The LME aluminium benchmark price movement slowed down since last Friday, registering a total fall of US$41 per tonne in two days.

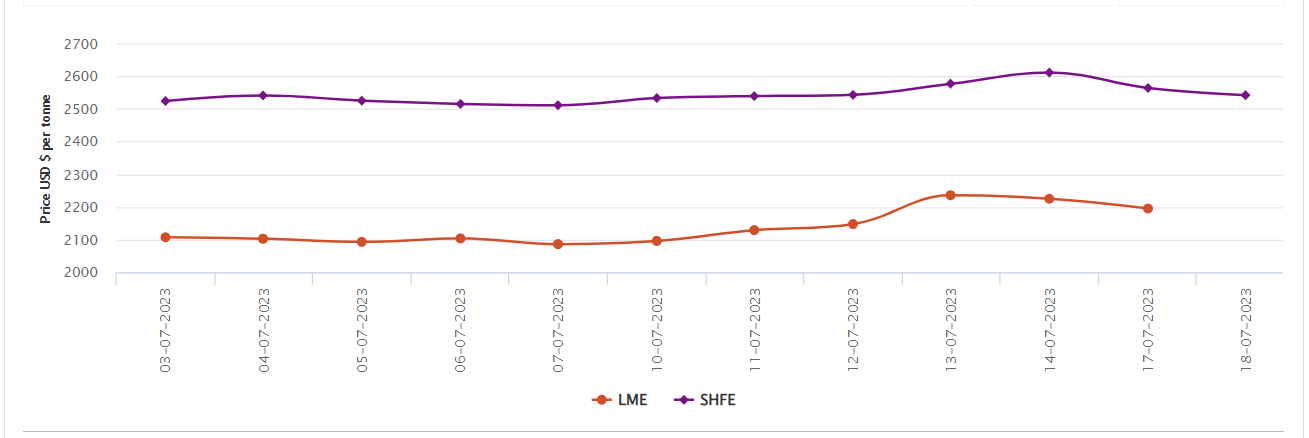

On Monday, July 17, both LME aluminium cash bid price and LME aluminium official settlement price declined drastically over the weekend by US$30.50 per tonne and US$30 per tonne, respectively, to open the week at US$2,194 per tonne and US$2,195 per tonne. But despite the two consecutive days of fall, the LME aluminium benchmark price stood 4.72 per cent higher week-on-week than US$2,096 per tonne.

The 3-month bid price and 3-month offer price also shrunk over the weekend by US$24 per tonne to rest at US$2,244 per tonne and US$2,245 per tonne. December 24 bid price and December 24 offer price decreased by US$16 per tonne to score at US$2,402 per tonne and US$2,407 per tonne, respectively.

LME aluminium opening stock fell by 7,675 tonnes, amounting to 520800 tonnes. Live Warrants and Cancelled Warrants clocked at 279475 tonnes and 241325 tonnes.

LME aluminium 3-month Asian Reference Price declined by US$26.04 per tonne to reach US$2,249.88 per tonne.

SHFE aluminium price

On Tuesday, July 18, the SHFE aluminium benchmark price has dropped for the second consecutive day this week by US$22 per tonne to settle at US$2,542 per tonne.

Responses