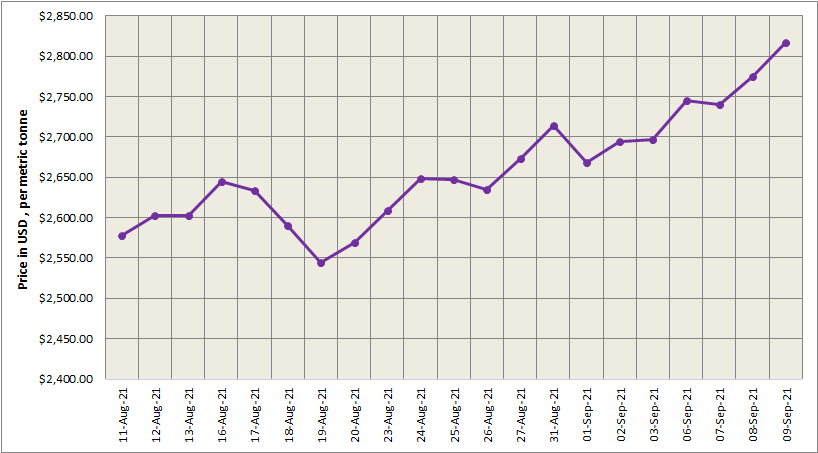

Three-month LME aluminium opened at US$2,795.5 per tonne on Thursday morning and hit a multi-year high of US$2,848 per tonne before closing at US$2,836 per tonne, an increase of US$45 per tonne or 1.61 percent. Trading volume was 19,006 lots, and open interest increased by 2,413 lots to 648,000 lots.

On Thursday, September 9, LME aluminium cash (bid) price and LME official settlement price jumped by US$42 per tonne to come in at US$2,816.50 per tonne and US$2,817 per tonne, respectively. 3-month bid price and 3-month offer price were at US$2,827 per tonne and US$2,828 per tonne. December 22 bid price stood at US$2,743 per tonne and the offer price for the same day was US$2,748 per tonne.

LME aluminium opening stock for September 9 was 1325225 tonnes. Live warrants amounted to 839650 tonnes, while cancelled warrants totalled 485575 tonnes.

LME aluminium 3-month Asian Reference Price settled at US$2,840.50 per tonne as of September 9.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHEF soared by US$59 per tonne to reach at US$3,494 per tonne on Friday, September 10.

The most-traded SHFE 2110 aluminium contract opened Thursday’s night session at RMB 22,400 per tonne, with the highest and lowest prices at RMB 22,505 per tonne and RMB 22,375 per tonne before closing at RMB 22,410 per tonne, down by RMB 65 per tonne. Trading volume was 92,340 lots, and open interest decreased by 4,328 lots to 288,000 lots.

Responses