您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

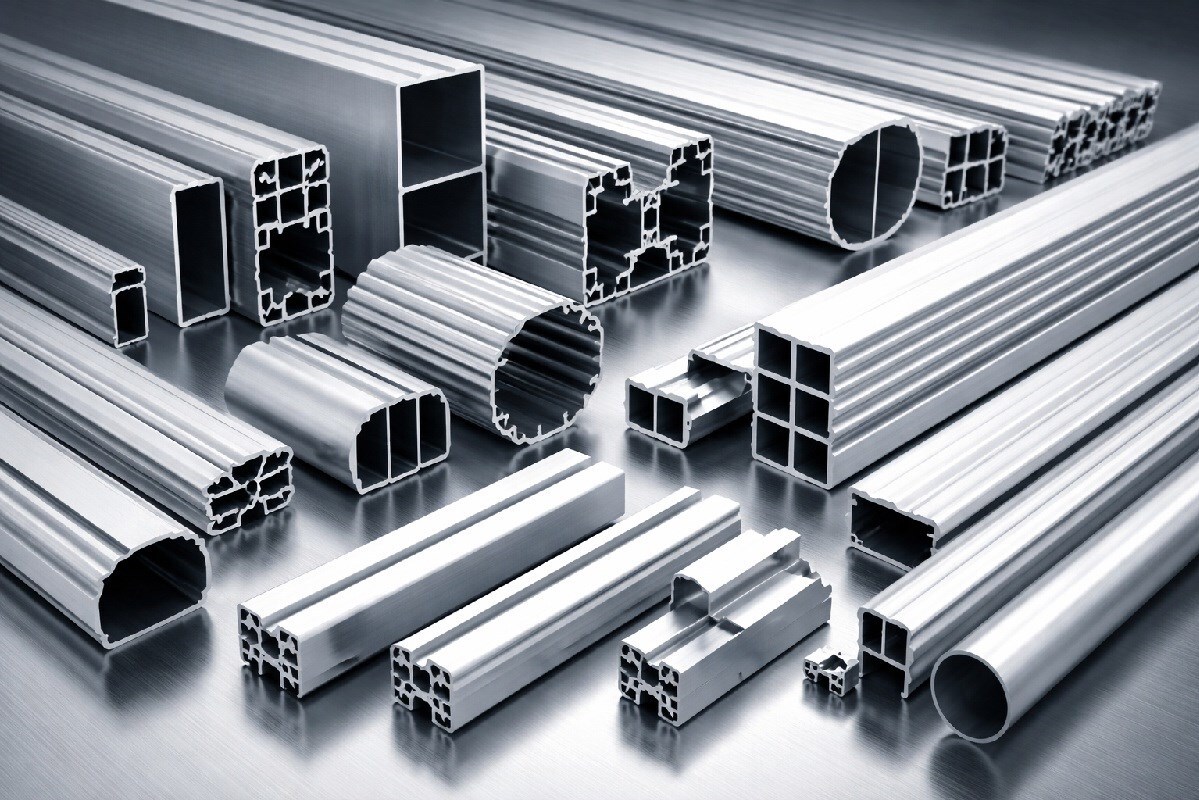

Aluminium extrusion begins with a heated billet pushed through a precision steel die under intense pressure. What comes out can be something as simple as a rod or tube - or as complex as a structural component for an aircraft or a crash-management system in a vehicle. Its appeal lies in a rare mix of strength, light weight and design freedom, which is why extrusion continues to sit at the centre of modern manufacturing. Across Europe, North America, India and the Gulf, extrusion players are adjusting capacity, investing in downstream capabilities and fine-tuning operations to stay aligned with demand that is increasingly specialised rather than purely volume-driven. The top extrusions companies are listed below:

{alcircleadd}Hydro Extrusions

Hydro Extrusions is one of the industry’s largest players by scale. To respond to continued market weakness, the company plans a major European restructuring by 2026, which includes closing five plants and reducing around 730 roles. The initiative is expected to generate annual savings of more than NOK 500 million. Once completed, Hydro will operate 28 extrusion plants and five recycling facilities across Europe.

The business has an annual extrusion capacity of 1.4 million tonnes. In 2024, it accounted for 16 percent of the European market and 19 percent in North America, alongside established operations in South America and Asia. Its activities are organised into four business units - Extrusion Europe, Extrusion North America, Precision Tubing and Building Systems - each covering the value chain from recycling and extrusion to downstream processing and commercial functions.

In 2025, company delivered an adjusted EBITDA of NOK 28.9 billion, up from NOK 26.3 billion in 2024. Adjusted RoaCE reached 10.2 percent, slightly exceeding its cycle target of 10 percent. The performance highlights Hydro’s resilience despite a demanding market backdrop.

…and so much more!

SIGN UP / LOGINResponses