The global aluminium semi-fabricated and consumer product stories this week didn’t move in a straight line. It zigzagged across corporates, trade corridors, design studios, and even distant mountain towns, with each turn bringing forth an industry pulled forward by markets it can’t fully control and reshaped by choices it can no longer postpone.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

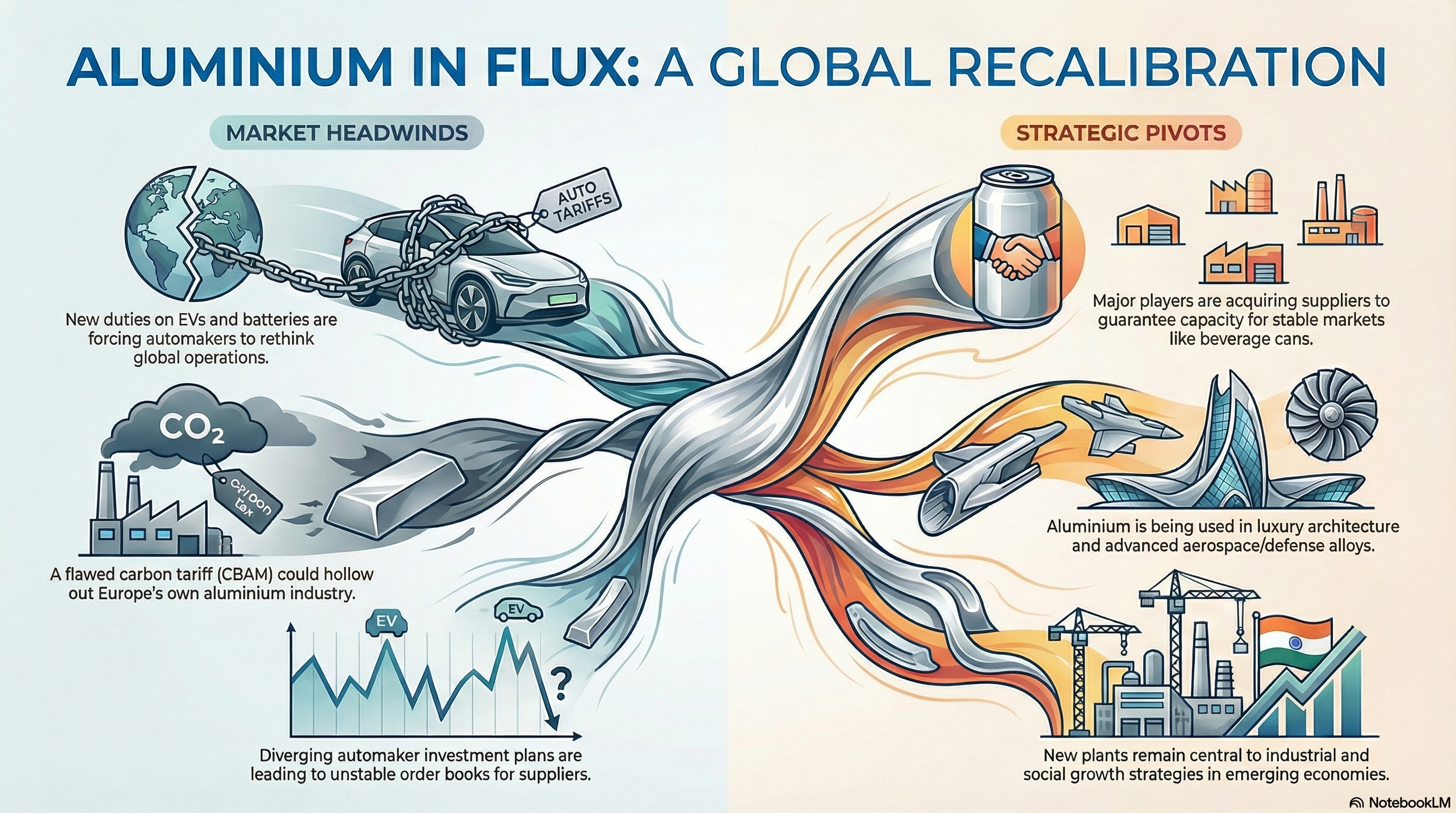

Ball set the tone early by stepping deeper into Europe’s beverage can landscape, announcing its plan to acquire a majority stake in local manufacturer Benepack after two years of relying on its capacity under a supply agreement. The deal wasn’t framed as expansion for expansion’s sake; it was an insurance policy. Beverage cans’ demand has held firm, but regional capacity needs rebalancing, and Ball seems unwilling to leave that equation to chance.

Far from consumer packaging, the industrial side of aluminium was confronting pressures of its own as the 2025 auto tariff regime began redrawing the world’s vehicle supply lines. Three layers of duties — on EVs, batteries, and critical minerals — haven’t merely complicated trade; they have shifted it. Auto exporters are reshuffling markets, OEMs are rethinking assembly locations, and aluminium demand is being pulled into a new geometry shaped by politics as much as production costs.

China’s automakers felt that shift immediately. With EVs consuming the domestic market, petrol cars increasingly became an export product — a remarkable reversal captured in the surge of surplus internal-combustion models being shipped abroad. The structural imbalance reflects a sector transitioning faster than expected, with aluminium demand tethering itself to whichever powertrain finds a buyer next.

That uncertainty spilt into 2026 planning as well. The global EV outlook fractured into two camps: players accelerating investment and others tapping the brakes amid liquidity constraints and uneven consumer sentiment. For aluminium suppliers, the divergence means unstable order books — one month driven by aggressive model launches, the next by postponed capex and battery-metal caution.

Not every storyline this week was shaped by market tensions. In Tokyo, Cartier’s Ginza store reopened with a new aluminium façade crafted by Klein Dytham — an architectural statement that positioned the metal not as an industrial input but as a luxury surface. It was a reminder that aluminium continues to climb into higher-margin design segments where aesthetics matter as much as metallurgy.

Don't miss out- Buyers are looking for your products on our B2B platform

A different kind of aluminium milestone unfolded in Tajikistan, where Tursunzoda celebrated the inauguration of both a new aluminium plant and two schools. For one of Central Asia’s smallest economies, the project symbolised industrial ambition linked inseparably with social infrastructure — a pairing that shows how aluminium still anchors national development strategies.

In the UK, that same developmental impulse took a more technologically ambitious form. Metalysis entered high-grade aluminium–scandium alloy production , marking a midstream shift toward materials that serve aerospace, defence, and advanced mobility. The move sharpened Britain’s push to reclaim strategic relevance in speciality alloys — sectors where performance beats volume.

Corporate results elsewhere revealed how uneven that performance has become. Malaysia’s LB Aluminium closed the quarter with a MYR 5.34 million net profit despite a 9.33 per cent revenue decline, showing that margin discipline can still outrun market softness. India’s Hind Aluminium, however, found itself deeper in financial strain, signalling how vulnerable smaller players have become as working-capital cycles stretch and demand pockets shift.

But the strongest jolt came from Europe, where Constellium delivered a blunt warning about CBAM: either the EU rethinks the mechanism or risks hollowing out its aluminium base entirely. The message echoed across the industry, capturing a fear long whispered — that decarbonisation, if misaligned with global competitiveness, could end up exporting emissions and importing vulnerabilities.

Taken together, these events sketched an aluminium world in constant recalibration. Companies chased supply security, governments redrew trade maps, designers pushed the metal into new cultural spaces, and producers navigated margins that defied old playbooks. Nothing in the past 10 days moved in isolation — not the acquisitions, not the tariffs, not the plant launches, not the warnings. Aluminium’s story unfolded as a single, interconnected arc this time!

Must read: Key industry individuals share their thoughts on the trending topic

Responses