您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Norsk Hydro has grabbed headlines during the entire 2025 calendar year for its job cuts, plant closure and among other relatively positive news pieces. And this time, it is the financial results that has pulled eyeballs and rightfully so as the global business has managed to affirm positive financial outcome as announced previously while taking all those tough calls.

{alcircleadd}Hydro closed 2025 in a year defined less by expansion in volumes and more by structural adjustment. The company delivered financial resilience despite weaker downstream demand, executed workforce reductions and plant closure proposals in Europe, reduced capital expenditure guidance, and simultaneously advanced selective investments in renewable power, recycling and low-carbon metal.

Adjusted EBITDA reached NOK 28.9 billion (USD 3.03 billion) in 2025, up 9.9 per cent from NOK 26.3 billion (USD 2.74 billion) in 2024. Adjusted return on average capital employed (ARoaCE) came in at 10.2 per cent, above Hydro’s through-cycle target of 10 per cent. Free cash flow rose sharply 78.5 per cent to NOK 13 billion (USD 1.37 billion), compared to NOK 2.8 billion (USD 294 million) in 2024. Adjusted net debt stood at NOK 18.2 billion (USD 1.91 billion). The Board proposed a dividend of NOK 3.0 per share, corresponding to a 60 per cent payout of adjusted net income.

Yet beneath these promising figures, performance diverged across business areas and geographies of 40 countries across 140 locations with approximately 32,000 employees.

For the global aluminium value-chain 2026 outlook, book our exclusive report “Global ALuminium Industry Outlook 2026"

Upstream stability in Brazil

Hydro Bauxite & Alumina remained the operational backbone of the group. Alumina production reached 6.1 million tonnes in 2025 against a nameplate capacity of 6.3 million tonnes at Alunorte, the world’s largest alumina refinery outside China. The segment employs 3,822 people and accounts for NOK 26.1 billion (USD 2.74 billion) in capital employed.

The fuel switch at Alunorte from oil to natural gas continued to strengthen cost positioning. The company estimates energy savings of NOK 1.61 billion (USD 169.1 million) in 2025 from the fuel transition. Carbon emissions at the refinery were reduced by 700,000 tonnes annually, with two new electric boilers contributing up to an additional 550,000 tonnes of annual CO₂ reduction.

Brazil remains central to Hydro’s integrated value chain. Roughly 30 per cent of Alunorte’s long-term bauxite supply is supplemented through MRN agreements, reinforcing security of supply amid geopolitical uncertainty.

Renewable power: a structural advantage

Hydro Energy produced 14 TWh of hydropower in a normal year, with 9.4 TWh of captive production. Including long-term power purchase agreements, Hydro’s Nordic power portfolio totals approximately 18 TWh annually.

In November 2025, Hydro approved a NOK 2.5 billion (USD 262.5 million) investment in the Illvatn pumped storage hydropower plant. The project will add 107 GWh of annual renewable production and enhance system flexibility. Long-term power agreements signed during the year strengthened supply visibility for smelters through 2030 and beyond.

With around 80 per cent of electricity used in primary aluminium production sourced from renewables, energy remains Hydro’s defining competitive lever.

Don't miss out- Buyers are looking for your products on our B2B platform

Primary aluminium: cost curve discipline

Hydro Aluminium Metal operates five wholly owned smelters in Norway and holds stakes in five additional smelters across Qatar, Brazil, Canada, Australia and Slovakia. Total annual primary aluminium capacity stands at approximately 2.1 million tonnes.

The company maintained a position in the 16th percentile of the global primary aluminium cost curve in 2025. Alumina represented 45-50 per cent of cash cost, while power and carbon anodes each accounted for roughly 15-20 per cent. Capital employed in the segment reached NOK 44 billion (USD 4.62 billion), with 4,671 employees.

While market volatility persisted, upstream integration and renewable power sourcing insulated margins.

Recycling expansion amid margin pressure

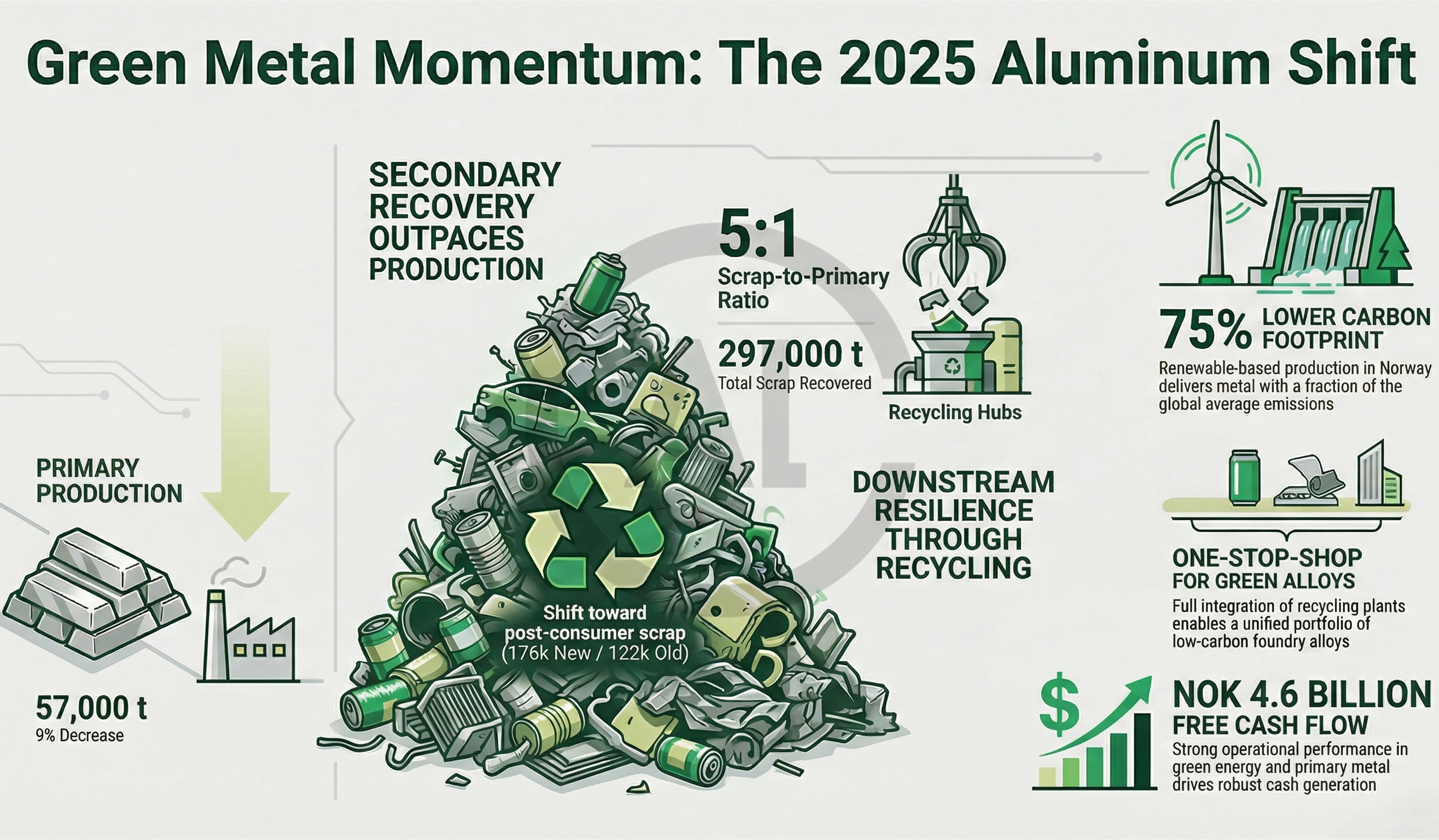

Metal markets, encompassing recycling and commercial activities, operated recycling capacity of around 1 million tonnes annually. In 2025, 313,000 tonnes of post-consumer scrap were processed. Total annual post-consumer scrap capacity stood at 745,000 tonnes.

During the year, Hydro began construction of a new 120,000-tonne recycling plant in Torija, Spain, including 60,000 tonnes of Hydro CIRCAL capability. Two advanced scrap sorting machines were installed in Poland, adding approximately 20,000 tonnes of sorting capacity.

However, softer European demand weighed on recycling margins. Hydro has set a 2030 ambition to increase post-consumer scrap capacity to between 850,000 and 1.1 million tonnes, signalling continued structural commitment despite short-term pressure.

Must read: Key industry individuals share their thoughts on the trending topic

Extrusions: restructuring in Europe

Hydro Extrusions is one of the leading players in the market. It remains the group’s largest employer, with 19,427 employees and capital employed of NOK 27.8 billion (USD 2.92 billion). Annual extrusion capacity is 1.4 million tonnes, with 2025 sales volumes of 1.0 million tonnes. Market share stands at 14 per cent in Europe and 18 per cent in North America.

Demand weakness in 2025 forced revisions. The adjusted EBITDA outlook was cut from NOK 4.5-5.5 billion (USD 472.5-577.5 million) to NOK 3.5-4.5 billion (USD 367.5-472.5 million) early in the year. Hydro announced a proposal to close five extrusion plants in Europe and confirmed the closure of the Birtley extrusion plant in the UK.

Alongside, another workforce reduction programme will see approximately 850 employees leave the company by mid-2026.

The restructuring was concentrated in Europe, where downstream markets faced slower construction and automotive demand.

At the same time, Hydro continued with its targeted downstream investments. In Gainesville, Georgia, the company launched its first all-electric extrusion press line. Production of Hydro CIRCAL recycled aluminium was expanded at facilities in Sweden and Belgium, with Italy scheduled to follow in 2026.

Capital discipline and portfolio reset

Midway through 2025, Hydro reduced its capex guidance by NOK 1.5 billion (USD 157.5 million) to reflect market realities. The company also phased out its batteries and hydrogen business units, streamlining the portfolio to focus on core aluminium and renewable power activities.

Despite cost containment, strategic investments continued. Hydro committed NOK 1.65 billion (USD 173.3 million) to construct a new 110,000-tonne wire rod casthouse at Karmøy, targeting Europe’s expanding grid infrastructure. A long-term offtake agreement was signed with NKT to secure demand visibility.

The company’s improvement programme delivered NOK 1.4 billion (USD 147 million) in 2025 and forms part of a broader NOK 6.5 billion (USD 682.5 million) accumulated target by 2030.

Also read: Global EV sales 2025: Volume expansion up 20%, but growth paths diverge sharply by regions

Responses