您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

China’s rapid embrace of electric vehicles has transformed its home market so completely that gasoline-powered cars, once the backbone of global automakers’ operations in the country, have been pushed to the margins. As Chinese consumers started embracing EVs, traditional foreign manufacturers were not the only ones left struggling. Renowned Chinese automakers faced the same with their combustion-engine sales drop in their country.

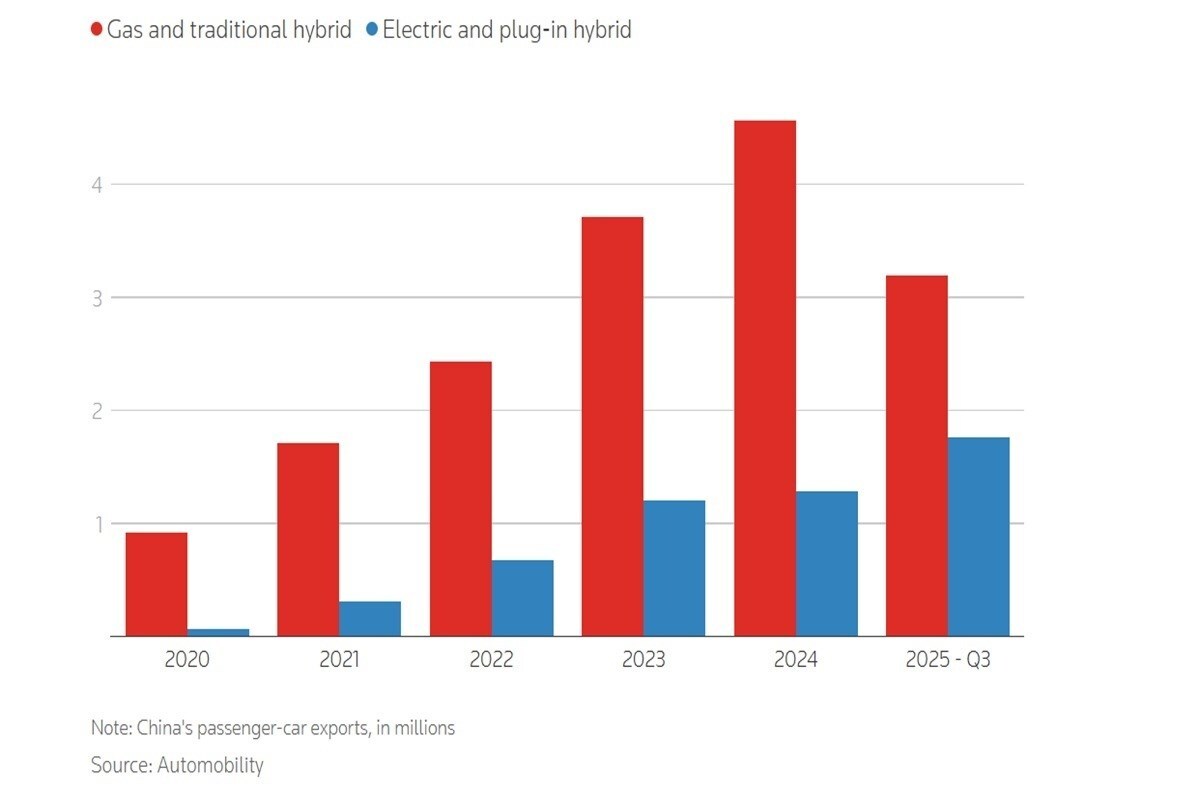

While Western governments have focused their defensive measures on China’s subsidised electric cars, it is China’s petrol models that are increasingly appearing in markets from Poland and South Africa to Uruguay. Fossil-fuel vehicles have represented 76 per cent of China’s auto exports since 2020, with total foreign shipments climbing from 1 million annually to what is likely to exceed 6.5 million this year, according to consultancy Automobility in Shanghai.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

The surge is rooted in the same industrial policies and subsidies that reshaped the domestic EV landscape and pushed global firms such as Volkswagen, GM and Nissan into steep decline in China. These incentives supported dozens of Chinese EV makers, triggered a fierce price war and ultimately drew demand away from combustion-engine cars. Reuters’ analysis of vehicle sales across numerous countries, and interviews with executives at 11 Chinese carmakers and two Western companies, as well as dealers and researchers, reveal how this shift has carried far-reaching consequences for the global car industry.

Even without counting EVs or plug-in hybrids, China’s petrol-car exports last year were substantial enough to make it the world’s largest auto exporter by volume, according to industry and government figures.

State-owned manufacturers named SAIC, BAIC, Dongfeng and Changan among them have become central players in the boom. For decades, many of these companies relied on joint ventures with foreign brands for both earnings and engineering expertise, partnerships that date back to China’s policy-driven arrangements of the 1980s. But with newer, privately led EV makers such as BYD gaining ground, the old joint ventures have faltered. SAIC-GM’s China sales, for example, tumbled from over 1.4 million vehicles in 2020 to 435,000 in 2024.

Now these same state-backed firms are expanding abroad at a pace that mirrors the retreat of their foreign partners. SAIC’s exports, mostly under its own marques, jumped from about 400,000 vehicles in 2020 to more than one million last year. Dongfeng’s nearly 250,000 exports in 2023 were almost four times its total five years prior, offsetting plummeting China sales from its Honda and Nissan ventures.

Image source: Reuters

Chinese makers have found particular traction in regions where charging infrastructure is limited, and petrol vehicles remain the most practical option, which includes Eastern Europe, Latin America, Africa and other emerging markets. While Beijing ultimately aims to dominate the global EV and plug-in hybrid segments, many companies are using petrol models to build brand recognition overseas in the meantime.

Chery has become China’s leading auto exporter, with its global sales soaring from 730,000 in 2020 to 2.6 million by 2024. Roughly 80 per cent of its output remains petrol-powered. China’s top 10 exporters include five state-owned giants and two privately owned carmakers, Geely and Great Wall Motor, which also ship more combustion vehicles than EVs. Only two companies in the top tier export solely battery-powered models: Tesla and BYD, the latter now China’s second-largest exporter and the main force pushing plug-in hybrids into global markets. Even so, petrol-vehicle exports are expected to top 4.3 million units this year, representing nearly two-thirds of China’s overseas sales.

Also Read: EV anticipation for ’26: Who’s accelerating and who’s hitting the brake?

Executives from Chery, Dongfeng and state-owned FAW told Reuters that China’s hyper-competitive domestic market has made foreign sales essential for profitability. FAW’s global design head Giles Taylor warned that some rivals are just “one product failure away from going under,” describing an industry he sees as teetering on “dog-eat-dog” conditions. Most companies, managers said, prioritise petrol-car exports simply because they are easier to sell in most regions. Changan’s European marketing director, Nic Thomas, noted: “We can fine-tune our offering for every market.”

Some major exporters, including SAIC, BAIC, Geely and Great Wall Motor, and China’s National Development and Reform Commission did not comment on the Reuters report. Western automakers, asked about the competitive threat from China’s petrol-vehicle exports, largely declined to respond; only Volkswagen said it had “no fear” of Chinese rivals entering South America, while GM reiterated its goal to compete with the right technology at appropriate cost.

The root of China’s export wave lies in years of government-backed factory building. Automobility’s Bill Russo estimates that the rise of EVs has left production lines capable of making up to 20 million petrol cars per year sitting idle. Automakers are now channelling that excess output overseas.

Also Read: Africa EV Mobility Expo Kenya 2025 to Power Africa’s Green Transport Transition

Consultancy AlixPartners expects Chinese carmakers to add 4 million annual overseas sales by 2030, gaining significant market share in South America, the Middle East, Africa and Southeast Asia. By then, Chinese firms could hold 30 per cent of the global car market.

Local governments across China fuelled overcapacity by subsidising new EV plants rather than repurposing petrol factories, even providing land and constructing facilities so manufacturers could “move in with just a suitcase,” said Sany Heavy Truck chairman Liang Linhe. China now has the capacity to make 20 million EVs and plug-in hybrids each year, along with factories capable of producing 30 million petrol cars, far more than the domestic market can absorb. Former vice minister of industry Su Bo warned earlier this year that faltering petrol sales have left the sector in a “critical survival crisis.”

These pressures have sent legacy Chinese brands racing into global markets. Poland offers a glimpse of the shift: since 2023, 33 Chinese brands have launched or announced their entry, many offering primarily petrol cars. At a BAIC showroom in Warsaw, manager Jerzy Przadka said so many Chinese mid-size SUVs look alike that buyers struggle to distinguish them. Local distributor Jameel Motors described the wave of Chinese entrants as “madness.”

Distribution heavyweight Inchcape, which now secures most of its new contracts from Chinese automakers, opined that Chinese firms succeed abroad by tailoring vehicles to what each region wants. In many emerging markets, that still means petrol engines. Even in wealthier countries such as Australia, Chery’s sales thus far have been almost entirely combustion models.

Analysts at JATO Dynamics argue that Western automakers left themselves exposed by focusing their innovation and pricing on wealthy markets such as Europe, the United States and Japan. Chinese brands, often offering better safety features and software at similar or lower prices, have seized the opportunity. “Legacy automakers were sleeping,” said analyst Felipe Munoz.

The consequences are particularly evident in Mexico, now China’s largest overseas destination. Chinese carmakers are expected to sell more than 200,000 vehicles and capture a 14 per cent share this year, while legacy brands such as Chevrolet face double-digit declines. Mexico recently raised tariffs on Chinese cars from 20 per cent to 50 per cent, partly in response to US pressure to prevent China from using Mexico as a back door into the American market.

Russia has also introduced steep import fees as Chinese brands have expanded their share from 21 per cent in 2022 to 64 per cent in 2024, equivalent to some 900,000 vehicles. Meanwhile, in South Africa, Chinese automakers’ share reached nearly 16 per cent in the first half of this year, with sales of almost 30,000 petrol cars but only 11 EVs. Toyota recorded the sharpest drop among established players there.

Chinese pickups have become a competitive force in Latin America. In Chile, where charging infrastructure is sparse, Chinese brands now account for almost one-third of all car sales, displacing Chevrolet, Nissan and Volkswagen. In Uruguay, Dongfeng’s Rich 6, essentially a Nissan Frontier with different styling and an older Nissan V6 engine, sells for about USD 21,490, compared with roughly USD 30,990 for the Nissan.

However, not all Chinese brands rely on deep discounts. Jetour, owned by Chery, intends to keep prices aligned with international rivals as it expands across Europe by 2027. “We don’t want to get involved in any more price wars,” said Jetour International’s executive vice president Yan Jun.

Must read: Key industry individuals share their thoughts on the trending topics

Responses