您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

As 2025 has made an exit with 2026 endeavours coming into practice, the aluminium extrusion market witnessed a steady Y-o-Y growth. The global demand approximately reached 34.3 million tonnes in 2024, against almost 49.9 million tonnes of annual installed capacity. Accounting for about two-thirds of global extrusion output, China dominates the industry. Globally, there has been an increased shift of extruders towards green billets and recycled or post-consumer scrap billets, while simultaneously investing in larger extrusion presses. The industry comprises over 1,600 extrusion companies worldwide.

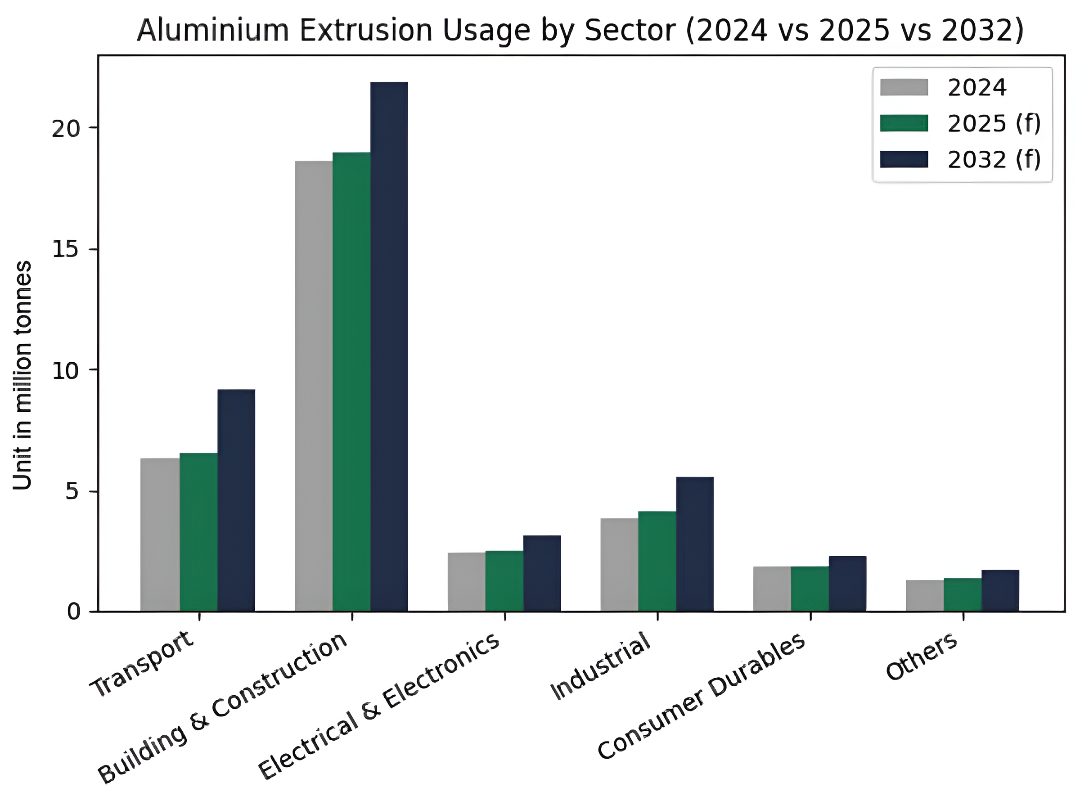

{alcircleadd}According to the data analysis by AL Circle, the transport and industrial sectors saw the steepest growths in aluminium extrusion demand, of 4.74 and 4.54 per cent, respectively. It indicates their faster climb than the overall market average of 3.05 per cent. The sector consuming the dominating volume was building and construction, although its growth rate remains the lowest at 2.07 per cent, suggesting it is a more mature market segment. The 2032 projection shows the total global usage to rise significantly to 43.58 (f) from 2024’s amount of 34.27 (f).

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

With these insights in mind, here are the primary highlights of the aluminium extrusion sector’s performance in the global market throughout 2025.

Maan Aluminium’s rebound comes with expansion plans in India

Maan Aluminium’s share price climbed after a 52-week low. An overall 16 per cent gain from March 3 to March 6, 2025, raised the price from INR 85.2 (USD 0.95) to INR 98.93 (USD 1.10). The company announced the acquisition of a building and a leasehold land of 13,117 square metres at Devas Industrial Area, Madhya Pradesh, against INR 8.75 crore (approx.).

It aimed to expand extrusion capacity with value-added services to achieve a 24,000-tonne annual capacity after starting commercial production on a new press in December 2024. The new extrusion line supported alloy series from 1000-7000, accommodating profiles up to 300 mm, fit for the Indian as well as the global market.

Responses