您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Ashapura Minechem, an India-headquartered mining and mineral processing company, has announced its financial results for Quarter 3 of fiscal year 2026 (ending December 2025). The company specialises in bentonite mineral processing and trading, and is a leading multimineral solution company involved in mining (including bauxite in Guinea), processing, and trading for steel to oil and gas globally.

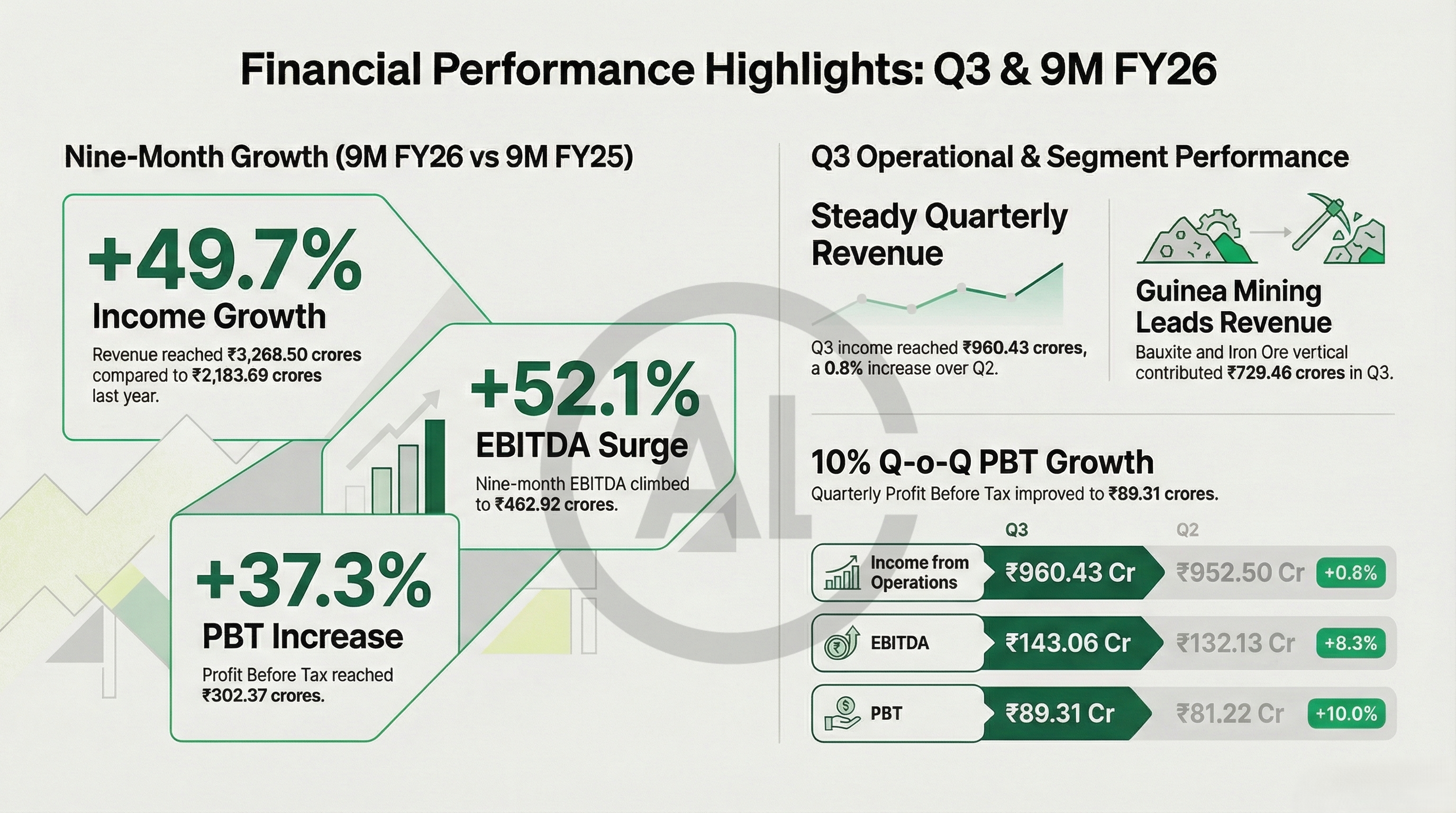

{alcircleadd}With a steady growth in the third quarter (Q3FY26), INR 9.60 billion (USD 106.86 million) were achieved by their operational performances, showing a marginal increase of about 0.8 per cent compared to the previous quarter’s (Q2FY26) INR 9.52 billion (USD 104.99 million).

For the global aluminium value-chain 2026 outlook, book our exclusive report “Global ALuminium Industry Outlook 2026"

The company’s core profitability, Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA), shows a growth of about 8.3 per cent from the second quarter, INR 1.43 billion (USD 15.79 million) to INR 1.32 billion (USD 14.59 million) in the current quarter.

Calling attention to their nine-month performances ending on December 31, 2026, the company demonstrated year-on-year growth throughout key performance indicators (KPIs).

Also read: Ashapura rises as the dominant mineral platform in the midst of the global bauxite tussle

The core, primary business activities contributed to the flow of about 49.7 per cent compared to the previous year, which is INR 32.69 billion (USD 360 million) in 9M FY26 from INR 21.84 billion (USD 241.1 million) during the same period of FY25.

In terms of EBITDA, the company achieved INR 1.59 billion (USD 17.5 million) revenue, 52.1 per cent growth compared to the previous year. Their profits before taxes on exceptional items brought 37.3 per cent returns, which is about INR 822.3 million (USD 9 million).

With operations assimilated both in India and abroad, Ashapura’s business vertical is categorised into four distinct segments. The company’s bauxite and iron ore mining infrastructure has been established in Guinea, with 872 sq km of mining concessions since 2016 and showed revenue of INR 7.3 billion (USd 80.5 million) in the 3rd quarter of FY26 and INR 1.23 billion (USD 13.5 million) in the same quarter of FY 25.

The performance upped in Q3, mainly because of smoother operations and better cost control. The company faced reduced penalty fees, improved China Railway facilities and benefits from customer cataracts ended up in increased bauxite volumes from 1.33 million tonnes to 1.39 million tonnes, with EBITDA increased to USD 10.5 (previously USD 8.9) per tonne.

In the Q3 FY 26, the bentonite segment reported revenue of INR 2.31 billion (USD 25.4 million), which is largely stable when compared to Q2 of FY26 (INR 2.3 billion or USD 25.38 million). The company, being the largest bentonite manufacturer in India had the EBITDA fall from INR 3.5 million (USD 3.8 million) to INR 2 million (USD 2.2 million).

In the Q3 FY 26, the Speciality Adsorbent Solutions segment, managed under Ashapura Perfoclay Ltd, operated by a 9MV solar plant, recorded INR 1 billion (USD 11.6 million) of revenue, which climbed from INR 11.77 billion (USD 12.98 million) in Q2FY26. In terms of their Advanced Ceramic Materials, handled through a 31.76 per cent investment in associate entity, Orient Ceratech Ltd, showed a fall from INR 1.1 billion (USD 12.5 million) in Q2FY 26, ending in September 2025, to INR 933.5 million (USD 10.2 million) in Q3 FY26.

Don't miss out- Buyers are looking for your products on our B2B platform

Hemul Shah was reappointed as the CEO and executive director of the company after the Board of Directors met on Thursday, February 5 and has since reviewed the quarterly results. Jagdish Shetty and Wilson Mathais were also designated as independent directors, and the former additionally as audit Chairman to serve for five-year term starting from February 5, 2026.

On February 7, 2026, the Secretary of the company, Sachin Polke, shared the publication details with BSE Limited and National Stock Exchange of India Limited, upholding listing obligations.

The company reported exceptional items amounting to INR 17.7 million (USD 195 thousand) in its autonomous results and INR 45.6 million (USD 503 thousand) in its consolidated results, arising from the implementation of the New Labour Codes.

Must read: Key industry individuals share their thoughts on the trending topics

Looking back at the stock returns of the company, though Ashapura Minechem have fallen 28.89 per cent in the last month, it gained 17.04, 28.67 and 402.65 per cent profit in the last six months, one year and five years respectively.

Going forward, Ashapura Minechem’s core management anticipates moderation in EBITDA levels of the Guinea business due to softening bauxite index prices. However, the impact is expected to be partially mitigated through continued operational efficiencies and higher export volumes.

Responses