您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

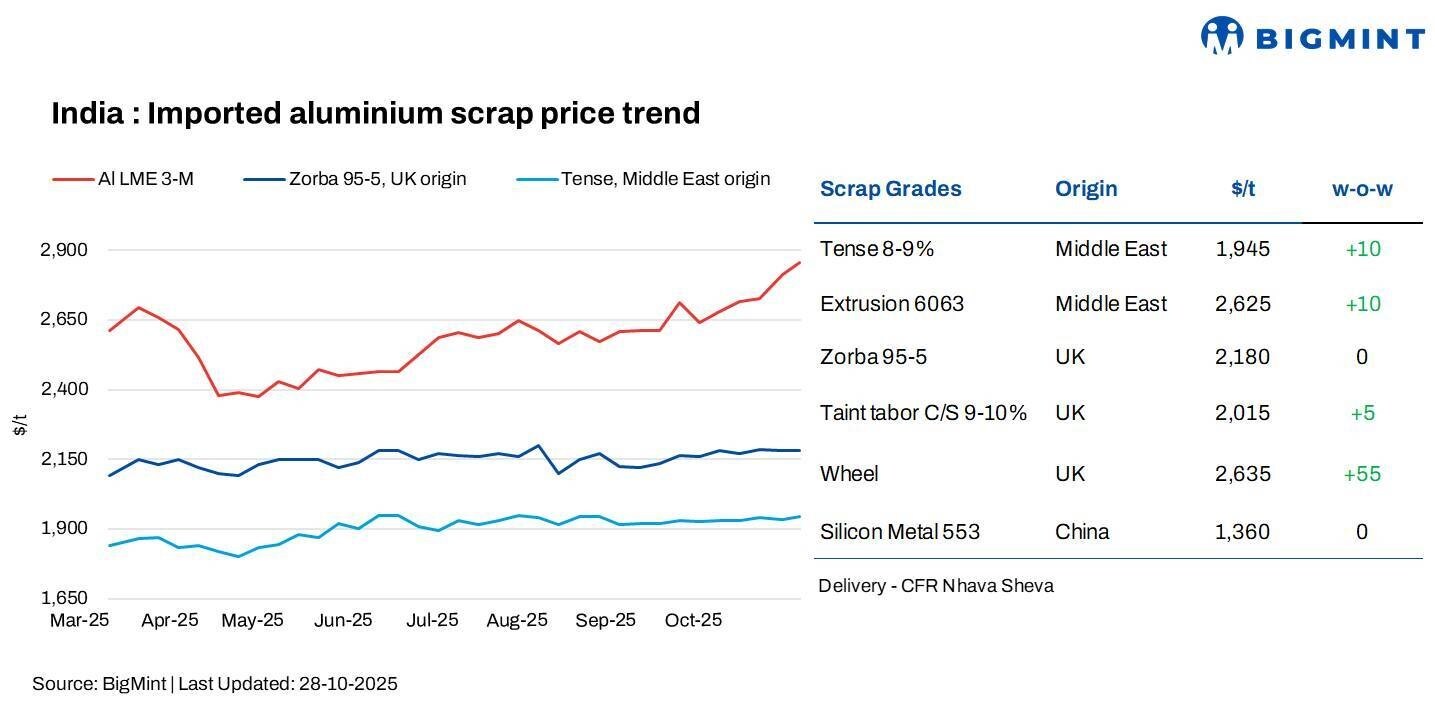

India's imported aluminium scrap prices inched up w-o-w, though London Metal Exchange (LME) benchmarks witnessed positive movements. BigMint assessed UAE-origin Tense scrap at USD 1,945 per tonne, up by USD 10 per tonne w-o-w, while UK-origin Taint Tabor C/S (9-10 per cent) stood at USD 2,250 per tonne, up by USD 5 per tonne w-o-w.

UK-origin Zorba 95/5 remained stable at USD 2,180 per tonne w-o-w, while UAE Extrusion 6063 inched up by USD 10 per tonne, stood at 2,625 per tonne w-o-w. Meanwhile, UK-origin Wheel increased by USD 55 per tonne to USD 2,635 per tonne w-o-w.

LME prices increase w-o-w; inventories decline

At the time of reporting, LME aluminium prices stood at USD 2,856 per tonne, up by around USD 73 per tonne as compared to USD 2,783 per tonne last week.

London Metal Exchange (LME) aluminium prices climbed to a three-year high during week 43 of CY'25, surpassing the USD 2,850 per tonne mark. The surge was fueled by tightening supply concerns and renewed optimism over a potential US-China trade agreement, which boosted overall market sentiment.

Meanwhile, aluminium inventories at registered warehouses declined significantly by 14,850 tonnes to 469,275 tonnes from 484,125 tonnes in the previous week, indicating tightening supply conditions.

Read More: Aluminium’s circular fortnight: From US recycling labs to India’s water breakthroughs

Market scenario

The imported aluminium scrap market continues to witness subdued activity despite LME aluminium prices reaching a three-year high. Market sentiment remains cautious, with buyers refraining from making large purchases amid price volatility and uncertain demand trends.

Trading volumes have been particularly weak in Taint Tabor, where most buyers consider the segment risky due to inconsistent offers and limited liquidity. In contrast, Zorba scrap is showing relatively better movement, supported by slightly improved demand and stable pricing from select secondary producers.

Currently, there are no fresh offers in the market as sellers await a clearer direction before quoting new prices. Many market participants expect conditions to improve in the first week of November, once price clarity returns and buyers begin restocking after the festive lull. However, for now, overall imported scrap trading remains slow, reflecting a cautious and wait-and-watch approach across the segment.

Domestic aluminium Tense scrap prices held steady at INR 191,000-192,000 per tonne amid a sluggish local market and weak demand.

Meanwhile, Tense scrap prices in the southern region fell to INR 186,000-187,000 per tonne, as Chennai's market saw a notable week-on-week decline. The drop was driven by reduced demand, improved scrap availability in the domestic market, and tighter enforcement of GST compliance, all contributing to downward price pressure.

In the utensil segment, prices increased by INR 4,000 per tonne w-o-w to INR 217,000 per tonne ex-Delhi, supported by consistent demand, while extrusion and Taint Tabor scrap prices remained range-bound w-o-w.

India's aluminium ADC12 alloy ingot prices remained steady across both southern and northern regions, supported by robust automotive demand following recent GST reductions. The firm trend in ADC12 offers was mainly driven by a surge in September auto sales, spurred by the government's GST 2.0 reforms that enhanced consumer confidence and improved vehicle affordability.

Furthermore, a major Indian automaker has raised its ADC12 settlement price by INR 2,900 per tonne month-on-month to INR 231,800 per tonne for November 2025. The revision reflects strong auto demand momentum, as the GST cut has significantly boosted vehicle sales to record levels.

Silicon price trends

According to BigMint's assessment, silicon 553 prices from China remained stable at USD 1,360 per tonne CFR Mundra, due to softening demand amid the recent Chinese holidays, along with improved availability from Chinese producers.

Outlook

The imported aluminium scrap market is expected to see a gradual improvement in early November as buyers return after the festive lull and market participants gain a clearer price direction. While demand remains cautious in segments like Taint Tabor, activity in Zorba and utensil scrap is likely to pick up amid firm LME prices and tighter global supply. However, volatility in exchange prices and domestic demand recovery trends will continue to influence short-term price movements.

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses