您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

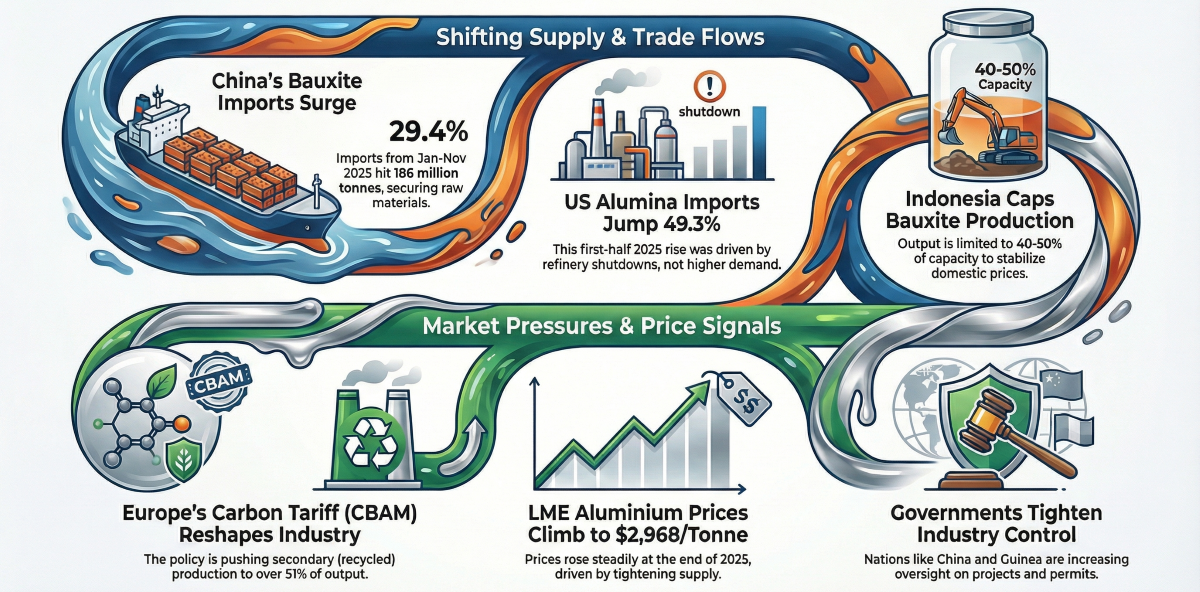

As we look ahead to 2026, the global aluminium value chain is experiencing some significant shifts with changing trade flows, updated policies and price signals reshaping the core market dynamics. Notable fluctuations in bauxite and alumina imports in major consuming regions, alongside stricter production controls and evolving carbon regulations. The industry is juggling a tricky blend of supply discipline, sustainability demands and geopolitical adjustments. Meanwhile, stronger price trends on global exchanges and specific government initiatives are introducing new uncertainties and opportunities throughout both upstream and downstream sectors, paving the way for important developments in the near future.

{alcircleadd}Aluminium upstream weekly recap by AL Circle Pvt Ltd

Unfolding the production, imports and exports stories

According to the latest figures from the General Administration of Customs (GACC), China’s bauxite imports, from January to November 2025, hit a total shipment of 186 million tonnes, representing a jump of 29.4 per cent from the previous year. In the month of November, imports soared to 15.11 million tonnes, reflecting a 22.9 per cent increase year-on-year and a 9.8 per cent rise month-on-month. As the year ended, Guinea continued to be China's top bauxite supplier by exporting 10.71 million tonnes in November alone. This marked 34.7 per cent year-on-year growth and a 19 per cent increase month-on-month. This ongoing surge in imports highlights China's commitment to securing the raw materials needed for its aluminium industry.

In 2026, the production of Indonesia’s bauxite industry will remain tightly controlled under the annual Work Plan and Budget (RKAB) framework. The main aim here is to keep output below full capacity, helping to align supply with actual demand from downstream markets and support a gradual recovery in domestic prices. In West Kalimantan, where most of the bauxite is sourced, current free on board (FOB) prices hover between USD 28 and USD 32 per tonne, significantly lower than the government’s Harga Patokan Mineral (HPM) benchmark of USD 42 per tonne. For 2025, RKAB approvals are projected to be around 12 to 15 million tonnes, which is about 40 to 50 per cent of the potential capacity. This price disparity is largely attributed to structural oversupply, logistical challenges and limited intake from alumina refineries. Unlock the complete outlook here.

Alumina imports by the US rose by 49.3 per cent, reaching 906 thousand tonnes in the first half of 2025. As highlighted by data from the US Geological Survey included in the report, the rise in imports is owed to the refinery shutdowns rather than an increase in demand. This rebound comes after high import levels in late 2024 and stands in stark contrast to the softer activity seen a year earlier, when imports in H1 2024 were much lower. Read now to know the entire import story.

As reported by the Iranian Mines and Mining Industries Development and Renovation Organisation (IMIDRO), the aluminium hydrate production by Iran, in the first eight months of the Iranian calendar year (from March 21 to November 21), reached 665,189 tonnes. There has been a significant rise in the overall output due to a strong performance in the production of downstream raw materials. At the same time last year, the country produced over 155 thousand tonnes of alumina powder, showcasing ongoing progress in its value chain. IMIDRO also revealed that the Iran Alumina Company increased its output of alumina powder, aluminium hydroxide and bauxite by 2 per cent, 2 per cent and a remarkable 40 per cent, respectively.

According to data from the General Administration of Customs (GACC), in November 2025, there was a surge in alumina imports by China, where the total shipment in that month reached 232,376 tonnes, presenting an increase of 134 per cent from the same month the previous year and 22.7 per cent month-on-month. On the contrary, the total imports by China starting from the first month to November 2025, stood at 970,083 tonnes, which is down about 31 per cent year-on-year, highlighting the broader market trends. Meanwhile, China’s alumina exports dropped by 12.2 per cent in November, leading to a second consecutive month of net import volumes. Learn more.

India's domestic aluminium market presented week-on-week growth, with primary producers raising P1020 ingot prices. The shift is owed to global supply worries, and stronger LME and MCX aluminium complexes influence market sentiment, irrespective of local availability remaining comfortable and a modest downstream demand. The price of P1020 in Delhi, India, rose by INR 8 thousand per tonne, reaching INR 300 thousand per tonne, while in Mumbai, ex-works prices nudged up to INR 302 thousand per tonne. For further details on Indian aluminium dynamics, click here.

Don’t miss out- Buyers are looking for your products on our B2B platform

Year-end LME price movement

From December 19 to the year-end, the London Metal Exchange (LME) aluminium cash offer rose steadily, reflecting a boost in market momentum. After reaching around USD 2,852.50 per tonne, offers jumped to USD 2,896 per tonne by mid-December, mainly due to strong bids and positive inventory trends. Prices continued to climb, reaching a peak of USD 2,932 per tonne before easing slightly to about USD 2,913.5 per tonne amid modest inventory fluctuations. The upward trend picked up again near the end of the calendar year 2025, with LME cash offers hitting USD 2,945 per tonne and eventually USD 2,968 per tonne, driven by tightening supplies and stronger signals for three-month forward prices.

2026 is set to welcome CBAM

Europe’s Carbon Border Adjustment Mechanism (CBAM) is impacting the aluminium industry with policy pressures in play, where the growth in primary aluminium output has been pretty modest. The industry witnessed a 0.9 per cent increase in 2025, as both producers and buyers shifted their focus towards recycling. The shift pushed secondary production to over 51 per cent, whilst navigating through energy challenges and regulatory hurdles. CBAM is gearing up to fully kick in by 2026, introducing a carbon tariff on imports of energy-intensive goods like aluminium. This move is set to reshape trade dynamics and cost structures by factoring in the carbon emissions tied to imports, aiming to create a fairer playing field for EU producers who are bound by strict climate regulations, while also discouraging carbon-heavy supply chains. On the flip side, exporters to the EU, including those from India, are already feeling the pinch with reduced shipments and looming compliance costs as they prepare for the full implementation of CBAM. This highlights how the mechanism serves as both a market signal and a competitive hurdle for aluminium supply chains that are linked to European markets.

Must read: Key industry individuals share their thoughts on the trending topics

Government interventions in the industry

GIADEC officially dismissed reports that included the suggestion that the Government of Ghana intends to hand over the Nyinahin bauxite concessions to businessman Ibrahim Mahama. The firm indicated these claims to be “false and misleading,” and added that there's no such plan in place. It further emphasised that following the executive approval framework set up during President John Dramani Mahama’s administration, it has been tasked with centralising control over Ghana’s bauxite resources and managing leases for all known deposits. The corporation also pointed out that six mining leases, including the Nyinahin concessions acquired in June 2025, are currently awaiting ratification by Parliament. Uncover the full story here.

The Indian Supreme Court overturned the Chhattisgarh High Court’s ruling, bringing back the arbitral award in the Ramesh Kumar Jain vs. Bharat Aluminium Company Ltd (BALCO) case. This indicates the limited role of judicial review as outlined in Sections 34 and 37 of the Arbitration and Conciliation Act, 1996. Additionally, the apex court made it clear that judges are not supposed to act like appellate tribunals by re-evaluating evidence or imposing their own commercial judgments under the pretext of “patent illegality.” Read about the full case here.

Guinea is facing an arbitration challenge after Axis International Ltd went ahead with the proceedings, demanding USD 28.9 billion in compensation from the West African nation. The challenge came right after the firm's bauxite mining permit was revoked earlier this year, with the dispute now being handled by the World Bank’s International Centre for Settlement of Investment Disputes. This situation is faced mainly because of the policy shift in Guinea’s mining sector, where the government has tightened its grip, cancelling and redistributing numerous permits to enhance revenue and promote local processing. Read the complete scoop here.

The National Development and Reform Commission (NDRC) of China is shifting in its industrial policy by tightening the reins on new copper and alumina projects. The shift aims to rein in reckless investments and “disorderly expansion” as part of the upcoming 2026–2030 five-year plan. The NDRC is reaching out to local governments to enhance feasibility studies to ensure project approvals align with national industrial goals. This reflects Beijing’s attempt to balance between capacity growth, regional resource availability and environmental limits, especially given the rising concerns about overcapacity in crucial metal sectors.

To know more about the global primary aluminium industry 2026 outlook, pre-book the report “Global Aluminium Industry Outlook 2026” at a special price.

Responses