您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

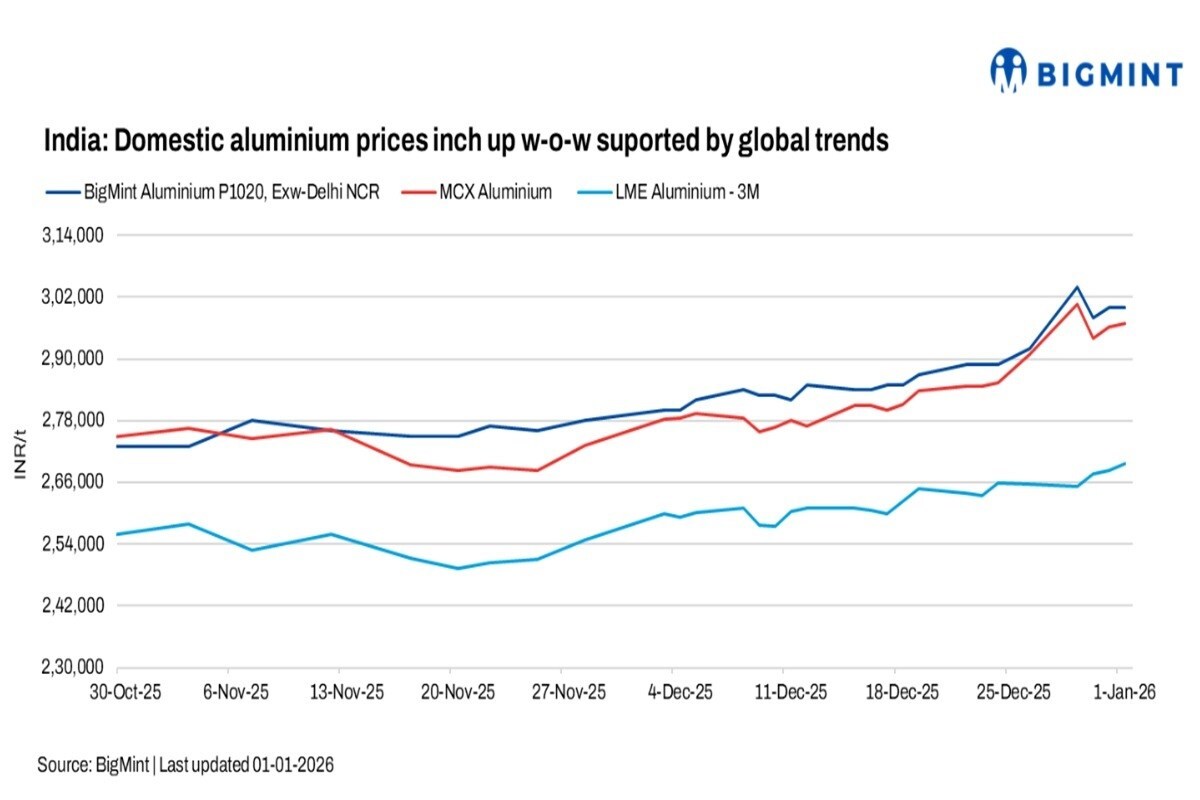

India's domestic aluminium prices recorded strong week-on-week gains, supported by upward revisions from primary producers in response to a firmer LME and MCX aluminium complex and renewed global supply concerns. The increase came despite comfortable domestic availability and only a gradual improvement in downstream demand, highlighting the continued dominance of global market cues in shaping prices.

{alcircleadd}According to BigMint's assessment, domestic P1020 ingot (99.7 per cent) prices in Delhi rose by INR 8,000 per tonne w-o-w to INR 300,000 per tonne ex-Delhi NCR, while Mumbai ex-works prices edged up by INR 1,000 per tonne to INR 302,000 per tonne.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

How did Indian and global exchanges perform?

Domestic aluminium futures on the MCX continued to strengthen during the week, rising from INR 290,900 per tonne to INR 296,900 per tonne, a gain of INR 6,000 per tonne (around 2 per cent). The move reflected firmer underlying physical market conditions, with steady spot demand and higher regional prices lending support rather than speculative positioning alone.

On the global front, LME aluminium three-month prices advanced by USD 36 per tonne (around 1.2 per cent) to USD 2,997 per tonne, supported by persistent supply-side concerns and steady buying interest. The upside was underpinned by ongoing global supply risks, including smelter-related disruptions, which continue to reinforce a tight supply outlook for aluminium.

LME aluminium prices were supported by tightening global supply prospects, led by the confirmed plan to place Mozambique's Mozal smelter under care and maintenance by March, which is expected to reduce global output, alongside disruptions such as the suspension of a potline at Iceland's Grundartangi smelter. Physical tightness was evident as Japanese port inventories fell 5.2 per cent m-o-m and producer premiums for Q1 Japan shipments surged. However, gains were partly capped by renewed demand concerns from China, where property-sector weakness offset higher aluminium production and modest inventory declines on the SHFE.

Meanwhile, LME warehouse stocks declined by 7,850 t w-o-w to around 511,750 t, reinforcing the view that inventories remain tight in a broader context and continue to underpin prices. Firm domestic spot trends, coupled with ongoing global supply concerns, helped keep MCX aluminium prices on a strong footing through the week.

Read More: Year-end momentum lifts LME aluminium cash offer to USD 2,968/t

The rise in domestic ingot prices reflected fresh price hikes by primary producers toward the end of the week. BALCO increased its P1020 price from INR 314,000 per tonne on 25 December to INR 316,500 per tonne on 31 December, reinforcing a firmer pricing stance. Hindalco also raised its P1020 price from INR 312,500 per tonne to INR 314,500 per tonne over the same period, indicating continued support amid improving market sentiment. NALCO kept its published P1020 price unchanged at INR 301,600 per tonne since 24 December, signalling a stable supply approach.

Market participants reported domestic aluminium premiums in the Delhi NCR region remained unchanged w-o-w at USD 230-240 per tonne above LME cash, indicating stable market conditions. Domestic prices moved higher in line with the firm LME and MCX aluminium complex, rather than a pickup in local demand. Market participants noted that one major primary producer continues to hold ample inventories, keeping domestic availability comfortable.

At the same time, imports of primary ingots and billets slowed, impacted by year-end holidays, elevated international prices, and currency-related constraints. As a result, domestic market activity remained muted, with limited spot transactions, though participants expect trading momentum to improve from the second week of January. Globally, aluminium supply tightness is expected to persist as several smelters struggle to secure power contracts, keeping LME prices elevated. Domestic P1020 prices are likely to remain aligned with this supportive global trend.

Additionally, global primary aluminium production reached 67.49 mnt in 11MCY'25, up 1.1 per cent y-o-y, although November output declined 3.3 per cent m-o-m to 6.09 mnt.

Global primary aluminium supply diverges amid uneven regional recovery

Global primary aluminium supply trends are increasingly uneven across regions. Outside China, output rose modestly in late-2025, led by new smelter ramp-ups in Indonesia, including the 500-ktpa (kilotonnes per annum) PT Kalimantan Aluminium Industry project, though commissioning-related inefficiencies have kept operating rates soft and full output is not expected until late-2026. At the same time, supply risks persist as South32 plans to place the Mozal smelter under care and maintenance from March 2026, which is expected to offset part of these additions and keep global primary supply tight, even as risks ease at some assets such as Rio Tinto's Tomago smelter following a new power agreement.

In contrast, Europe's primary aluminium output remains structurally capped, despite sharply lower energy prices in 2025. Permanent closures and long-term curtailments have limited restarts, leaving over 1 million tonnes of capacity idled. Policy measures, including CBAM, sanctions on Russian aluminium, and strong Green Deal support, have accelerated a shift toward recycling, pushing secondary aluminium to more than half of total production. As a result, Europe continues to rely on imports and scrap rather than new smelting, keeping global primary aluminium supply constrained.

Outlook

India's aluminium prices are expected to remain supported in the near term, tracking a firm LME and MCX aluminium complex amid persistent global supply tightness. While domestic availability remains comfortable and demand recovery is gradual, global supply-side risks -- particularly smelter disruptions and power-related constraints are likely to keep price sentiment firm. Trading activity may pick up from mid-January as post-holiday demand improves, but price direction will continue to be driven more by global cues than domestic fundamentals, with domestic P1020 prices expected to stay aligned with elevated international levels in the short term.

Must read: Key industry individuals share their thoughts on the trending topics

Note: This article has been issued by BIGMINT and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses