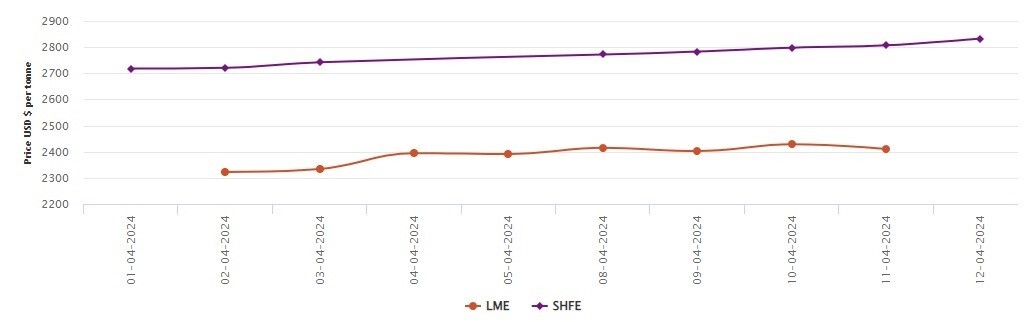

LME benchmark aluminium price dives by US$18/t to US$2410.5/t; SHFE adds US$26/t

LME aluminium opened at US$2,463 per tonne in the previous trading day, with its high and low at US$2,482 per tonne and US$2,443 per tonne respectively before closing at US$2,457 per tonne, down US$14 per tonne or 0.57 per cent.

The London Metal Exchange graph registered descending prices on April 11, with the LME aluminium cash bid and the LME aluminium official price losing US$19.50 per tonne or 0.8 per cent and US$18 per tonne or 0.74 per cent to close at US$2,409.50 per tonne and US$2,410.50 per tonne, respectively.

The LME 3-month bid price and the LME 3-month offer price have marked a decrease of US$26 per tonne or 1.05 per cent and US$24 per tonne or 0.97 per cent, to settle at US$2,459 per tonne and US$2,460 per tonne.

The LME 25-December bid price and the 25-December offer price have dwindled by US$37 per tonne or 1.39 per cent and US$27 per tonne or 1.02 per cent to officiate at US$2,625 per tonne and US$2,630 per tonne.

The opening stock has refrained from any change, staying stoic at 524,625 tonnes. Live and cancelled stocks parked at 325,300 tonnes and 199,325 tonnes, showcasing no change.

The LME Asian reference price has negated US$9.85 per tonne or 0.4 per cent to arrive at US$2,465.27 per tonne.

SHFE aluminium price

The SHFE aluminium price has stopped at US$2,833 per tonne, with a minor increase of US$26 per tonne or 0.93 per cent.

Overnight, the most-traded SHFE 2406 aluminium contract opened at RMB 20,425 per tonne, with the highest and lowest prices at RMB 20,510 per tonne and RMB 20,380 per tonne before closing at RMB 20,460 per tonne, flat from the previous trading day.

On a macro level, recent employment data and high inflation data have delayed the Fed's interest rate cut expectations. Additionally, China has introduced favourable policies such as "trade-in". Domestic aluminium operating capacity is slowly recovering. On the demand side, high aluminium prices have suppressed downstream purchasing enthusiasm and operating rates.

The spot discounts have been sustained, but driven by the destocking of aluminium ingots; the discounts may lessen. Overall, aluminium prices continue to stay high due to growing expectations of US economic recovery and positive fundamentals and may swing on a strong note. It is important to pay attention to the impact of high prices on downstream procurement and changes in domestic inventory.

This news is also available on our App 'AlCircle News' Android | iOS