您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

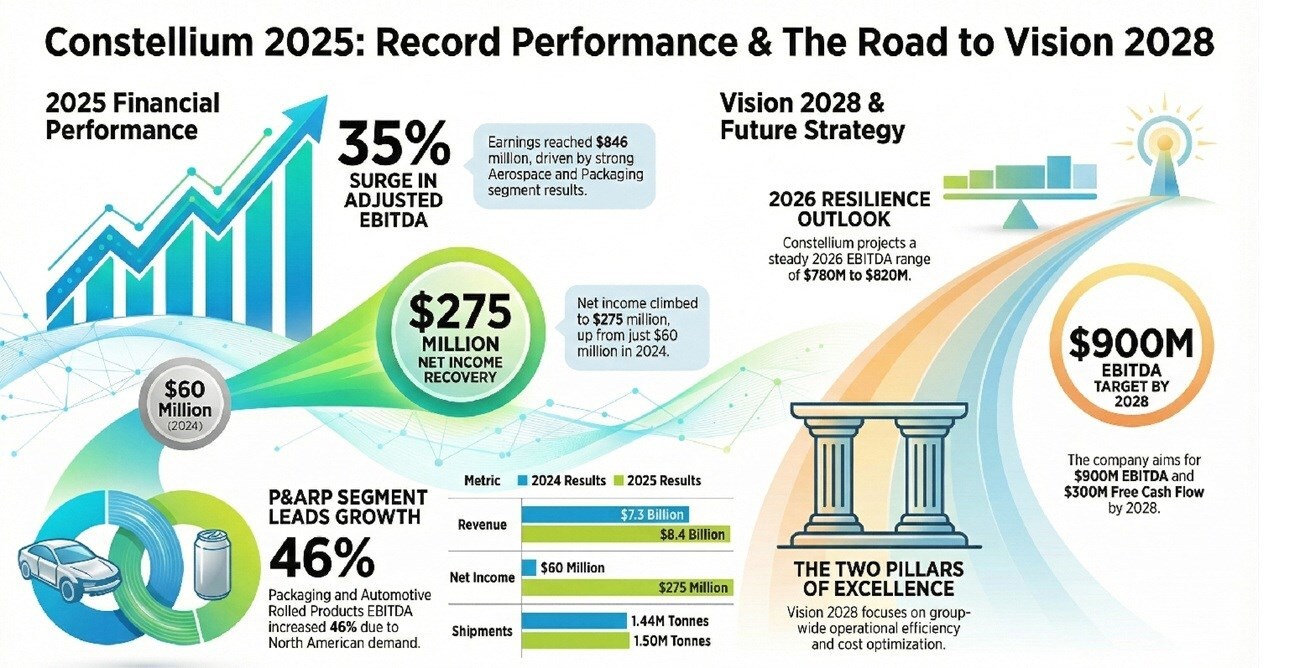

Constellium, a global leader in the design and manufacturing of high value-added aluminium products, has reported a strong financial performance for 2025, despite beginning the year amid an unsettled backdrop. At the outset, demand patterns were uneven, tariffs were reshaping pricing dynamics, and several of its end markets were still adjusting to earlier disruptions. As the year progressed, conditions improved. Although volumes did not rise uniformly across segments, the alignment of margins, favourable pricing and disciplined operational execution supported solid results by year-end.

{alcircleadd}For the full year ended December 31, 2025, revenue rose 15 per cent to USD 8.4 billion from USD 7.3 billion in 2024, driven by higher shipments and higher revenue per ton, including higher metal prices. Net income climbed to USD 275 million from USD 60 million, primarily reflecting higher gross profit and favourable changes in other gains and losses, partly offset by higher depreciation and amortisation, increased selling and administrative expenses and a higher income tax expense.

Adjusted EBITDA reached USD 846 million, up 35 per cent from USD 623 million in 2024. The improvement stemmed mainly from stronger results in the Aerospace & Transportation (A&T) and Packaging & Automotive Rolled Products (P&ARP) segments, a favourable change in the non-cash metal price lag impact and favourable foreign exchange translation.

Shipments increased 4 per cent year-on-year to 1.5 million tonnes, largely due to higher volumes in P&ARP, while operating cash flow strengthened to USD 489 million from USD 301 million.

To learn about the global aluminium downstream market, download our report: Global Aluminium Industry Outlook 2026

Quarter by quarter: momentum builds through the year

The earnings recovery gathered pace as the year progressed, even as volumes softened in the final stretch. Revenue rose 5 per cent from USD 2.0 billion in Q1 to USD 2.1 billion in Q2, increased a further 4.8 per cent to USD 2.2 billion in Q3, and then remained flat in Q4.

Profitability followed a sharper curve. Net income edged down 5.3 per cent from USD 38 million in Q1 to USD 36 million in Q2, then surged 144.4 per cent to USD 88 million in Q3 and climbed another 28.4 per cent to USD 113 million in Q4. Adjusted EBITDA mirrored that trajectory - falling 21.5 per cent from USD 186 million in Q1 to USD 146 million in Q2, before rebounding 61 per cent to USD 235 million in Q3 and rising a further 19.1 per cent to USD 280 million in Q4.

Volumes, however, moved in the opposite direction toward year-end. Shipments increased 3.2 per cent from 372 thousand tons in Q1 to 384 thousand tons in Q2, then declined 2.9 per cent to 373 thousand tons in Q3 and slipped another 2.1 per cent to 365 thousand tons in Q4. Despite softer volumes, earnings momentum strengthened, reflecting the impact of pricing, cost discipline and mix.

Also read: Constellium and Infracell collaborate, investment in finishing lines proves worthwhile

Q4 2024 vs Q4 2025

The shift was most visible in the final quarter, where performance moved decisively ahead of the prior year’s weak base. Constellium increased Q4 shipments by 11 per cent to 365 thousand metric tons from 328 thousand tonnes, with gains across all operating segments. Revenue rose 28 per cent to USD 2.2 billion from USD 1.7 billion, supported by stronger volumes and higher revenue per ton, including improved metal prices.

The improvement flowed through to the bottom line. Net income reached USD 113 million, reversing the USD 47 million net loss recorded in Q4 2024 - a positive swing of USD 160 million. Higher gross profit, lower selling and administrative expenses and favourable changes in other gains and losses drove the turnaround, partly offset by higher depreciation, amortisation and income tax expense.

Adjusted EBITDA climbed to USD 280 million from USD 125 million, reflecting stronger segment results, lower corporate costs, a favourable change in the non-cash metal price lag impact and positive foreign exchange translation.

CEO Ingrid Joerg described 2025 as a year of near-record results, including record fourth-quarter Adjusted EBITDA, achieved despite macroeconomic uncertainty, and credited the company’s 11,500 employees for their focus on safety and customer service.

Demand patterns and pricing shifts shaped the year

Behind the financial recovery were shifting market forces. Packaging demand remained healthy, supported by improved performance at Muscle Shoals. Aerospace demand softened due to continued destocking, although high value-added products stayed resilient. Automotive demand was weak in Europe and stable in North America, with a fourth-quarter lift driven by short-term US supply shortages. Industrial markets stabilised during the year, while European shipments improved following recovery from the flood in Valais, Switzerland.

Pricing dynamics also played a key role. North American aluminium prices - LME plus Midwest Premium — rose sharply following U.S. tariff announcements. At the same time, scrap spreads widened from previously tight levels.

Segment scorecard: who powered the growth?

The year’s progress was not uniform across businesses. In Aerospace & Transportation (A&T), full-year Segment Adjusted EBITDA rose 16 per cent to USD 339 million from USD 292 million in 2024, mainly due to lower operating costs and favourable foreign exchange translation, partially offset by unfavourable price and mix.

Shipments declined 1 per cent to 207 thousand tonnes from 209 thousand tonnes, reflecting lower aerospace rolled products, mostly offset by higher TID rolled products. Revenue increased 8 per cent to USD 2.0 billion from $1.8 billion, primarily due to higher revenue per ton, including higher metal prices, partly offset by lower shipments.

Packaging & Automotive Rolled Products (P&ARP) delivered the strongest growth. Segment Adjusted EBITDA increased 46 per cent to USD 353 million, driven by higher shipments in North America with improved Muscle Shoals performance, favourable price and mix, favourable metal costs and favourable foreign exchange translation. Shipments rose 6 per cent to 1.1 million tonnes, reflecting higher packaging rolled products, partially offset by lower automotive and specialty rolled products. Revenue increased 21 per cent to USD 5.1 billion, supported by both higher shipments and higher revenue per ton, including higher metal prices.

Automotive Structures & Industry (AS&I) faced pressure. Segment Adjusted EBITDA declined 3 per cent to USD 72 million, primarily due to unfavourable price and mix and the unfavourable impact from tariffs. These were partially offset by net customer compensation for underperformance of an automotive programme and lower operating costs.

Shipments were stable at 202 thousand tonnes, as higher shipments of other extruded products following flood recovery were offset by lower automotive extruded volumes. Revenue increased 10 per cent to USD 1.6 billion, mainly due to higher revenue per tonne, including higher metal prices.

2026 outlook and forward strategy

Ingrid Joerg, Constellium’s Chief Executive Officer, said current demand trends across key end markets are expected to extend into early 2026, with the broader macroeconomic environment remaining relatively stable. The company also anticipates benefiting from supportive market dynamics, including ongoing supply tightness in automotive rolled products and improved scrap spreads in North America.

To advance its longer-term strategy, Constellium is launching Vision 2028, a group-wide excellence programme centred on two pillars — operational efficiency and cost optimisation — aimed at delivering its 2028 performance targets.

Joerg added, “Based on our current outlook, we expect Adjusted EBITDA to be in the range of USD 780 million to USD 820 million, excluding the non-cash impact of metal price lag, and Free Cash Flow in excess of USD 200 million in 2026. We also remain confident in our ability to deliver on our targets of Adjusted EBITDA of USD 900 million, excluding the non-cash impact of metal price lag, and Free Cash Flow of USD 300 million, by 2028. Our focus remains on executing on our strategy, driving operational performance, controlling costs, generating Free Cash Flow and increasing shareholder value.”

Must read: Key industry individuals share their thoughts on the trending topics

Responses