您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

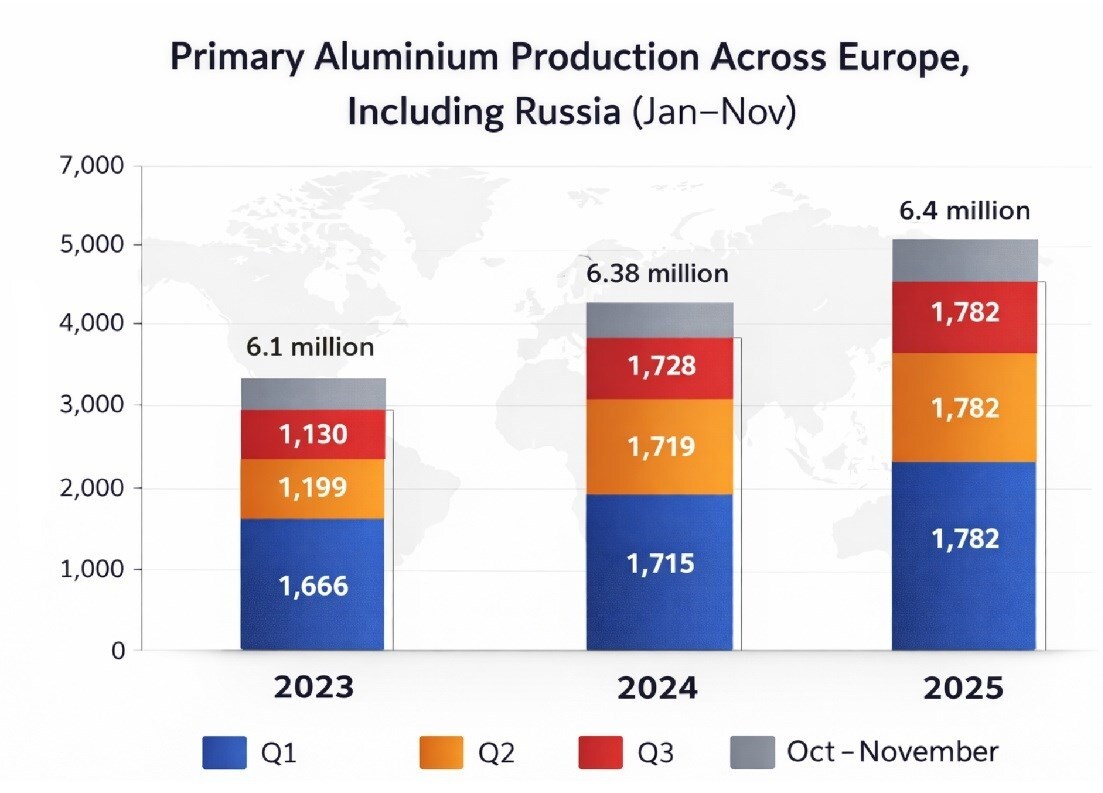

Just like the US, Europe appears to be reshaping its aluminium strategy - and scrap is steadily gaining the upper hand. With recycling crossing the 50 per cent mark in 2025, the balance of the industry is shifting away from primary aluminium and moving toward secondary metal. That trend is also visible in the production numbers. Primary aluminium production across Europe, including Russia reached 6.4 million tonnes between January and November 2025. That’s only slightly higher than the 6.38 million tonnes recorded in 2024 and 6.1 million tonnes in 2023, in the same period, working out to growth of about 0.9 per cent in 2025 after a stronger 3.8 per cent growth the year before.

During 2025, output moved up in stages - 1.72 million tonnes in the first quarter, 1.74 million tonnes in the second and 1. 78 million tonnes in the third. October added 606 thousand tonnes and November 584 thousand tonnes, taking the fourth-quarter running total to 1,190 thousand tonnes.

The year before followed a similar pattern. Production rose from 1.69 million tonnes in the first quarter of 2024 to 1.71 million tonnes in the second and 1.77 million tonnes in the third, while October and November contributed a further 609 thousand tonnes and 590 thousand tonnes - bringing the partial fourth-quarter figure to 1.19 million tonnes.

In 2023, the increases were more modest, with output at 1.6 million tonnes in the first quarter, 1.67 million tonnes in the second and 1.68 million tonnes in the third, followed by 574 thousand tonnes in October and 556 thousand tonnes in November.

…and so much more!

SIGN UP / LOGINResponses