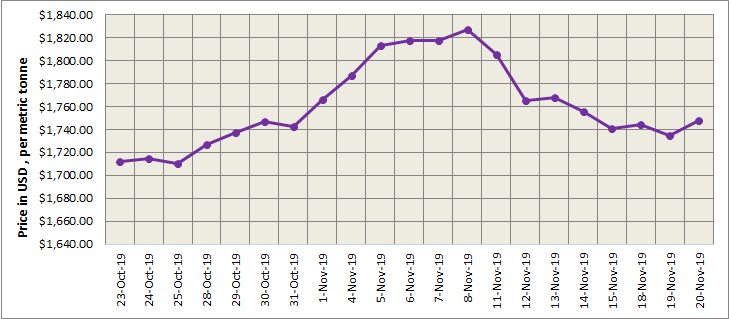

LME aluminium gained on Wednesday and maintained overnight; SHFE rose to its highest since November 11

The US dollar edged higher against a basket of other currencies on Wednesday amid increased political tensions between the US and China. Reuters reported Wednesday that “phase one” trade deal between the US and China may not be completed this year, as Beijing insists on the removal of tariffs. LME base metals closed lower on Wednesday but aluminium gained. The SHFE complex also saw mixed performance overnight and aluminium rose 0.8%.

Three-month LME aluminium gained 0.4% to reach US$1,744 per tonne on Wednesday. It is unlikely to convincingly break the five-day moving average today, as aluminium stocks across LME-approved warehouses extended their increase to 1.17 million tonne as of November 20. Transactions are expected at US$1,730-1,750 per tonne today.

{alcircleadd}

As on November 20, Wednesday, LME aluminium cash (bid) price stood at US$ 1747 per tonne, LME official settlement price stands at US$ 1748 per tonne; 3-months bid price stands at US$ 1740 per tonne, 3-months offer price is US$ 1740.50 per tonne; Dec 20 bid price stands at US$ 1808 per tonne, and Dec 20 offer price stands at US$ 1813 per tonne.

The LME aluminium opening stock increased to 1169525 tonnes. Live Warrants totalled at 989800 tonnes, and Cancelled Warrants were 179725 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1734 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) decreased to US$ 2002 per tonne today November 21, 2019.

The most-active SHFE 2001 contract reversed decline from the prior session with a rise of 0.22%, ending at RMB13,780 per tonne as investors cut their short position. The SHFE December contract registered a bigger increase, widening its price gap between the SHFE 2001 contract to RMB 100 per tonne. The SHFE 2001 contract rose to its highest since November 11 at RMB 13,875 per tonne in early trade overnight, before it ended up 0.76% at RMB 13,860 per tonne. The SHFE 2001 aluminium contract is expected to trade between RMB 13,800-13,870 per tonne today, with spot premiums of RMB 70-110 per tonne over the SHFE 1912 contract.

China’s rate cuts, together with falling inventories and robust demand, buoyed SHFE aluminium, but growing supply remains a major headwind in the longer term. Stable demand in the spot market and continued fall in alumina costs will likely keep the 2001 contract rangebound in the short term.

This news is also available on our App 'AlCircle News' Android | iOS