您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

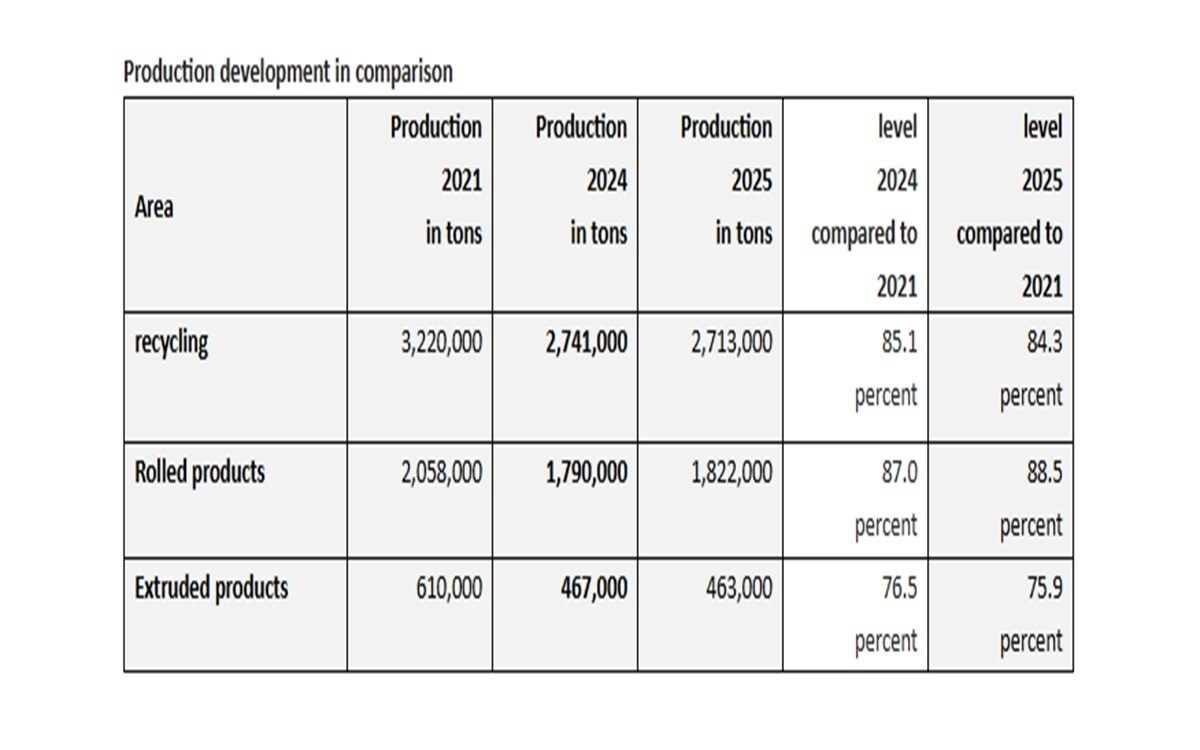

The German aluminium industry remains in crisis. In 2025, capacity utilisation is projected to decline by up to a further 0.8 percentage points. As production data for the fourth quarter of 2025 shows, production levels are only 76 to 88 per cent of those in 2021. Europe's most important aluminium production site has thus not grown for four years. The main reasons are inadequate economic policy frameworks, profound structural change, and a persistently weak economy. While not all sectors of the industry are experiencing declines, production levels remain significantly below those of 2021. Consequently, a considerable portion of capacity remains significantly underutilised, particularly in the predominantly medium-sized extrusion industry.

{alcircleadd}For the global aluminium value-chain 2026 outlook, book our exclusive report “Global ALuminium Industry Outlook 2026"

Aluminium Deutschland President Rob van Gils: “The situation is worrying. The production figures clearly show that our innovative German aluminium industry has not been able to recover since 2021 due to the moderately competitive framework conditions. Without an active and effective industrial policy and a significant improvement in location factors, our industry will not be able to survive – Germany will become even more dependent on raw materials and will miss its resilience targets. ”

Decline in recycling production

Aluminium recycling showed a negative trend in the fourth quarter of 2025. From October to December, companies produced approximately 629,000 tons of aluminium (-3 percent). The total production level for 2025, at around 2.7 million tons, is one per cent below the previous year's figure and about 16 per cent below the 2021 level. Key obstacles continue to be weak demand from customer industries, such as automotive, construction, and plant engineering, as well as a shortage and consequently sharp price increases for aluminium scrap.

Semi-finished product production 2025: previous year's level maintained, extrusion production continues to decline

The production of semi-finished aluminium products increased by two per cent to approximately 518,000 tons in the fourth quarter of 2025. Total production for the entire year of 2025 amounted to approximately 2.3 million tons (+1 percent). The production of rolled products reached 1.8 million tons, two per cent higher than the previous year, but still around 12 per cent below the 2021 level. The production of extruded products reached 463,000 tons, representing a decrease of one per cent and approximately 24 per cent below the 2021 level.

Industry sees no improvements in location factors in Germany – trade policy further exacerbates the situation.

The low capacity utilisation for the fourth consecutive year is a symptom of weak demand in the supplier industries – particularly in the automotive, construction, and plant engineering sectors. It also reflects Germany's increasingly uncompetitive business environment. EU trade policy and carbon border adjustments further jeopardise this competitiveness.

Angelika El-Noshokaty, CEO of Aluminium Deutschland, emphasises: “We urgently need a departure from traditional industrial policy thinking, in which we always speculate first about the possible effects of our actions on our trading partners and only then think about our domestic industry. If relief or protection instruments such as the industrial electricity price or CBAM prove ineffective and additional burdens threaten, we will not be able to stop the progressive deindustrialisation of Germany and will jeopardise urgently needed industrial jobs.”

Don't miss out- Buyers are looking for your products on our B2B platform

Note: This article has been issued by Aluminium Deutschland and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses