您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

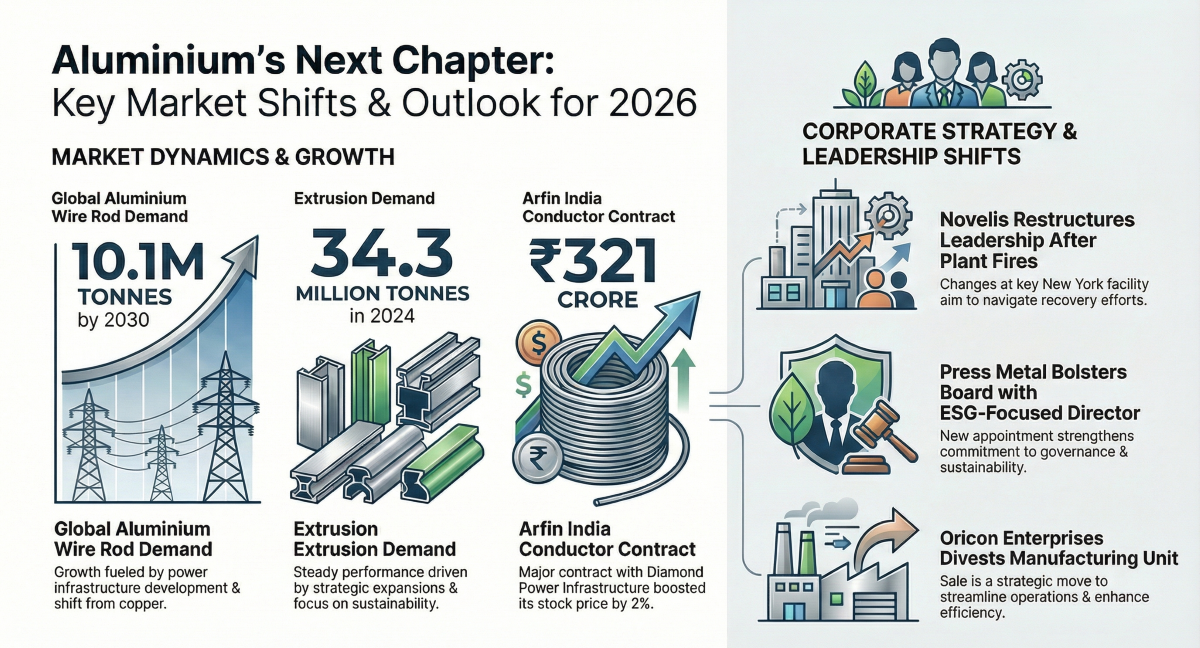

The global aluminium downstream, in 2026, looks with a fresh wave of energy, driven by changing corporate strategies, stronger demand signals and shifting leadership priorities. From stock fluctuations and portfolio adjustments to growth forecasts tied to capacity and changes in the boardroom, recent events indicate that downstream sectors are ramping up to unfold the next chapter of market growth. All these indicators hint at significant structural changes taking place in aluminium conductors, extrusions and value-added manufacturing, setting the groundwork for important developments on the horizon.

{alcircleadd}Share price rally in the global AL downstream sector

Oricon Enterprises Limited notified the stock exchanges that its Board of Directors has approved the sale of assets tied to its aluminium collapsible tube manufacturing unit based in MIDC Murbad, Thane, Maharashtra. This move is in line with the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. The aim here is to divest, which was confirmed during a board meeting on December 29, 2025 and is part of the company’s strategy for streamlining its manufacturing operations and enhancing efficiency.

Weekly downstream recap by AL Circle Pvt Ltd

Arfin India’s stock, on December 31, 2025, rose by 2 per cent, after the company announced it had secured a significant contract for aluminium conductors worth INR 321 crore from Diamond Power Infrastructure. As stated in the agreement, the firm will deliver 11 thousand tonnes of aluminium conductors over an 11-month span starting in January 2026. This indicates that the firm is expecting steady monthly revenue and a surge in the order book. This contract comes soon after the previous supply deal with the same client, showcasing the company’s strong execution skills and lasting relationships in this vital infrastructure sector.

Kaiser Aluminium's share price surged, lifting above the USD 118.11 mark, prompting analysts to rethink their stance on the stock. Zacks Research has downgraded its rating from “strong buy” to “hold,” citing valuation concerns, even though there's still confidence in the company's operational performance. This shift reflects a broader trend among analysts, who seem to be adopting a more balanced perspective. While some research firms are raising their price targets, others are sticking with hold ratings, indicating a cautious outlook for short-term gains after the significant increase in the company's share price.

How did the AL downstream products do in 2025

India's aluminium wire rod market is expected to see a demand rise by a CAGR of 5.93 per cent by 2030, which will be fueled by the rapid development of power transmission and distribution infrastructure, commitments to renewable energy and planned capacity expansions. On a global scale, the demand is expected to see a consistent increase in terms of aluminium wire rod consumption, mainly due to the increased preference for aluminium over copper for conductors. China and India are responsible for a significant portion of this demand, with total volumes anticipated to surpass 10.1 million tonnes by 2030.

Egypt’s Minister of Electricity and Renewable Energy, Mahmoud Esmat, completed his visit to China, where he connected with key industry players to boost collaboration and speed up the localisation of electrical equipment manufacturing in Egypt. The conversation mainly focused on setting up production lines for high and extra-high-voltage cable terminations and hybrid gas-insulated transmission lines that utilise aluminium alloy conductors. Furthermore, he also explored partnerships in renewable energy and raw material processing as a part of Egypt’s larger goal to fortify its domestic electrical equipment sector, improve grid infrastructure, transfer cutting-edge technologies and establish the country as a regional manufacturing hub, backed by robust domestic and regional market demand.

Year-on-year, the global aluminium extrusion industry, throughout 2025, continued to show steady performance. The main drivers of this growth are owed to consistent demand and strategic expansions in key regions as the sector gears up for planning cycles in 2026. As per AL Circle research estimates, total extrusion demand hit around 34.3 million tonnes in 2024, supported by a larger installed capacity. This is mainly due to the rising shift towards green and recycled billets, along with investments in higher-tonnage extrusion presses, highlighting a focus on sustainability and productivity. Uncover the complete outlook here.

Leadership changes at focus

Novelis is restructuring its leadership team at its Scriba, New York, aluminium facility, following the operational hiccups caused by two major fires in 2025 that altered the plant’s hot mill operations. The company has announced that the plant manager and several senior leaders have moved on as part of a larger organisational shift to navigate through ongoing recovery efforts. The Scriba site is a key player, with output over 1 billion pounds of aluminium sheet each year and meeting a significant chunk of North America’s automotive aluminium demands. Read more into the scoop here.

According to their filing with Bursa Malaysia, Press Metal is enhancing its board governance by appointing Amnah Apasra Emir Moehamad Izat Emir as an independent non-executive director, to be effective from 2 January 2026. With a background in architecture, urban development and infrastructure-led design, along with her leadership role at Neuformation Architects Sdn Bhd, Amnah brings valuable strategic insights into sustainable built environments and urban transformation. Her presence on the board is a perfect fit for Press Metal’s corporate vision, reinforcing the company’s commitment to governance, ESG priorities and creating long-term value for stakeholders in the aluminium manufacturing and downstream sectors. Learn more.

Responses