您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

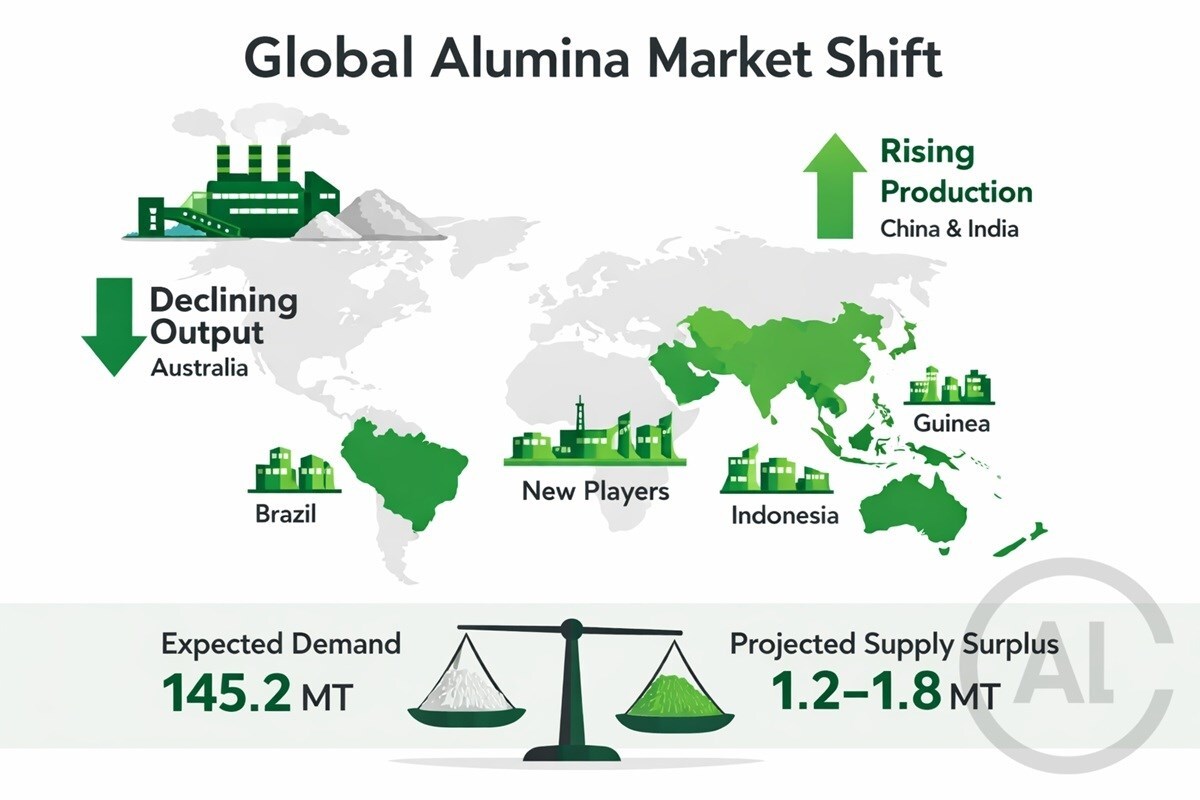

Global alumina production is increasing, although the drivers behind the rise are more layered than a straightforward growth story might suggest. Smelter-grade alumina output rose from 134.2 million tonnes in 2023 to 136.9 million tonnes in 2024, after which the curve steepened. For 2025, production is expected to reach between 143.3 and 143.6 million tonnes. That represents an increase of nearly seven million tonnes in a single year, translating into a compound growth rate of around 5 per cent. What’s driving it isn’t sudden optimism or a rush of new approvals. It’s backlog. Capacity that had been planned, financed, delayed, and reworked over several years is finally switching on. In many cases, the hard part - construction, permitting, logistics - is already behind operators. What’s left is ramp-up. This supply push is unfolding alongside steady growth in aluminium production, which has kept alumina demand moving in the same direction. AL Circle estimation suggests global SGA demand could reach about 145.2 million tonnes in 2026, with the broader market value approaching 147 million tonnes.

{alcircleadd}Whether the market absorbs this material smoothly, or faces a surplus - and how any excess would be utilised - is outlined in the Global Aluminium Industry Outlook 2026.

China: the backbone of global supply

If there is an anchor in the global alumina system, it remains China. Production barely changed between 2019 and 2020, slipping marginally from 70.61 million tonnes to 70.39 million tonnes. That pause didn’t last long. Output climbed to 74.54 million tonnes in 2021 and surged again to 79.62 million tonnes in 2022.

…and so much more!

SIGN UP / LOGINResponses