This week, the global aluminium industry is shook by the military coup in Guinea on September 5, which has impacted the raw material supply to the metal industry. As a result, the primary aluminium production is facing a disruption, causing an incessant hike in prices. Both the global aluminium price and domestic price in China have seen a surge to a decade high.

According to the Shanghai Metals Market, China’s domestic primary aluminium ingot price rose to a 13-year high, bolstered by the tight supply of the metal due to increased pressure on smelters to rationalise their power usage, coupled with political unrest in Guinea impacting the global raw material supply. On Thursday, September 9, China’s A00 aluminium ingot price soared by RMB 460 per tonne to reach at RMB 22,230 per tonne. The price surged further on September 10 by RMB 420 per tonne, following the detention of Alpha Conde, president of the Republic of Guinea. As per the SMM data, the price came in at RMB 22,650 per tonne on September 10.

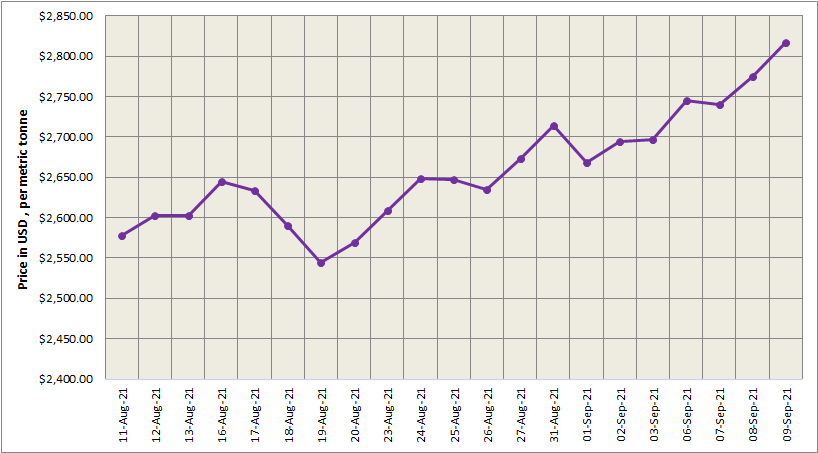

The Guinea military coup has also pushed the benchmark aluminium price on the London Metal Exchange throughout the week to as high as US$2,817 per tonne as of Thursday, September 9. 3-month bid price and 3-month offer price were at US$2,827 per tonne and US$2,828 per tonne, while December 22 bid price stood at US$2,743 per tonne and offer price at US$2,748 per tonne.

As of September 9, LME aluminium opening stock stood at 1325225 tonnes.

To know more: https://www.alcircle.com/news/lme-aluminium-price-soars-above-us2800-t-shfe-price-settles-higher-at-us3-494-t-70326

China’s social inventories of primary aluminium grew 2,000 tonnes across eight major consumption areas on Thursday, September 9, to stand at 751,000 tonnes. The rise was primarily contributed by Nanhai, Shanghai, and Tianjin. In Nanhai, primary aluminium inventories built up 8,000 tonnes to stand at 220,000 tonnes, followed by the growth of 2,000 tonnes in Shanghai to 73,000 tonnes. In Tianjin, inventories inched up by 1,000 tonnes to come in at 67,000 tonnes.

On September 8, 2021, Rusal confirmed the appointment of former Chalco trader Deng Gang as its new Sales Director for the China market. Deng previously held the position as Head of China for Concord Resources and before that, from 2016-20 he was the Chief Marketing Officer for Chalco Trading Hong Kong Ltd., a unit of China's state-run aluminium maker Chalco.

Deng has joined Rusal’s Shanghai office this week and will report to Roman Andryushin, Deputy General Director for Sales in Russia, CIS and China.

To know more: https://www.alcircle.com/news/rusal-appoints-former-chalco-trading-cmo-deng-gang-as-sales-director-for-china-market-70310

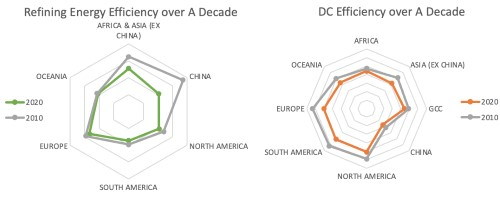

The International Aluminium Institute (IAI) revealed new data on the aluminium industry’s achievements in diminishing energy efficiency in the industry’s constant sustainability mission. The data release accords with a series of announcements in the lead up to COP26 in Glasgow.

The aluminium industry’s energy usage accounts for over two-thirds of global greenhouse gas emissions. The results from the 2020 Global Energy Survey conducted by the IAI deliver evidence of an industry customising pathways to manage the problem.

To know more: https://www.alcircle.com/news/iai-data-unveils-aluminium-industrys-constant-improvement-in-energy-efficiency-70301

The Government of India stated this week that the state-owned Navratna CPSE Company NALCO had been performing a vital role in empowering micro and small enterprises by providing a modern and innovative platform NAMASYA, an application (App) developed exclusively for the convenience of the PSU's MSE vendors. NAMASYA provides a platform to feature the efforts of National Aluminium Company Ltd towards the development of the MSEs.

Hindalco Industries Limited continued to increase its aluminium ingot and aluminium products prices for the fourth time in a row, with effect from Thursday, September 9. Hindalco’s aluminium ingot price came in at INR 236,500 per tonne, up by INR 4,250 per tonne or 1.83 per cent from INR 232,250 per tonne on September 7.

The company increased the prices in line with LME aluminium price rally to US$2,775 per tonne as of Wednesday, September 8.

To know more: https://www.alcircle.com/news/hindalco-sharply-grows-its-aluminium-ingot-price-by-inr4-250-t-or-2-w-e-f-september-9-70318

National Aluminium Company Limited (NALCO) sharply increased the price of its aluminium ingot with effect from Tuesday, September 7, in line with LME aluminium price hike to a 10-year high. Seeing a rise of INR 6,400 per tonne or 2.80 per cent, NALCO’s aluminium ingot price is came in at INR 231,150-234,650 per tonne in comparison with INR 224,750-228,250 per tonne on September 1.

AlCircle Team is thrilled to announce the “AlCircle Expo 2022”. Like the previous years, the expo in 2022 is going to be virtual scheduled on February 15 & 16. But what going to be new is – More Technology, Bigger Platform, and Wider Scope of Expanding Business!

The AlCircle Expo 2022 has already started preparing to bring in the aluminium industry leaders and partners from the entire value chain under one roof, driven by advanced technology to enable them to build a stronger network. Technology will help you correspond with participants and view their services and products to explore new business opportunities.

To participate in this mega global event as an exhibitor, feel free to write to us at events@alcircle.com.

To know more: https://www.alcircle.com/news/alcircle-expo-2022-on-february-15-16-be-ready-to-meet-the-global-aluminium-industry-70299

Responses