Steady growth was measured rather than dramatic - imports edged up from 0.92 million tonnes in CY’16 to 1.12 million tonnes in CY’18, before moving higher to 1.35 million tonnes in CY’19. The pandemic year brought a pause, with volumes easing to 1.29 million tonnes in CY’20. But the slowdown did not last. Imports rebounded sharply to 1.65 million tonnes in CY’21, rose again to 1.75 million in CY’22, this trend is still in continuation. Taken together, the trend reflects a long-term CAGR of about 8.6 per cent.

This points to a market responding to necessity rather than opportunity. Domestic scrap availability has remained limited, while demand from foundries, rolling mills and extruders has continued to rise. Imports are expected to maintain this upward trajectory into Q1 CY’26.

To know more about the global primary aluminium industry 2026 outlook, pre-book the report “Global Aluminium Industry Outlook 2026” at a special price.

…and so much more!

SIGN UP / LOGINResponses