您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

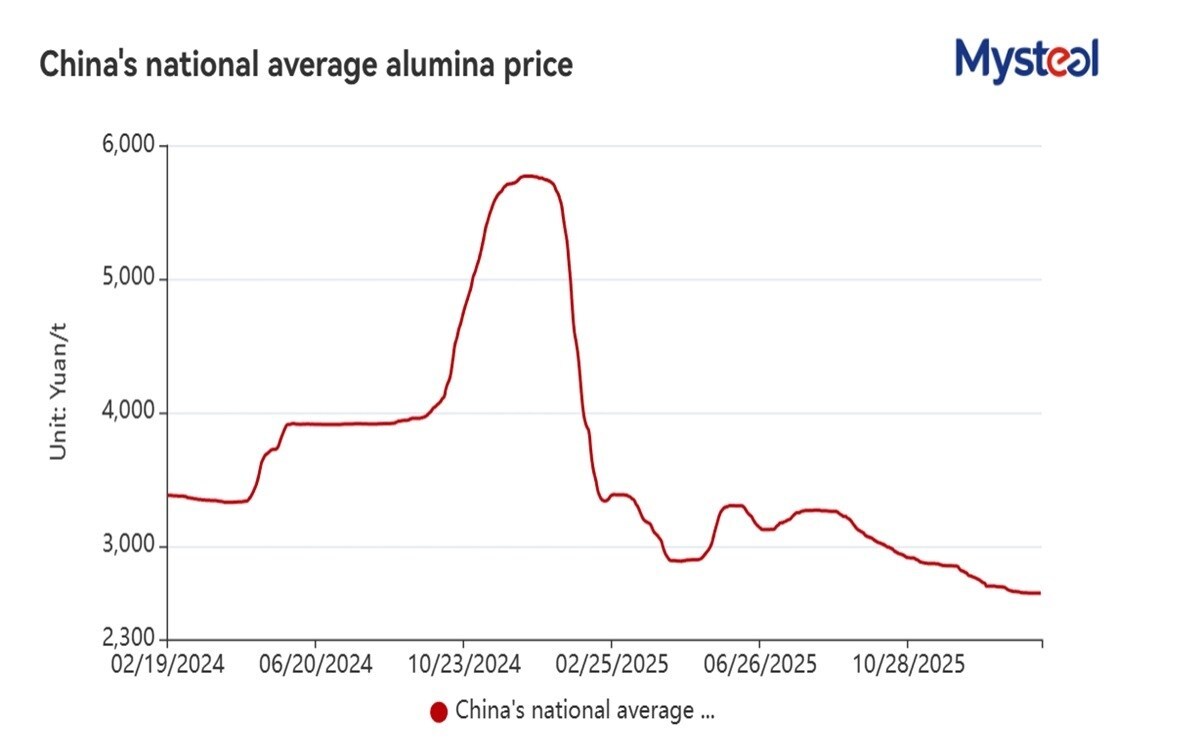

Mysteel assessed the national average spot price for smelter-grade alumina with a minimum purity of 98.6 per cent at RMB 2,646 per tonne (USD 383 per tonne), unchanged throughout the January 30-February 5 week.

{alcircleadd}To know more about the global primary aluminium industry 2026 outlook, book the report “Global ALuminium Industry Outlook 2026"

In response to the short-term reduction in alumina supply circulating in the spot market, many alumina producers and traders maintained a firm pricing stance during the week, as alumina production and inventory pressure on the supply side eased, market watchers noted.

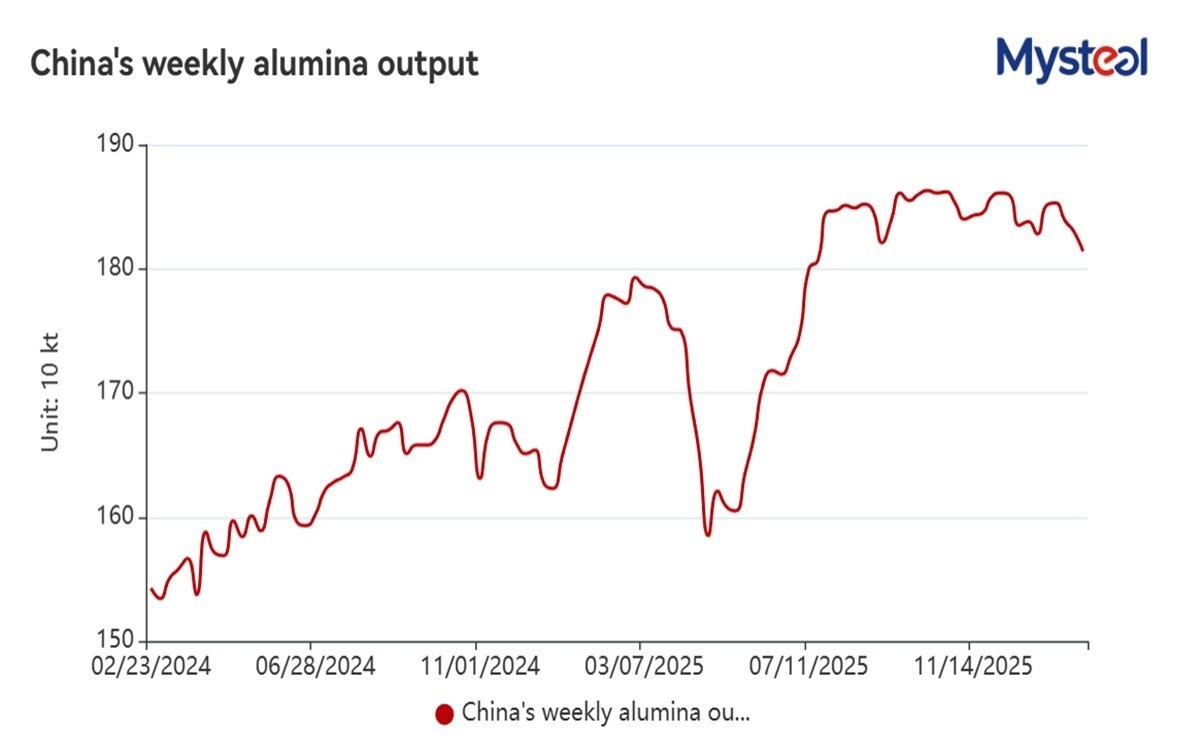

Several alumina producers carried out maintenance on calcinators last week, weighing on overall output, according to market participants. For example, a large alumina refiner in Hebei province with an annual capacity of 9.6 million tonnes partially suspended operations to begin calcinator maintenance during the week, Mysteel learned.

Mysteel's survey showed that total alumina output from the 44 producers regularly tracked reached 1.8 million tonnes during January 30-February 5, down 0.9 per cent from the previous week. This marked the third consecutive weekly decline, with the pace of contraction accelerating from the prior week's 0.5 per cent drop, Mysteel Global noted.

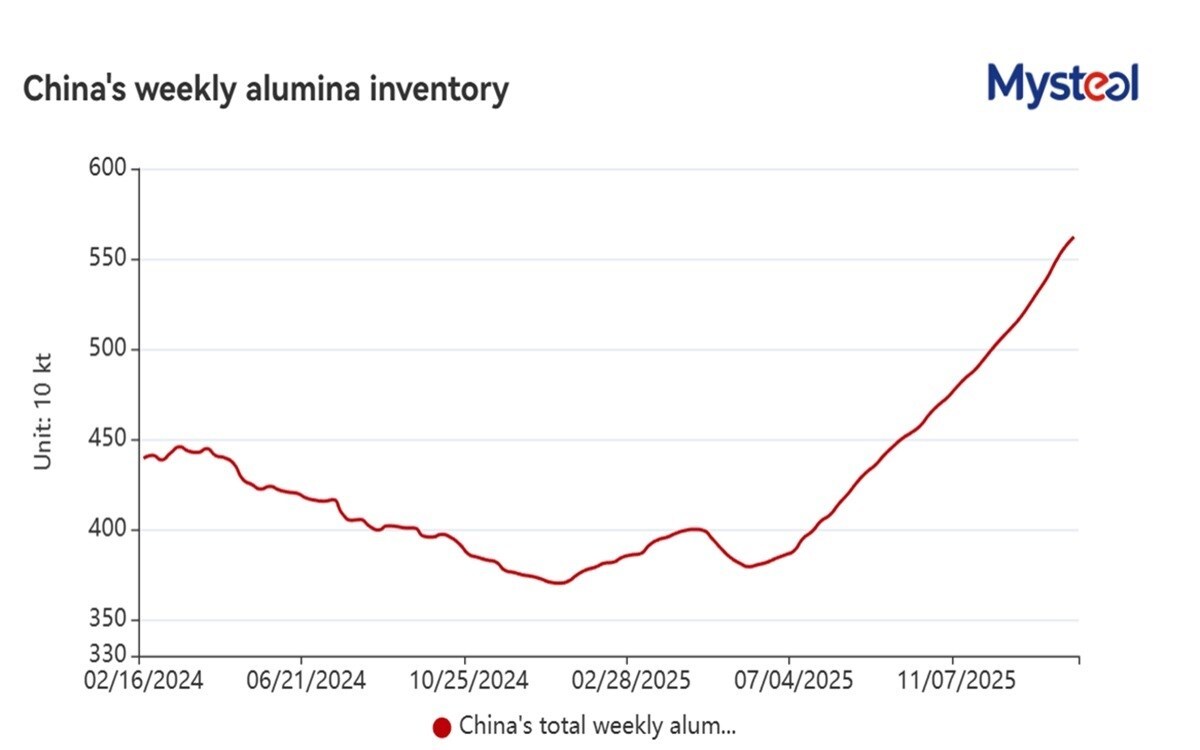

In addition, in hopes of reducing inventories, some alumina producers accelerated shipments to primary aluminium smelters ahead of the upcoming Chinese New Year holiday and to delivery warehouses registered with the Shanghai Futures Exchange, according to market sources. This further contributed to a temporary tightening of spot alumina availability.

Moreover, limited transportation capacity and rising freight costs also prompted alumina sellers to defend their offers, market watchers added.

Yet despite the short-term tightening in the spot market, alumina supply overall remained ample during the survey week. Inventory reductions at alumina producers were offset by rising stocks at smelters and at rail yards or in transit.

According to Mysteel's survey, as of February 5, total alumina inventories across China's 10 major ports, 44 producers, 89 smelters, and rail yards or in transit increased by 1 per cent on week to a new record high of 5.62 million tonnes. Due to producers' accelerated shipments, stocks held by smelters and at rail yards or in transit rose by 1.1 per cent and 2.3 per cent from a week earlier to 3.8 million tonnes and 1.4 million tonnes, respectively.

On the demand side, alumina consumption was steady during the same period, with most smelters sourcing the raw material under long-term contracts. Alumina consumption among the 89 smelters sampled in Mysteel's survey ticked up by a tiny 0.01 per cent from a week earlier to 1.65 million tonnes, Mysteel's tracking showed.

Don’t miss out- Buyers are looking for your products on our B2B platform

Note: This news is published under a content and exchange agreement with Mysteel

Responses