您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

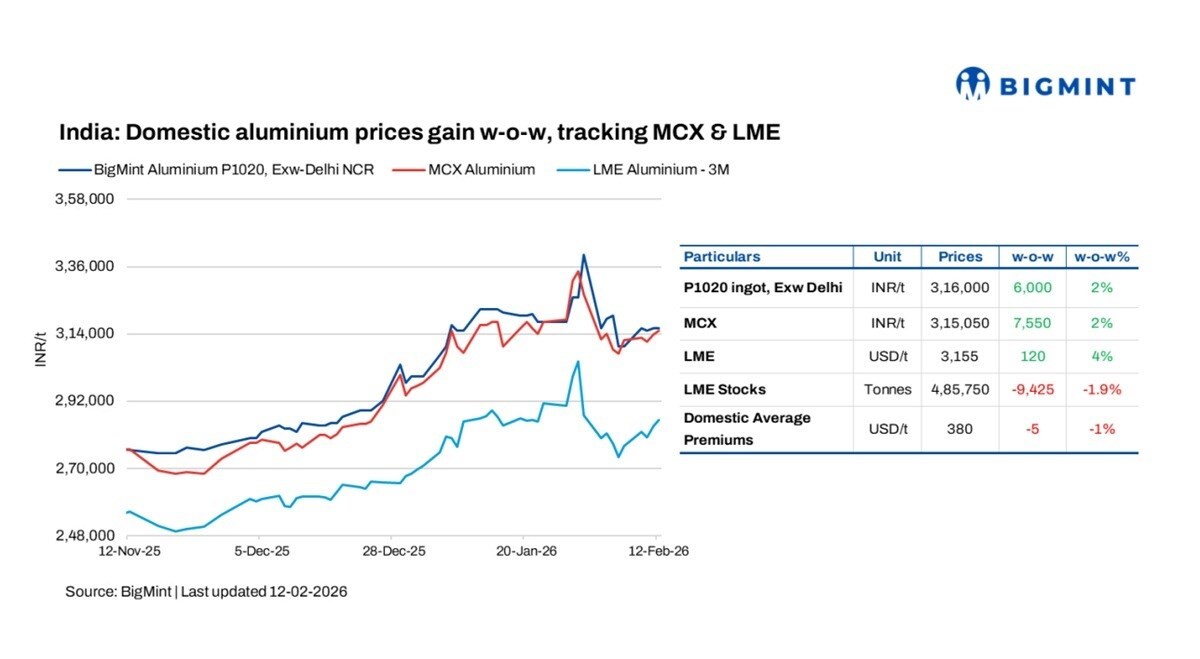

Firm pricing reflected upward revisions across major producers. Domestic premiums held largely steady w-o-w. Domestic aluminium prices in India edged higher w-o-w on 12 February, tracking gains in aluminium futures on the London Metal Exchange (LME) and the Multi Commodity Exchange (MCX), as global supply concerns persisted.

{alcircleadd}To know more about the global recycled aluminium industry 2026 outlook, book the report “Global ALuminium Industry Outlook 2026”

As per BigMint's assessment, domestic aluminium ingot prices in Delhi increased by INR 6,000 per tonne, or 2 per cent, w-o-w to INR 316,000 per tonne. Similarly, Mumbai prices witnessed a gain by INR 5,000 per tonne, or 2 per cent, w-o-w to INR 317,000 per tonne as of 12 February 2026.

How did Indian and global exchanges perform?

Domestic aluminium futures on the MCX strengthened w-o-w by INR 7,550 per tonne, or 2 per cent, to INR 315,050 per tonne, reflecting improved market sentiment.

In the global market, 3-month LME aluminium prices also increased by USD 120 per tonne, or 4 per cent, w-o-w to USD 3,155 per tonne. On the other hand, stocks at LME-registered warehouses witnessed outflows of 9,425 t w-o-w, marking a 1.9 per cent decline.

Aluminium prices increased following a recovery in LME benchmarks, with cash prices rising to around USD 3,098 per tonne and three-month contracts also posting gains. The uptrend was supported by a continued decline in LME inventories to 485,750 tonnes, signalling tightening supply and improved global market sentiment.

Also read: January for Japan: Aluminium stocks slip 1.5% at the ports of Yokohama, Nagoya and Osaka

Market insights

Domestic aluminium ingot prices showed an uptrend during the week, reflecting upward revisions by major primary producers compared to earlier levels.

NALCO increased its P1020 prices by INR 3,300 per tonne, or around 1 per cent, to INR 323,700 per tonne on 12 February from INR 320,400 per tonne on 1 February, aligning with improved market cues.

BALCO's P1020 prices rose by INR 1,250 per tonne to INR 333,500 per tonne on 12 February from INR 332,250 per tonne on 10 February and were also higher compared to INR 330,750 per tonne on 11 February. Similarly, Hindalco increased its prices by INR 1,750 per tonne to INR 332,000 per tonne on 12 February from INR 330,250 per tonne on 10 February, and up from INR 328,750 per tonne on 11 February, indicating a firm pricing trend across producers.

Market participants reported a pickup in domestic aluminium demand, while inventory levels at major primary producers stayed at moderate levels. Domestic premiums held steady week-on-week at around USD 380-390 per tonne over LME cash, as the recent rise in LME prices led to adjustments in premiums to maintain overall realisations.

Outlook

Indian aluminium prices are expected to stay firm in the near term, closely following LME and MCX trends. While seasonal demand weakness and declining inventories may constrain further gains, moderate producer stocks and steady domestic premiums are likely to provide support at lower levels. Overall price movement will depend on global macroeconomic developments, currency fluctuations, and the pace of post-correction restocking.

Must read: Key industry individuals share their thoughts on the trending topics

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses