您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

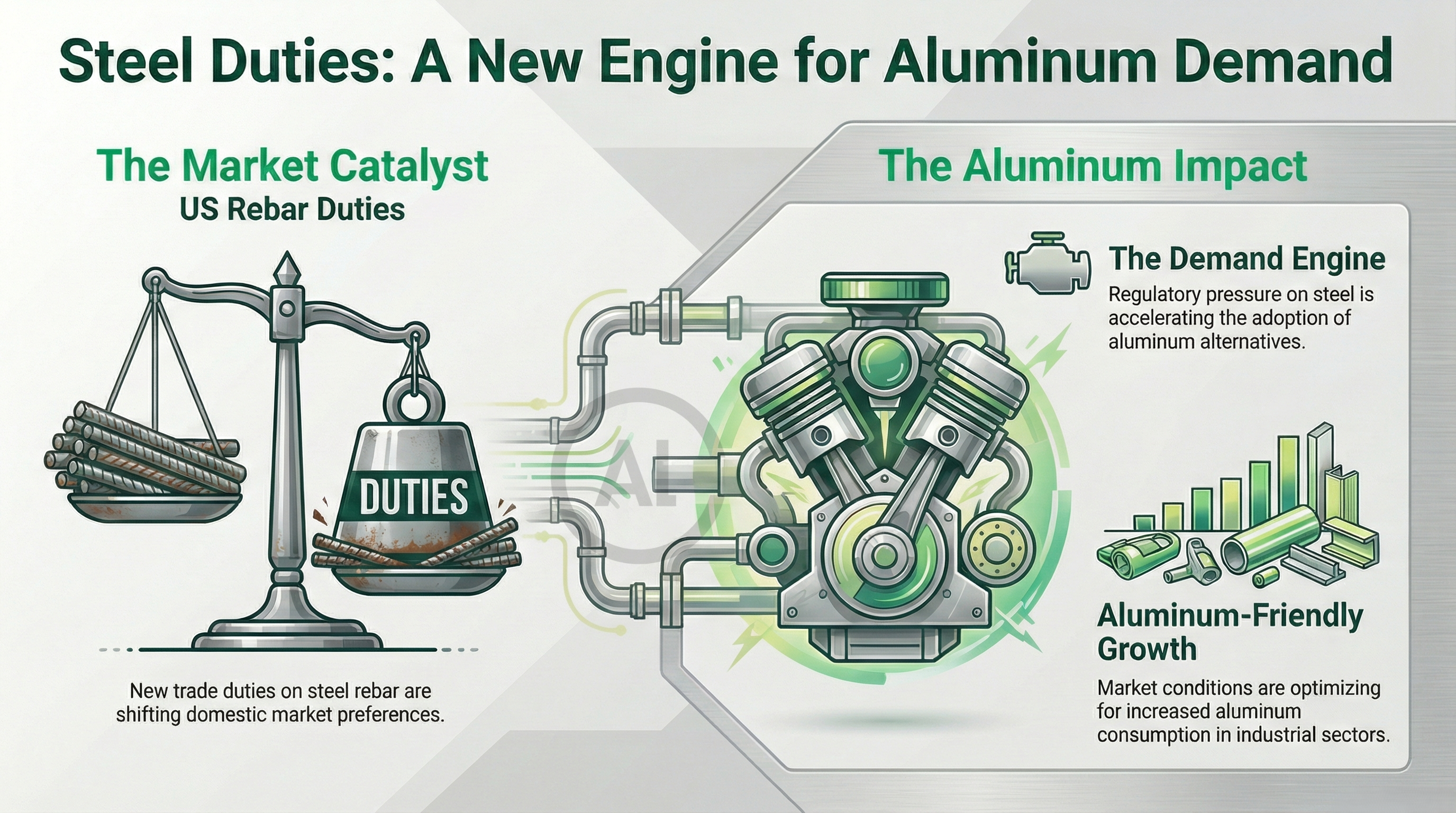

The US’s latest countervailing duty action against rebar imports from Algeria, Egypt and Vietnam is definitely a steel story. But in the layer under, it is shaping up to be a structural aluminium demand event for the North American construction ecosystem.

{alcircleadd}In January 2026, the US Department of Commerce imposed preliminary countervailing duties of 72.94 per cent on Algerian rebar, 29.51 per cent on Egyptian material and 1.08 per cent on Vietnamese shipments, on top of the blanket 50 per cent steel and aluminium tariff regime. The move followed investigations launched in mid-2025 after domestic producers alleged heavy subsidisation and dumping.

The immediate effect

There has been the sudden removal of a large volume of low-cost rebar from the US market. According to US import data, Algeria shipped about 91,543 tonnes of rebar to the US in 2024. Egyptian exports fell from around 243,000 tonnes in 2023 to about 205,800 tonnes in 2024, while Vietnam’s volumes, though smaller, doubled year-on-year to 56,400 tonnes. Overall, US rebar imports shrank from 1.41 million tonnes in 2023 to nearly 1.01 million tonnes in 2024.

In tonnage terms, nearly 400,000 tonnes of offshore rebar supply have disappeared in barely a year.

…and so much more!

SIGN UP / LOGINResponses