您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

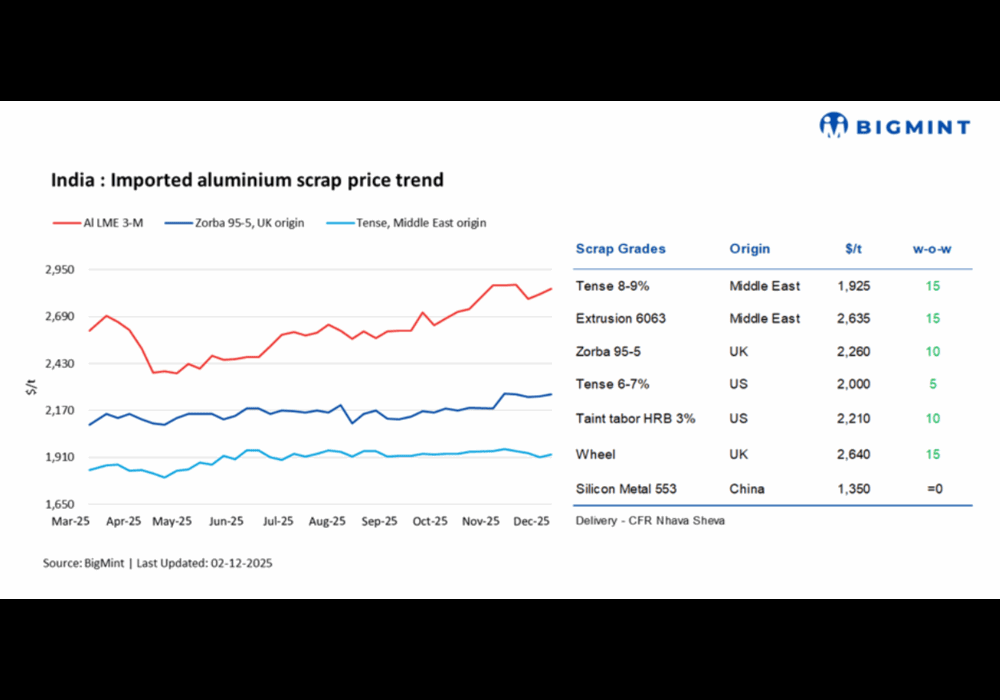

Fed rate cut expectations boost global prices. Year-end holidays are expected to slow trade down. India's imported aluminium scrap prices saw an uptrend w-o-w, following an increase in the London Metal Exchange (LME) price levels. BigMint assessed UAE-origin Tense scrap at USD1,925 per tonne, up by USD15 per tonne w-o-w, while UK-origin Taint Tabor C/S (9-10 per cent) stood at USD2,010 per tonne, firm w-o-w.

UK-origin Zorba 95 per 5 stood at USD2,260 per tonne, up by USD10 per tonne w-o-w, while UAE Extrusion 6063 increased by USD15 per tonne to 2,635 per tonne w-o-w. Meanwhile, UK-origin Wheel gained by USD15 per tonne to USD2,625 per tonne w-o-w.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

LME prices increase w-o-w; inventories rise

At closing on 2 December, LME aluminium prices stood at USD2,895 per tonne, up by USD80 per tonne from USD2,815 per tonne recorded on 25 November. Meanwhile, inventories at registered LME-warehouses decreased by 10,125 t to 537,900 t from 548,025 t in the previous week, indicating supply concerns.

LME aluminium prices recorded a modest week-over-week gain, supported by growing expectations of a US Federal Reserve rate cut in December after recent dovish policy signals. Improved risk appetite lifted sentiment across base metals. Supply-side tightness also contributed, with Chinese smelters nearing capacity limits and additional disruptions from the Grundartangi potline shutdown, Alcoa's Kwinana refinery closure, and production cuts at Century Aluminium's Iceland operations.

Also Read: India: Imported aluminium scrap prices inch up w-o-w; market expected to improve in early Nov'25

Market insights

Imported aluminium scrap prices have strengthened in line with the uptrend in LME aluminium. The rise in LME prices, supported by tightening global supply conditions and growing expectations of US Fed rate cuts in December, has pushed benchmark levels higher. In turn, this has kept imported scrap offers across major grades elevated.

Despite this bullish backdrop, traders and secondary smelters report that current offer levels remain significantly elevated and largely unworkable for buyers. As a result, overall procurement activity has slowed, with most market participants adopting a cautious wait-and-watch stance in anticipation of a potential price correction.

Additionally, with the year-end approaching, winter setting in, and holidays around the corner, the market has turned more sluggish, and trade activity has slowed down further.

In line with the rise in imported scrap offers, domestic aluminium scrap prices have also moved higher week-over-week across grades. However, casting scrap prices have remained largely rangebound in both Delhi and Chennai.

China silicon

According to BigMint's assessment, China's 553-grade silicon prices remained stable at USD1,350 per tonne CFR Mundra.

Outlook

Imported aluminium scrap prices are likely to remain rangebound in the near term, with muted buying interest and steady global offers keeping market sentiment cautious. With the year-end approaching, buying activity is also expected to slow further, as holidays in the West typically impact trading volumes and delay procurement decisions.

Must read: Key industry individuals share their thoughts on the trending topics

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses