您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

GDP is like a scorecard of the world economy - one number that says whether activity is up or down in a quarter or a year. It adds up everything produced, sold, and earned within a country. When it rises, factories run harder, construction picks up, and transport networks expand but when it slows, those same systems feel it first. That makes the metal a practical barometer of economic activity. Aluminium’s direct contribution to global GDP is roughly 0.15-0.23 per cent of an economy that’s projected to be around USD 114 trillion in 2025. Every dollar of aluminium output is estimated to support USD 3–5 of downstream activity in infrastructure, transport, energy networks and packaging. That multiplier effect gives aluminium-enabled value chains a footprint of about 5–7 per cent of global GDP - underscoring aluminium’s importance not merely as a commodity, but as a core enabler of industrial and economic activity. This is why governments treating aluminium as strategic, trade-sensitive or central to decarbonisation is not just rhetoric. The metal ties into systems that are essential to how economies build and move.

{alcircleadd}Does aluminium move with the economy, or ahead of it?

Aluminium demand doesn’t track GDP one-for-one, but it reacts reliably when economic momentum changes. Growth pushes activity across construction, manufacturing, transport and energy systems - all big users of aluminium. Buildings, bridges, vehicles (including electric cars and rail), aerospace, packaging, machinery, consumer goods - aluminium appears in them all. More recently, renewable energy and electrification have added to structural demand.

Global aluminium use is projected to climb from 101.6 million tonnes in 2024 to 104.0 million tonnes in 2025 and estimated to be 106.8 million tonnes by 2026, according to AL circle. To know more about the trend, read: Global Aluminium Industry Outlook 2026 .

If the 104 million tonnes of aluminium consumption is broken down by end-use, the split looks roughly as follows:

• Transportation: 27 per cent

• Building and construction: 22 per cent

• Packaging: 16 per cent

• Electrical and electronics: 14 per cent

• Industrial applications: 8 per cent

• Other uses: 13 per cent

Together these sectors represent about 70 - 80 per cent of global aluminium consumption.

Image source: AL Circle

What happens when growth slows?

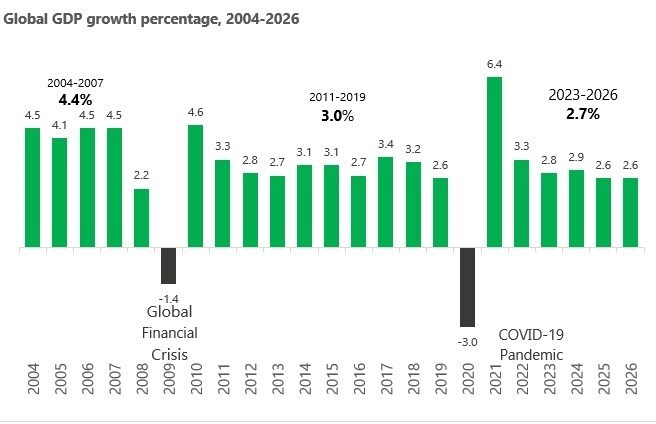

Global growth is easing. Estimates show world GDP to expand about 2.6 per cent in both 2025 and 2026, down from 2.9 per cent in 2024 and below the roughly 3 per cent pre-pandemic average. If we look at the growth picture in details, it hasn’t moved in a straight line. In the mid-2000s, before the financial crisis, the world economy was growing strongly, averaging about 4.4 per cent between 2004 and 2007. That phase ended in 2009, when the crisis hit and growth dropped to roughly 1.4 per cent. After that, growth never really recovered to earlier levels. For much of the 2010s, global GDP expanded at around 3 per cent, slower and more constrained. Then Covid arrived. In 2020, global GDP fell again, by about 3 per cent. The reopening period of 2021, rebounded sharply to around 6.4 per cent, but it was short-lived. From 2023 to 2026, global growth is now expected to settle lower again, averaging roughly 2.7 per cent as per AL circle. Read Global Aluminium Industry Outlook 2026 for an indepth insight.

Major economies show similar softening. The US is forecast to grow 1.8 per cent in 2025 and 1.5 per cent in 2026. China, long the engine of global demand, is expected to moderate from 5 per cent in 2025 to 4.6 per cent in 2026, below its pre-pandemic pace of around 6.7 per cent.

What does that tell us?

Aluminium isn’t the economy’s pulse. It does not lead economic growth; it follows it. As GDP growth moderates, aluminium demand also slows but does not contract. Structural drivers -urbanisation, infrastructure investment, electrification, and ongoing manufacturing activity -continue to support consumption.

As a result, aluminium demand tracks real economic activity rather than amplifying economic cycles, reinforcing its role as a stable indicator of underlying economic momentum.

Don’t miss out- Buyers are looking for your products on our B2B platform

Responses