您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

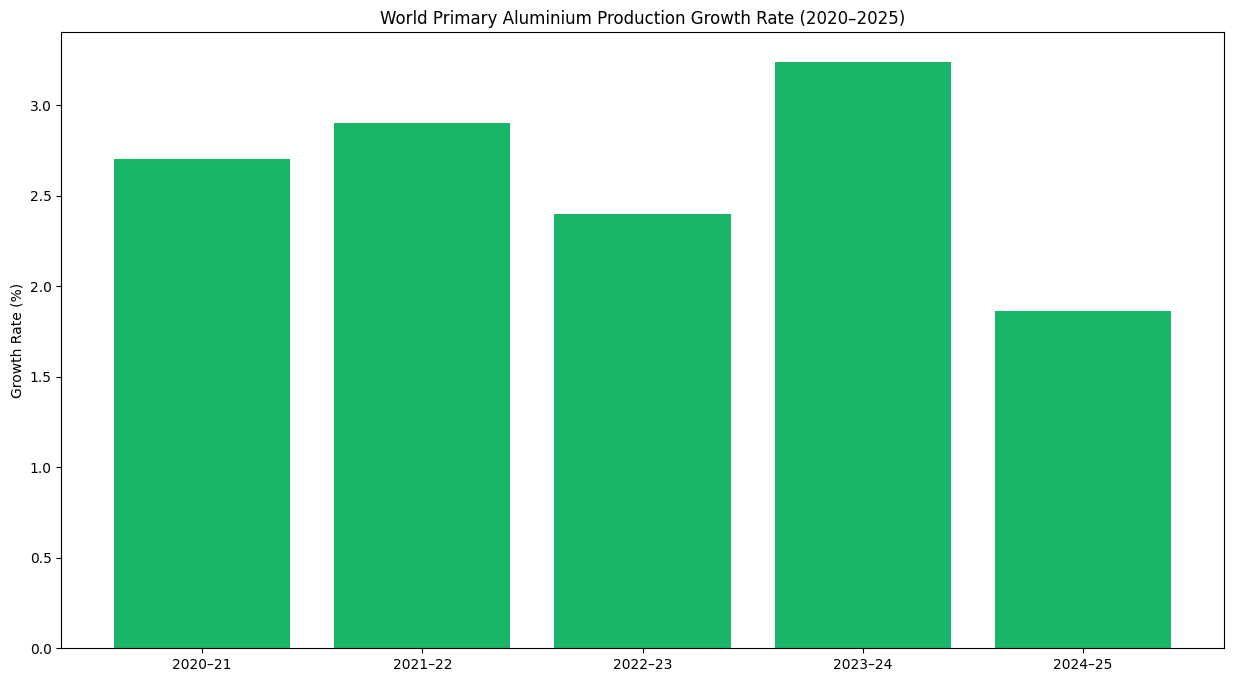

Going by the world primary aluminium production trend since 2020, 2025 saw the slowest pace in half a decade, reflecting a structural shift rather than a cycling dip. According to the International Aluminium Institute, world primary aluminium production grew by only 1.06 per cent, a sharpest deceleration from the 3.24 per cent growth recorded in 2024. Between 2020 and 2023, the world primary aluminium production growth remained between 2.4 and 2.9 per cent, underscoring how exceptional 2025 proved to be. Yet despite this muted growth, 2025 became one of the most closely watched years for the aluminium industry, as it coincided with China nearing its long-anticipated 45‑million‑tonne production cap and a visible pivot across regions from primary production to recycling-led supply strategies.

{alcircleadd}To be noted, this slow growth rate in the world primary aluminium production was not only due to China’s tightened output. Asia (ex-China), Europe, and also the Americas delivered slower growth in their respective domestic output, while GCC countries churned out lowest volume since 2020.

Global output: modest growth, muted momentum

Now, it is the time to delve into some real numbers. The world primary aluminium production reached 73.784 million tonnes at the end of 2025, up marginally from 73.009 million tonnes in 2024. The daily average output was 202,100 tonnes through the year, compared to 199,500 tonnes in 2024.

Quarterly trends, however, pointed to fading momentum. While production rose sequentially through the first three quarters, growth softened noticeably by year-end. In the final quarter (Q4) ended December 31, the output stood at 18.673 million tonnes compared to 18.619 million tonnes in Q3. For comparison, the world primary aluminium output in Q3 had grown by 1.32 per cent sequentially from 18.377 million tonnes, while that in Q2 rose by 1.45 per cent from 18.115 million tonnes.

…and so much more!

SIGN UP / LOGINResponses