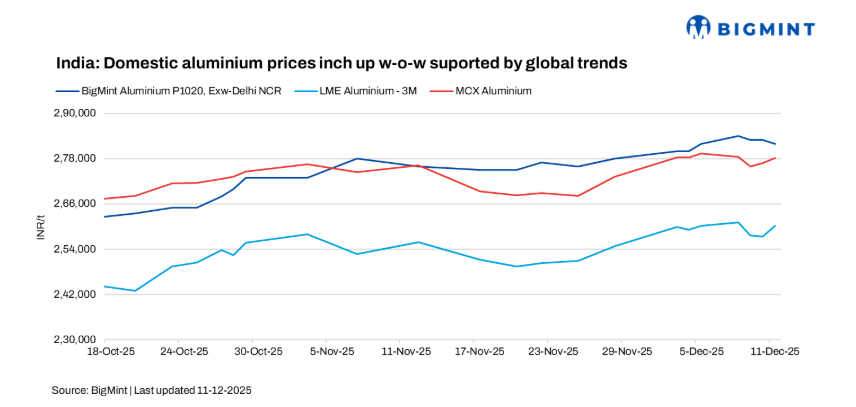

India's domestic aluminium market posted mild gains W-o-W as primary producers adjusted prices in response to a stronger LME complex and renewed supply concerns abroad. The uptick came despite a well-supplied domestic market and only a gradual improvement in downstream demand.

BigMint's assessment showed India's domestic P1020 ingot (99.7 per cent) prices rising by INR 2,000 per tonne W-o-W to INR 282,000 per tonne (USD 3,121.54 per tonne) ( ex-Delhi NCR, while Mumbai ex-works prices eased by INR 2,000 per tonne (USD 22.14) to INR 281,000 per tonne (USD 3,110), reflecting a mixed regional trend amid firm global market cues.

Also read: Global supply strains position Japan for higher aluminium premiums in 2026

How did Indian and global exchanges perform?

Domestic futures on MCX held largely stable through the week, easing marginally from INR 278,400 per tonne (USD 3,081.01) on 4 December to INR 278,150 per tonne (USD 3,078.55) on 11 December. The steady trend indicated that the physical market, rather than the futures curve, drove most of the weekly sentiment.

On the LME, aluminium prices inched up by USD 10 per tonne W-o-W to USD 2,875 per tonne (USD 31.82) as tightening exchange inventories supported the forward curve. LME stocks fell by 7,600 tonnes to 523,300 tonnes, signalling a gradual drawdown that continues to underpin price expectations. A 25 bps US Fed rate cut further strengthened the global outlook by softening the dollar and improving risk appetite.

Also read: Aluminium Fluoride’s dual reality - indispensable to aluminium, burdensome to producers

Domestic producers adjust prices amid steady output

The rise in domestic ingot prices aligned with upward revisions announced earlier in the week by Hindalco and BALCO. Hindalco raised its P1020 price by INR 2,500 per tonne (USD 27.67) before rolling back INR 1,000 per tonne (USD 11.07) by December 11. BALCO increased its P1020 price by INR 1,750 per tonne (USD 19.37). NALCO left its published P1020 price unchanged at INR 296,000 per tonne (USD 3,275.86).

Market participants reported domestic premiums in Delhi NCR at USD 260-265 per tonne above LME cash, up from last week's USD 250-255 per tonne. Traders attributed the marginal rise to firmer buying interest rather than any tightening of supply.

While demand is improving in pockets, the market remains comfortably supplied. One primary producer is holding sizeable inventories, which continues to keep domestic availability ample. The current upward trend therefore remains more aligned with global sentiment than with domestic consumption patterns. India's primary aluminium output remained strong, rising 10 percent Y-o-Y to 3.44 million tonnes in 9MCY'25.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

Global market sentiment firm despite seasonal slowdown

Across the US and Europe, demand held firm through November but is expected to moderate due to the year-end slowdown. Supply risks, however, remain elevated. The Iceland smelter closure and uncertainty over the Mozal smelter's power arrangements continue to cloud the supply outlook, potentially tightening availability if disruptions extend.

Japanese premiums for Q1 2026 are forecast in the USD 140-203 per tonne range, with current negotiations indicating offers of USD 190-203 per tonne--significantly higher than the USD 86 per tonne settled for Q4 2025. The steep rise reflects tighter global availability, higher overseas premiums, the Iceland outage, potential Mozal cutbacks, US tariffs, and stockpiling linked to the EU's carbon-tax framework.

Must read: Key industry individuals share their thoughts on the trending topics

In the US, domestic premiums have surged to record highs, with last heard levels near USD 1,950 per tonne above LME. The premium strength is driven by low domestic inventories, though weakening end-use demand may prompt adjustments through quotas or bilateral arrangements.

European premiums have rebounded, supported by pre-CBAM stockpiling and lingering supply concerns. Market levels recently hovered between USD 340-348 per tonne over LME.

Outlook

Indian aluminium prices are expected to remain firm in December supported by strong LME prices and elevated domestic premiums. Although demand is improving gradually, high inventories ensure a balanced market. Looking to 2026, persistent global supply risks may keep LME prices supported, though any resolution of outages and power-related disruptions could soften prices toward USD 2,500 per tonne.

Don't miss out- Buyers are looking for your products on our B2B platform

Responses