您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The global aluminium industry is facing transformation with new joint ventures popping up in North America, capacity expansions taking place in India and Indonesia and exciting technological advancements in material science. Additionally, there are strategic investments backed by governments in Africa and the Middle East. However, challenges like profitability pressures, operational hiccups and shifting trade dynamics are all influencing the financial results of major players. The sector is experiencing a complex mix of record earnings fueled by rising prices, alongside margin pressures from fires, tariffs and inflation. It is a fascinating time of growth, resilience and adjustment in production, consumption and end-use demand.

{alcircleadd}Recent developments in the Downstream AL sector globally

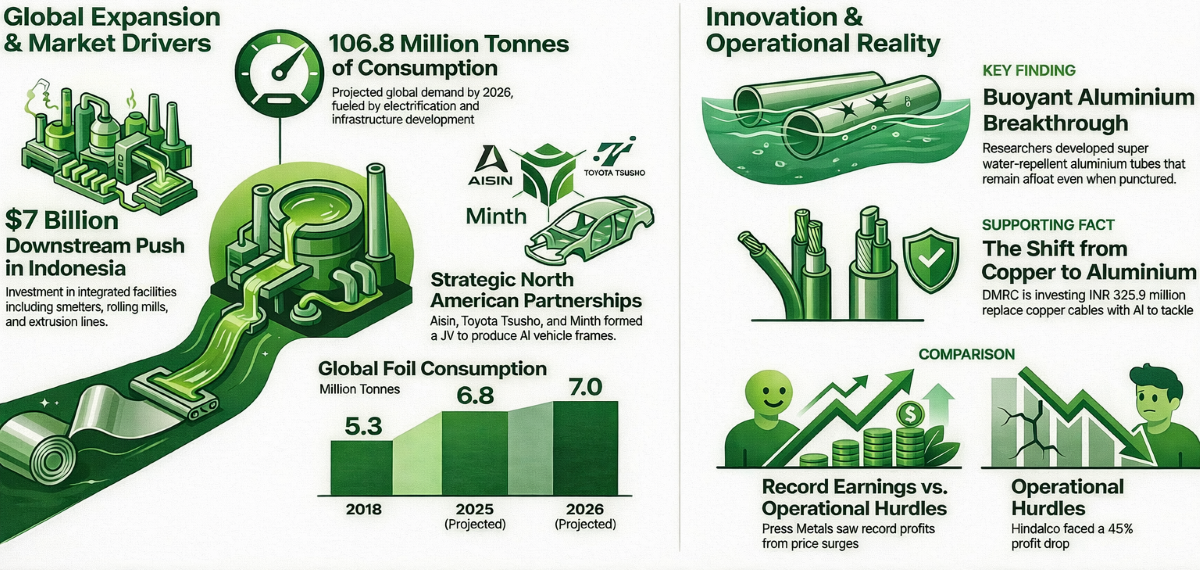

Aisin, Toyota Tsusho and Minth together formed a joint venture in Ontario, Canada, focused on producing aluminium body frame parts for vehicles. This partnership focuses on boosting supply for the North American market. Aisin and Minth will each own 40 per cent, while Toyota Tsusho will hold a 20 per cent stake. However, the specifics of the total investment have not been revealed yet. The production will utilise the company's own aluminium extrusion technologies and marks their first partnership in parts manufacturing, irrespective of previously produced components in various Asian markets.

Taural India launched the second aluminium sand-casting facility in Supa, Maharashtra, investing nearly INR 5 billion to boost production beyond its current plant, located in Pune, to enhance local manufacturing capabilities. Spanning over 30 acres, this new facility features automation, digital process controls and cutting-edge quality systems to create high-precision aluminium components that weigh between 20 kg and 1,000 kg.

GIADEC informed that VALCO will continue to be state-owned and is looking to form strategic partnerships and attract investments to modernise operations and boost competitiveness. Authorities are actively working to resolve a land issue with the Tema Development Corporation concerning a proposed aluminium park in Tema. So far, joint site inspections have been conducted and documentation has been gathered to support the development of a designated area of 122-127 hectares. The Cabinet has approved around USD 600 million for technology upgrades at VALCO to enhance productivity, minimise environmental impact, and facilitate expansion.

Danantara Resources invested USD 7 billion to start downstream industrial projects in Indonesia. The project will create integrated facilities for aluminium, steel, petrochemicals and other value-added sectors, aiming to speed up the country’s industrial transformation. This investment will pave the way for smelters, rolling mills, extrusion lines and the necessary infrastructure, backed by government partnerships and incentives.

University of Rochester's researchers innovated a way to keep aluminium tubes afloat by engineering their surfaces to trap air and repel water; these tubes can float despite aluminium being denser than water. The team achieved this by creating tiny pits on the tube surfaces using chemical etching, which gives them a super water-repellent texture. This design prevents water from seeping in and helps maintain stable air bubbles inside. Tests revealed that the tubes stayed buoyant even in saltwater and algae-filled environments and they continued to float even when weighed down or punctured, showcasing their durability in tough conditions.

Trinasolar, in perovskite-silicon tandem solar technology, is one of the manufacturers of efficient photovoltaic solutions that go beyond the limits of traditional silicon cells. The company’s advancements are part of a larger industry movement aimed at boosting power-conversion efficiency and cutting costs through tandem designs that merge perovskite and silicon layers. Read more into the scoop.

The downturns in the downstream AL sector

Worldwide Aluminium Ltd reported an increase in its sales; however, it is still adjusting to profitability challenges. Challenges like rising costs and operational hurdles make it difficult to turn that revenue growth into profitable earnings. Even with stronger sales figures, the company’s profit margins are squeezed from factors like increased input costs and various financial pressures, leading to a less-than-stellar profit performance during the period in question.

DMRC is switching from copper to aluminium cabling throughout its network to tackle the ongoing theft issues that have been causing disruptions and driving up maintenance costs. The plan involves replacing the easily targeted copper cables with more secure aluminium options across a significant portion of the network. To support this transition, DMRC is investing around INR 325.9 million and implementing stronger security measures.

Some glance at production, expansion & financial details

Europe's aluminium foil market saw an upswing, with global consumption moving from 5.3 million tonnes in 2018 to 6.8 million tonnes by 2025 and possibly will reach 7 million tonnes in 2026. In Europe, the demand is strengthening mainly due to the needs of pharmaceutical packaging and a growing preference for premium applications. However, due to stricter regulations on packaging waste and rising energy costs, this growth is taking place slowly. Get more from here.

Oman is pulling Indian investment to grow its downstream aluminium sector by creating a specialised processing zone. This will enhance value-added manufacturing while cutting down on the country's dependence on raw material exports. It is for industrial diversification, building on the success of an existing plastics cluster and utilising local primary aluminium supplies to boost production in areas like extrusion, rolling, fabrication, packaging and automotive components. Uncover more about the scoop here.

Kaiser Aluminium’s stock recorded a high of USD 145.62, showing a 101 per cent increase year-on-year, pushing the company’s market cap to about USD 2.32 billion. This surge is owed to strong investor confidence, boosted by a positive assessment of the firm’s financial health and optimistic expectations for net income growth this year. However, the stock is currently trading above its estimated fair value and the gross profit margins are still relatively weak.

Hindalco reported a 45 per cent drop in its consolidated profit for Q3 FY26 year-on-year. This decline is because of the fire that broke out at the Novelis-owned facility in Oswego, New York, which disrupted operations and earnings during the quarter. However, the company’s business in India performed exceptionally well, achieving a record profit after tax due to better operational efficiencies and favourable market conditions. Know more in detail here.

Press Metals posted its best earnings performance ever, due to a surge in aluminium prices that boosted profits across its entire product range. The company has seen an uptick in shipments and a more favourable cost structure, with unit-level operating performance benefiting from the ongoing price rise in key markets. While energy costs and supply chain issues are still important to track, the current pricing landscape has shifted the firm’s revenue and margin outlook for this reporting period.

Ball’s performance in 2025 showcased growth driven by increased volume, marginal management and revamping the capital framework to enhance financial flexibility. The surge in beverage can shipments across major markets fueled revenue growth and the company stayed committed to controlling costs and boosting operational efficiency to safeguard its margins in a fluctuating pricing and demand landscape.

Global aluminium consumption by end-use sectors will hit 106.8 million tonnes by 2026, fueled by consistent demand in key sectors like transport, construction, packaging and electrical applications. This growth is owed to the ongoing trends in electrification, the need for lighter materials and infrastructure development. Asia, especially China and India, continues to dominate both consumption and production. On the other hand, North America and Europe maintain stable demand despite shifting industrial and energy costs.

In 2025, global electric vehicle sales jump by 20 per cent year-on-year, with battery-electric vehicle volumes rising to 14 million units. However, the growth patterns varied quite a bit across different major markets. China continued to lead, benefiting from a steady increase in battery-electric adoption and a growing market share. Meanwhile, Europe and the United States experienced different trends due to varying levels of policy support, product offerings and demand dynamics.

Responses