您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

When the European Union rolled out its Carbon Border Adjustment Mechanism (CBAM) in 2023, a few energy-intensive industries felt the tremors more. Aluminium was one of them, while the rest were iron and steel, cement, fertilisers, hydrogen, and electricity industries. For them, CBAM appeared not just as another climate regulation but as a structural shift in its basic operational values. Apparently, CBAM is a bespoke tariff policy designed to target imported goods with high carbon emissions. But its underlying goal is also to introduce a level playing field in the domestic market by imposing the same carbon costs on importers that indigenous manufacturers pay under the ETS (Emissions Trading System).

Among all the sectors caught in the net, aluminium and iron/steel are poised for the most profound impacts, given their energy-intensive nature. They record high carbon footprint, especially in countries with high-emission electricity sources. That is why the global aluminium industry is closely watched as they are racing to brace for what lies ahead. So, here are some essentials that every aluminium producers should know.

CBAM regulations effective from January 1, 2026

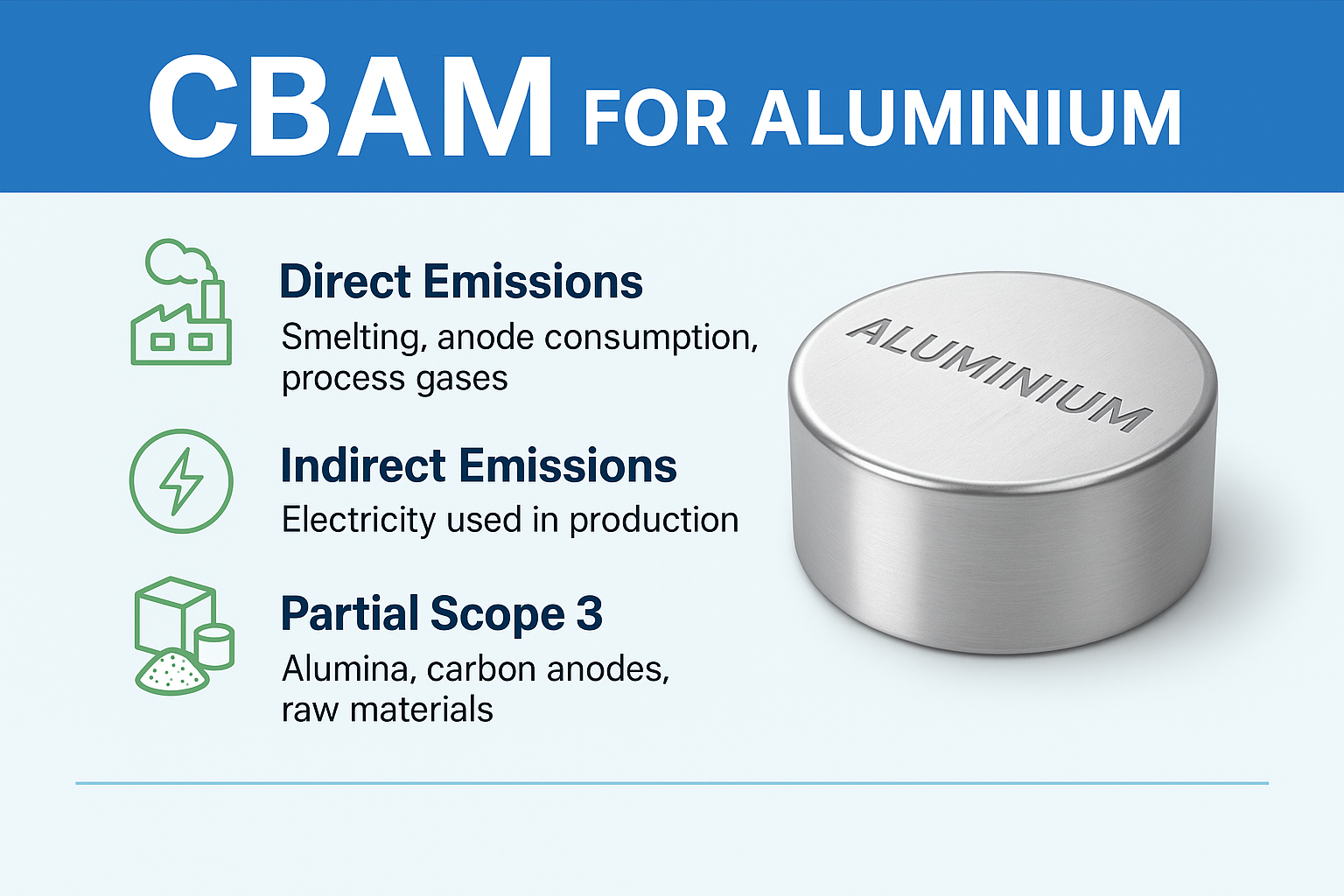

Starting on January 1, 2026, CBAM will graduate from its transitional “report-only” phase to full-fledged regime. For aluminium, the policy covers:

While primary and semi-finished aluminium, such ingot, billet, slab, foil, sheets, and extrusions, come under CBAM rule, finished downstream products found in final goods made of aluminium, such as automotive components, building materials, and packaging, are exluded, at least for now. So are imported aluminium scrap and remelted products.

From the specified date, importers will have to start purchasing CBAM certificates for goods with emissions above the EU benchmarks. Under the Omnibus simplification introduced in October 2025, importers less than 50 tonnes of aluminium annually are exempted from CBAM – a shift from the previous EUR 150 value-based threshold that penalised small and medium-sized enterprises. Under the latest regulation, importers can continue importing after January 1, 2026, provided they apply for authorisation by March 31, 2026.

…and so much more!

SIGN UP / LOGINResponses