您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Image for reference only

Image for reference only

The European Union’s (EU’s) much-talked-about regulatory framework is finally in full action. The Emissions Trading System (ETS) and the Carbon Border Adjustment Mechanism (CBAM) are fruits of the Fit for 55 package introduced on July 14, 2021, aligned with the United Nations’ Sustainable Development Goals, especially SDG 12 on responsible consumption and production, which played an equally notable role in shaping carbon-emission curtailment policies. ETS has been proactively adopted by emission-heavy industries since 2005, whereas CBAM’s transitional phase was first introduced on October 1, 2023.

{alcircleadd}Explore- Most accurate data to drive business decisions with our upcoming Global Aluminium Industry Outlook 2026 report across the value chain

The sustainability agenda has aimed to level the playing field for EU industries by pricing carbon on certain imported goods – aluminium, cement and steel among them – to prevent companies from shifting production to jurisdictions with weaker climate rules, a phenomenon known as carbon leakage.

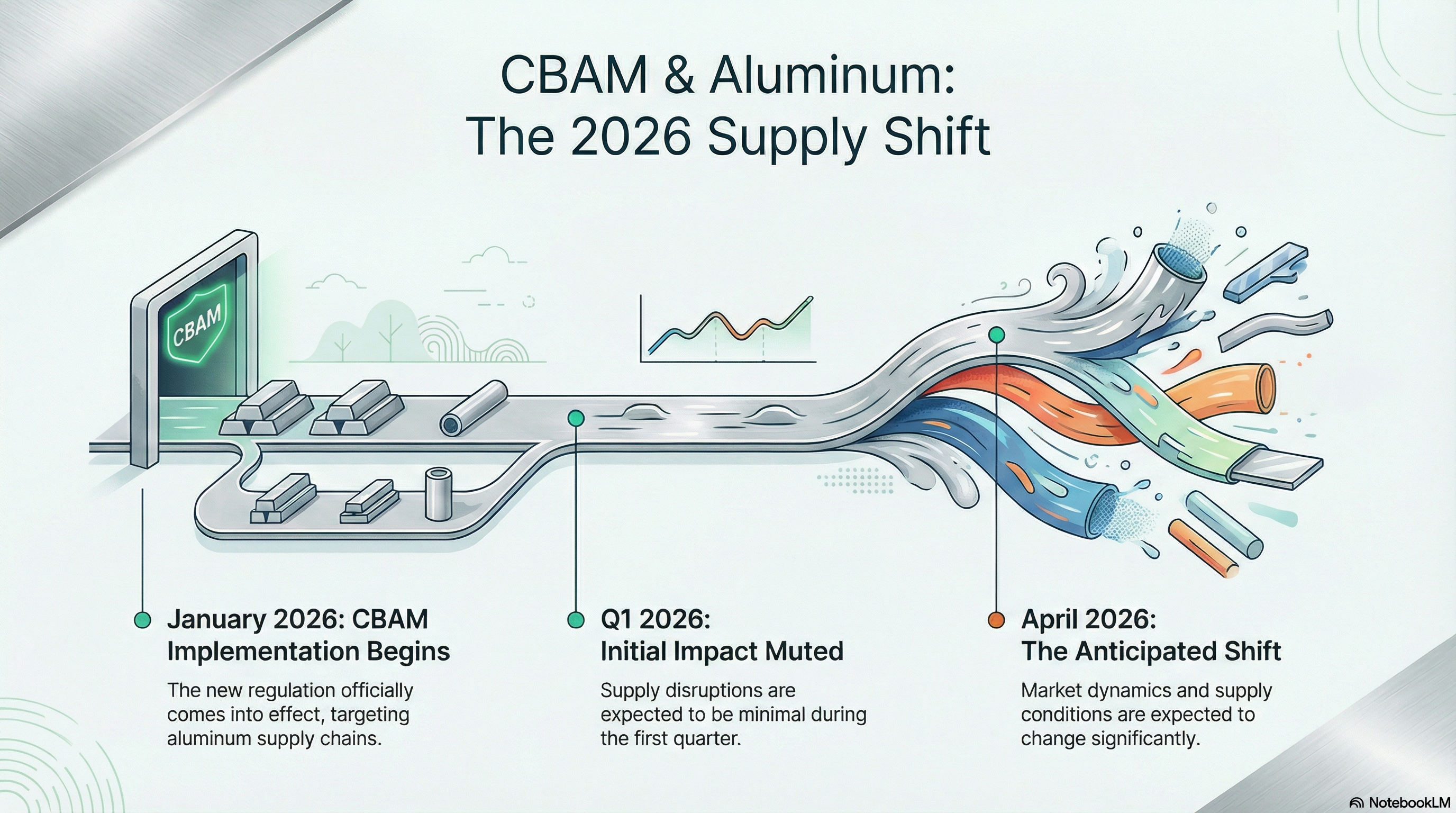

But while the framework promised protection, producers, suppliers and cross-border traders had anticipated the opposite. Now that CBAM has entered its definitive regime from January 1, 2026 – involving the financial obligation to purchase CBAM certificates – it is time to assess the ground-level reality of how the EU’s aluminium industry is coping.

The ground-level scenario at the moment

“I think everybody is sitting on a huge amount of metal, and you can sell without paying CBAM as it's already cleared,” a trader told S&P Global. “I expect things to be clearer in March when dynamics consolidate a bit more.”

EU primary aluminium production between 2021 and 2025(e) stood at 20.08 million tonnes, 11.86 million tonnes, 9.52 million tonnes, 9.17 million tonnes and an estimated 10.81 million tonnes respectively.

…and so much more!

SIGN UP / LOGINResponses