您想继续阅读英文文章还

是切换到中文?

是切换到中文?

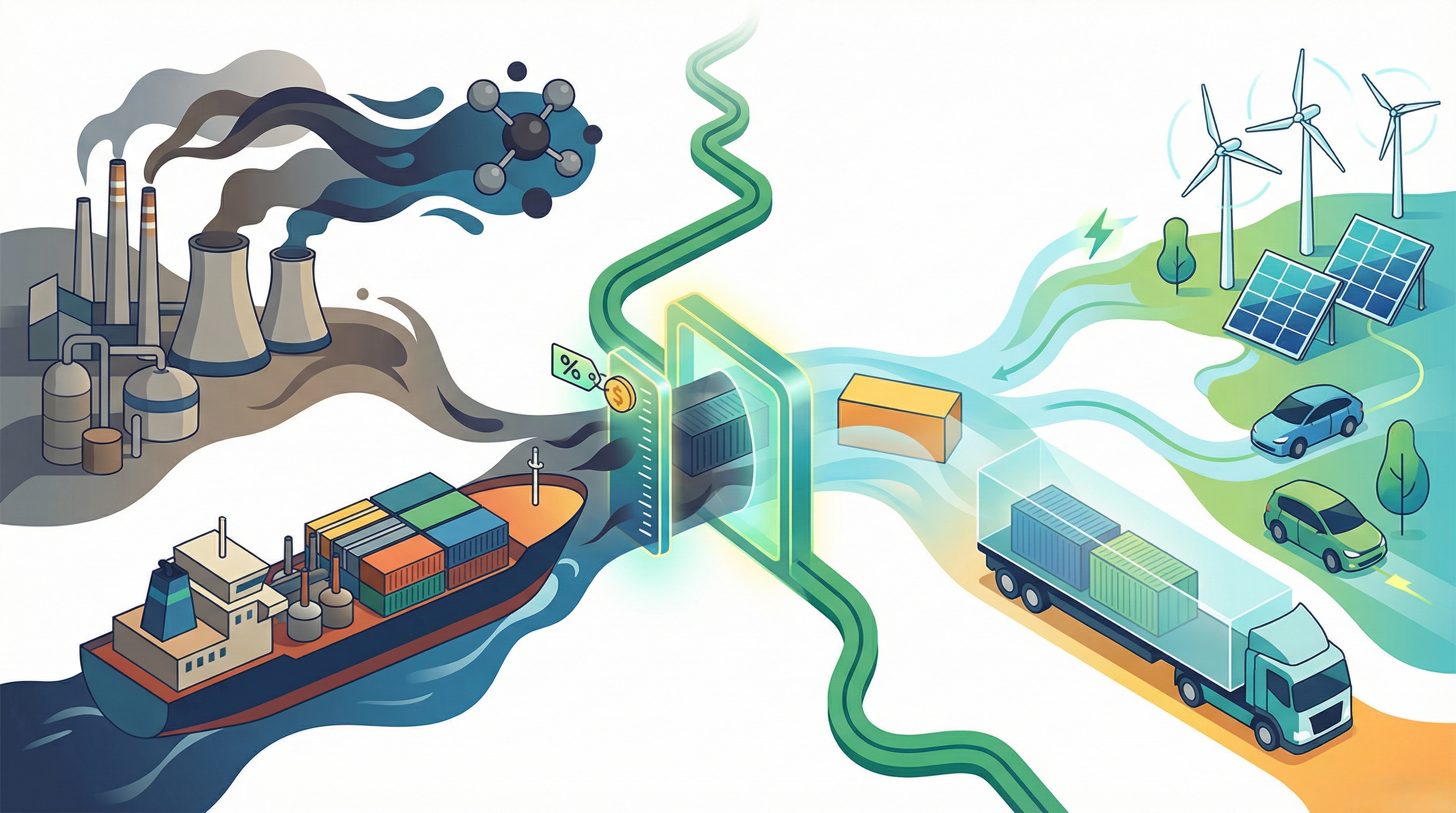

THINK ALUMINIUM THINK AL CIRCLE

The European Union is considering an expansion of its carbon border charge, a levy which is already set to apply to carbon-intensive metals like steel and aluminium as they enter the bloc. CBAM is designed to put a carbon price on imports of these materials to align them with the EU’s domestic emissions costs under its Emissions Trading System, a move aimed at discouraging production in countries with looser climate rules and reducing “carbon leakage”. Items such as car components and household appliances, including fridges and washing machines, are among the products that could be added, as the bloc moves to shut down avenues that allow overseas producers to avoid the levy.

Image for reference only

Image for reference only

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

The proposals are part of a wider set of measures linked to the EU’s carbon border system, which is expected to be presented on Wednesday. From January, the scheme will begin applying CO₂-related costs to imports of high-emission materials such as steel, cement and other carbon-intensive goods.

In the draft text, the Commission explains that the planned changes are designed to push the Carbon Border Adjustment Mechanism (CBAM) further along industrial supply chains. By doing so, the EU aims to reduce the risk that emissions are effectively “exported” abroad through the relocation of production, a phenomenon known as carbon leakage.

A spokesperson for the Commission declined to comment on the contents of the draft, noting that the proposals remain subject to revision ahead of their formal release.

The document is focused on the concerns that the overseas steel and aluminium producers might alter the trade flows to minimise the impact of the levy. Instead of shipping raw metals to the EU, which would incur a charge, exporters could send finished or semi-finished products containing large volumes of those materials, which are not currently covered.

Under the draft plan, the decision to include additional products would depend on an assessment of their vulnerability to carbon leakage. The Commission also signalled that the scope of the levy could be reviewed again in the future, with possible extensions to downstream products linked to the cement, fertiliser and hydrogen industries.

The move reflects the EU’s efforts to reinforce its pioneering carbon border framework and ensure imported goods are subject to climate-related costs comparable to those faced by producers within the bloc.

Don't miss out- Buyers are looking for your products on our B2B platform

Responses