您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

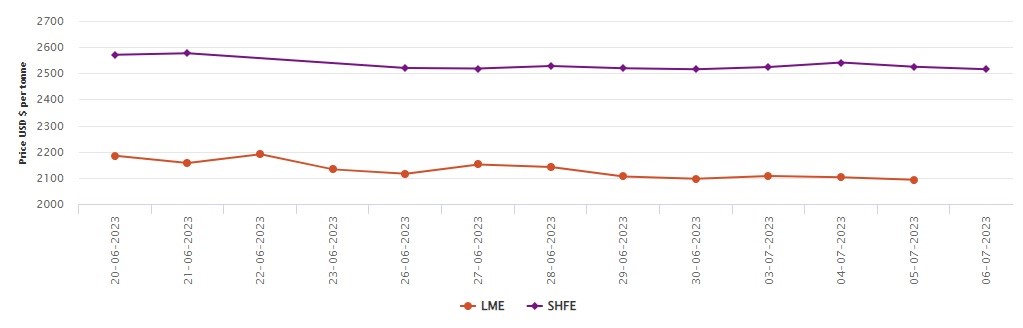

On Wednesday, July 5, the LME aluminium cash bid price dropped down by US$9.50 per tonne or 0.45 per cent to rest at US$2,092.50 per tonne, while the LME official settlement price locked at US$2,093 per tonne, with a similar loss.

The 3-month bid price and the 3-month offer price plunged by US$9.50 per tonne or 0.44 per cent to rest at US$2,146 per tonne and US$2,147 per tonne, as it was on July 3, Monday.

December 24 bid price and December 24 offer price both slumped by US$13 per tonne or 0.56 per cent to officially close at US$2,305 per tonne and US$2,310 per tonne, respectively.

LME aluminium opening stock lost 0.86 per cent or 4,700 tonnes, officially closing at 539,700 tonnes from 544,400 tonnes recorded the previous day.

Live warrants read 271,925 tonnes, with no measurable change at all. Cancelled warrants stood at 267,775 tonnes, with 4,700 tonnes or a 1.72 per cent plunge.

The 3-month Asian Reference Price closed at US$2,147.62 per tonne, falling by US$17.99 per tonne or 0.39 per cent.

SHFE aluminium price

Today, on July 6, the SHFE aluminium spot price rests at RMB 2,515 per tonne, with a US$10 per tonne or 0.39 per cent dive.

SHFE 2307 aluminium added RMB 595 per tonne or 3.38 per cent to RMB 18,185 per tonne. The open interest fell 11,785 lots to 256,640 lots.

Responses