您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

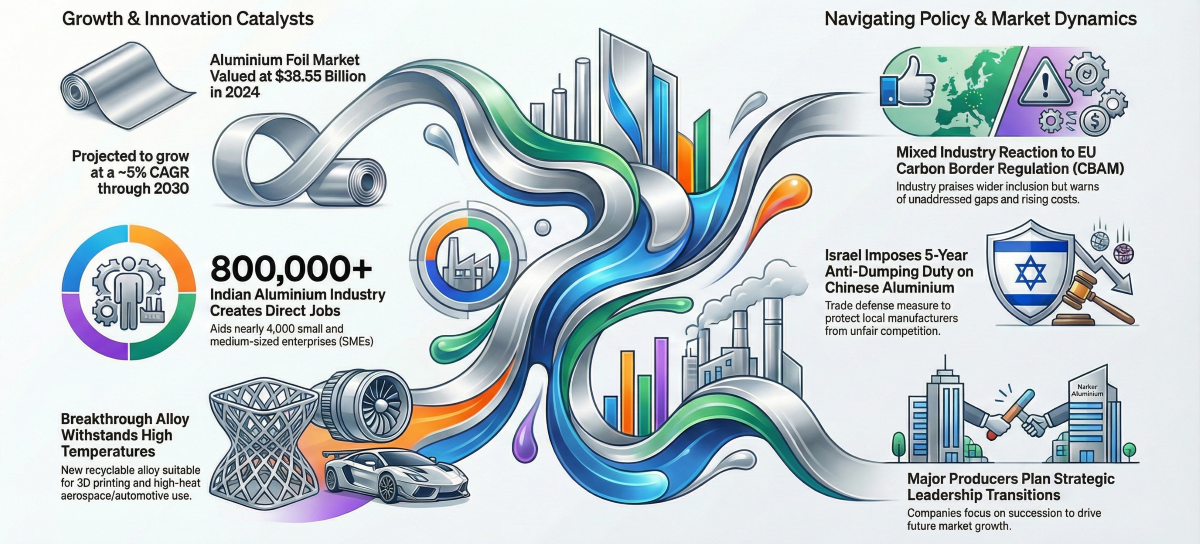

Leadership changes, shifts in policy, market trends, and innovation are subtly transforming the aluminium industry’s outlook for the near future. From strategic succession planning at major producers and increasing job opportunities in key markets to the evolving dynamics of the Carbon Border Adjustment Mechanism (CBAM), along with investment-driven growth in aluminium foil and significant developments across exchanges and projects, this week’s news indicates that deeper structural changes are in motion. All these signs suggest that the global aluminium value chain is gearing up for enhanced competitiveness, resilience, and growth as we move toward 2026.

Global downstream aluminium industry weekly recap by AL Circle Pvt Ltd

{alcircleadd}AL leadership transforming the industry

Kaiser Aluminum announced a leadership change in its commercial team, starting January 1, 2026. Hugh (Jack) J. Barger III will step into the role of Executive Vice President of Sales and Marketing as Blain A. Tiffany, the current EVP, prepares for retirement and it’s all part of the company’s future thought leadership succession planning. Barger, earlier this year, joined Kaiser as Senior Vice President of Sales and Marketing and has been settling into the new role. With over 25 years of experience in the metals industry, including key leadership positions at Central Steel & Wire and A.M. Castle & Company, his appointment aims to maintain strong leadership in Kaiser’s sales and marketing efforts while enhancing customer relationships and driving market growth.

The Indian aluminium industry is creating employment opportunities not just in cities but also in rural areas, uplifting the broader economic development goals. According to the Aluminium Association of India, the industry created nearly 800 thousand direct jobs and aids almost 4 thousand small and medium-sized enterprises (SMEs). Based on government statistics, overall employment in the economy grew by about 36 per cent from 2016 to 2017 and from 2022 to 2023, which is roughly 170 million jobs. Major aluminium companies like National Aluminium Company Limited (NALCO) are actively posting job openings in technical, operational and corporate roles and they plan to keep hiring through 2025.

The global aluminium foil market, in 2024, was worth around USD 38.55 billion and has been on a growth trajectory ever since. This expansion is owed to investments from major producers and an increased demand for applications in sectors like packaging, construction, energy and electric vehicles. Key players in the aluminium foil manufacturing scene are located in major producing regions such as Turkey, China, Russia and Japan, showcasing a diverse global supply chain that’s adapting to the rising demand. In the years to come, the aluminium foil industry is expected to maintain its growth momentum through 2030, with an estimated CAGR of about 5 per cent, due to the ongoing investments and diverse use of aluminium foil products.

Don’t miss out- Buyers are looking for your products on our B2B platform

CBAM: A friend or foe?

The aluminium industry has reacted to the European Commission’s proposed changes to the Carbon Border Adjustment Mechanism (CBAM) with a mix of optimism and caution. They’re pleased to see the extension of CBAM to include downstream aluminium products and appreciate the effort to strengthen the overall framework. However, they also pointed out that there are still some significant issues that need to be addressed. Industry representatives highlighted that while the inclusion of additional product codes, like automotive components, wires and cables, meets a long-standing request, many important aluminium CN codes are still left out.

They further believe that the unique value chains and competitive challenges in the sector require customised solutions instead of a blanket approach. The Commission’s focus on preventing circumvention, especially regarding scrap misclassification, was recognised, but the industry emphasised that both pre- and post-consumer scrap should be treated equally to maintain the competitiveness of EU recyclers and the integrity of carbon accounting. Additionally, while the proposal introduces a new tool to aid decarbonisation, the lack of export support for aluminium producers, especially those downstream producers not covered by the EU Emissions Trading System, could lead to increased input costs without any competitive relief. This highlights the urgent need for mechanisms that include export support and further adjustments before the proposal is finalised.

Innovations and projects this week

In Japan, researchers at Nagoya University reported a breakthrough with a new set of aluminium alloys that not only hold their strength at high temperatures but are also highly recyclable and perfect for metal 3D printing. This innovation tackles a major drawback of traditional aluminium alloys, which usually weaken when exposed to heat for extended periods. This limitation has restricted their use in high-temperature settings like engines, turbines, automotive parts, and aerospace systems. Read more into the innovation here.

The Imo State Government recommissioned the Imo Aluminium Extrusion Industries Limited (ALEX) located in Inyishi, Ikeduru Local Government Area. This project brings back to life a long-dormant aluminium plant, which is a key industrial asset for the region. ALEX was originally set up in 1983 and was once a leading producer of long-span roofing sheets, profiles, and accessories for the national market. Unfortunately, it fell into decline due to mismanagement and neglect by previous technical partners, putting over 200 jobs in jeopardy. Know more about the project here.

Must read: Key industry individuals share their thoughts on the trending topics

And here's more

On the Nigerian Exchange (NGX), aluminium extrusion witnessed a weekly gain, with its share price surging by 59.35 per cent at N12.35 (USD 0.0082). This surge is owed to the interest from investors and a positive trend in the market. Followed by Mecure Industries and First Holdco, which also saw significant gains, while the overall market breadth improved, reflecting a significant rise in the stock price over the last week. However, on the other hand, firms like Living Trust Mortgage Bank and International Energy Insurance experienced declines. This rally helped boost market indicators, with the All-Share Index climbing and total market capitalisation increasing, driven by a surge in trading activity and renewed buying enthusiasm across various sectors.

Israel's imports of aluminium profiles and tubes from China will now face a five-year anti-dumping duty as the region aims to safeguard its domestic industry. This decision came soon after an official investigation revealed that Chinese exporters were selling these products at unfairly low prices, which was hurting local manufacturers. The announcement came from the Minister of Economy and Industry, following findings from the Trade Duties Commissioner and an advisory committee. These duties align with standard trade defence measures set by World Trade Organisation rules and are commonly used around the world to promote fair competition and protect local producers from harmful import practices.

To know more about the global primary aluminium industry 2026 outlook, pre-book the report “Global Aluminium Industry Outlook 2026” at a special price.

Responses