您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

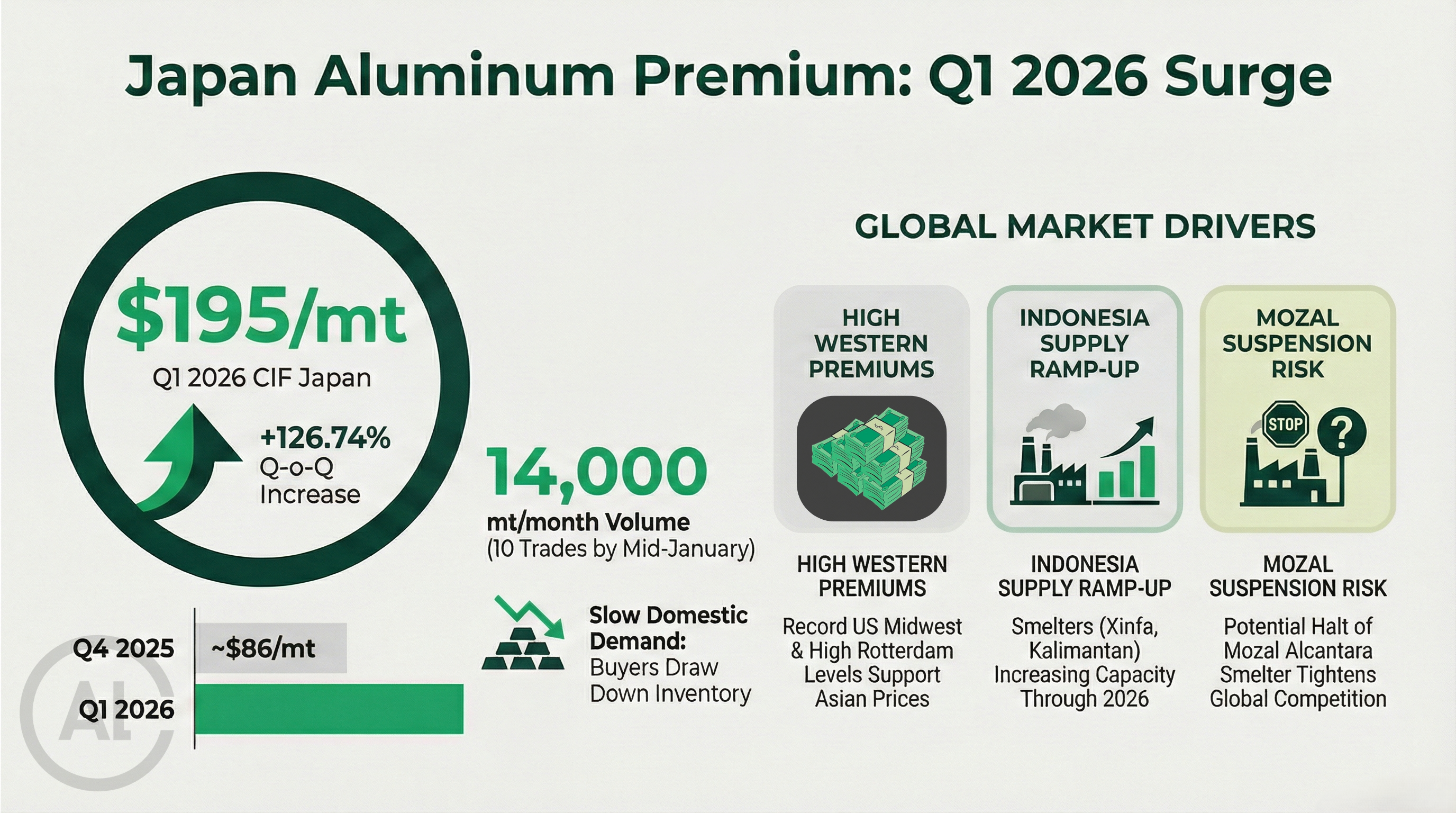

A single smelter has had immense impact on the global trade scenario. Mozal’s closure hit the CBAM impacted nations, tightened the global aluminium supply chain scenario and now is influencing the Japan’s Q1 2026 aluminium premium with around a 127 per cent hike quarter-on-quarter. After a year of buyer resistance and sliding settlements, the country’s benchmark aluminium premium has snapped back sharply. But is Mozal the only inhibiting factor for Japan? And why are analysts anticipating similar premium bracket for Q2 2026?

{alcircleadd}Japan’s quarterly premium for imported primary aluminium surged to USD 195 per tonne CIF for January-March 2026 (Q1), a jump from the roughly USD 86 per tonne settled for Q4 2025. The market spent most of last year defined by weak demand, buyer pushback and collapsing premiums, the move is striking for its scale and for what it says about shifting global supply dynamics.

The CIF Japan settlement was based on 10 trades reported up to January 16, with a minimum aggregate volume of 14,000 tonnes per month of P1020 and P1020A aluminium ingot loaded for the first quarter. All reported transactions concluded at that single price level.

Also read: Alumina’s journey through 2025: A year known for ambition, friction and recalibration

From buyer pressure to seller leverage

During Q1 negotiations, sellers’ offers ranged between USD 190 and USD 225 per tonne for CIF Japan, calculated to be increases of roughly between 120 and 162 per cent compared with the official Q4 2025 level. The lowest reported offer, which was heard at the beginning of the talks at the beginning of December, was USD 190 per tonne CIF Japan. However, subsequent offers climbed amid tightening global supply signals.

The contrast with the previous quarter could not be sharper. In Q4 2025, Japanese buyers successfully pushed premiums lower as sluggish automotive and construction demand weighed on negotiations. Sellers, facing weak spot interest and ample availability in Asia, conceded ground. The result was one of the lowest quarterly premiums Japan had seen in years.

Responses