Global Bauxite and Alumina Industry Outlook 2025

Gain exclusive, forward-looking insights into the backbone of the aluminium industry with our Global Bauxite and Alumina Industry Outlook 2025. This in-depth report offers a strategic analysis of global bauxite mining, alumina refining capacity, trade dynamics, regional developments, and industry sustainability trends. Designed for industry leaders, investors, analysts, and policymakers, the report equips you with the data and forecasts needed to navigate market volatility, identify growth opportunities, and future-proof your position in the aluminium value chain.

Bauxite and Alumina Sector: Exclusive Industry Insights

A Lite Version of the "Global Aluminium Industry Outlook 2025"

This exclusive segment from the Bauxite and Alumina sector is a condensed yet insightful extract from our comprehensive Global Aluminium Industry Outlook 2025 report. Gain a deep understanding of the supply chain, production trends, market dynamics, and future projections for these critical raw materials in the aluminium industry.

Why this report is important

Bauxite and alumina form the backbone of aluminium production, making them indispensable to global industrial growth. This segment provides crucial intelligence on:

- Global production and supply chain trends

- Market demand and price forecasts

- Geopolitical influences on supply security

- Technological advancements in refining and processing

- Sustainability and environmental impact

Exclusive benefits

- Concise & actionable insights: Focused information tailored for quick decision-making.

- Market intelligence: Data-backed analysis for strategic planning.

- Competitive edge: Stay ahead of industry trends and developments.

What's inside

- Current market landscape and outlook

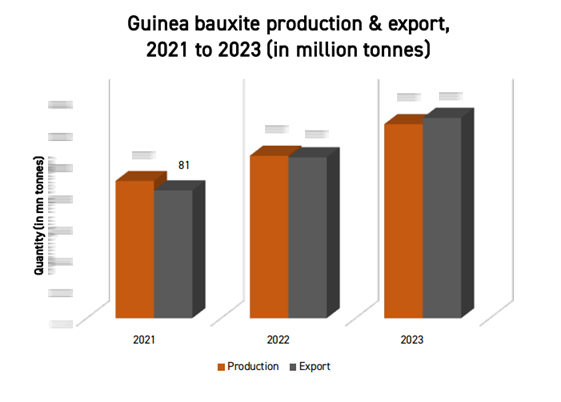

- Global and regional production analysis

- Key market drivers and challenges

- Trade flows and investment opportunities

- Insights from industry experts

Who should read this report

This segment is essential for:

- Aluminium industry professionals

- Investors & analysts tracking commodities and metals markets

- Supply chain & procurement managers optimizing resource acquisition

- Government & policy makers involved in industrial strategies

- Sustainability & ESG professionals assessing environmental impact

Get your exclusive access

Don't miss out on this vital industry intelligence. Subscribe to the report now to stay informed and ahead in the industry.

Methodology

Our study on the Aluminium Outlook 2025 will adopt a comprehensive, structured approach to analyse key aspects of the industry. The research will cover an in-depth assessment of raw material sources, price trends of alumina and bauxite, and examine the impact of global carbon tariffs and newly imposed United States tariffs on the aluminium sector. The study will be conducted through a multi-faceted methodology, detailed as follows.

1. Research Approach

The study was conducted through extensive secondary research, complemented by targeted primary research, and structured into the following key components:

- Secondary Research: A thorough review of publicly available resources, including government reports, industry publications, company sustainability disclosures, annual reports, and environmental reports.

- Primary Research: A series of 5–10 structured telephonic and online interviews were conducted with key industry stakeholders, including raw material traders, suppliers, and industry associations.

- Industry Seminars: Relevant industry conferences and seminars were attended to gather first-hand insights from policymakers and industry experts.

2. Data Collection

To ensure a comprehensive market analysis, data will be sourced through multiple channels:

a. Reviewing Publicly Available Resources

- Company annual reports and investor presentations.

- Environmental reports and sustainability disclosures.

- Official company websites and press releases.

- Published articles, white papers, and research papers from reputable sources.

b. Accessing Curated Databases

We utilised our in-house aluminium industry-focused database to support the research. For trade-related insights, we accessed and extracted relevant trade data using subscription-based trade data tools.

3. Data Validation

To ensure accuracy and alignment with client requirements, all collected data underwent a rigorous validation process:

- Cross-referencing: Primary research findings were cross-checked against secondary data.

- Expert Review: Subject matter specialists validated key insights to ensure reliability.

4. Data Analysis

The collected data were systematically analysed using advanced methodologies, including historical data review, five-year price analysis, forecasting and projections, and trade data evaluation, to generate meaningful insights.

- Historical Data Review: A detailed examination of past trends in aluminium raw materials, pricing, and market movements over the previous decade was conducted.

- Five-Year Price Analysis: Historical pricing patterns were tracked to identify long-term market trajectories for primary aluminium.

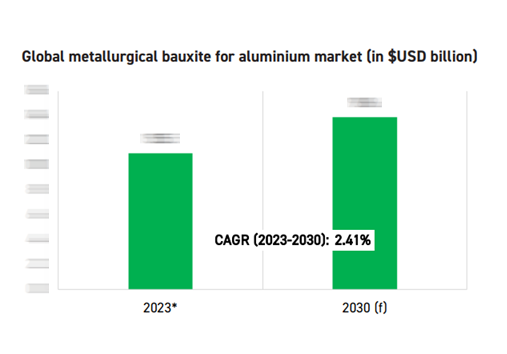

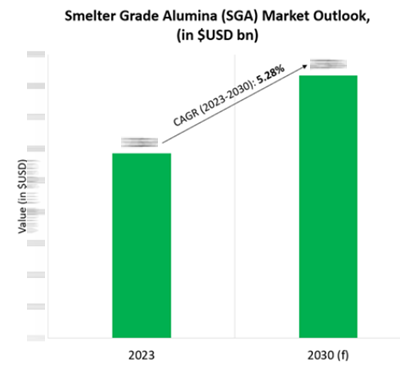

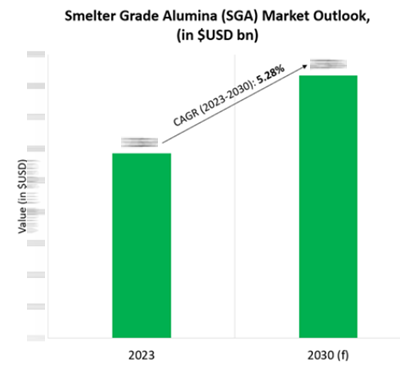

- Forecasting and Projections: Compound annual growth rates (CAGR) were calculated, and trend analysis was performed to predict future market movements.

- Trade Data Evaluation: An in-depth analysis of trade-related data from credible institutions such as the International Trade Administration and the International Trade Council was carried out, supported by paid trade intelligence platforms.

After analysing the information, a proprietary statistical tool was used for market estimation and forecasting, generating the quantitative figures and sizes of the market and its sub-segments for both the current scenario and the forecast period. This included production, consumption, and supply volumes, as well as usage by end-user sectors. After estimating the market sizes and figures, the numbers were verified through consultation with industry participants and key opinion leaders. The extensive network of industry participants added value to the research process by validating the numbers and estimates provided in the study. At the final stage of the research process, the findings were consolidated, and a final report was prepared.

Frequently asked questions

The report delivers a strategic outlook through 2025 and beyond, offering historical trends and short-medium- and long-term forecasts. It identifies future market drivers, upcoming projects, and potential disruptors—giving you the foresight needed to plan effectively in an evolving global landscape.

Yes. It includes company profiles, project pipelines, and investment trends across the value chain. Whether you're looking for growth markets, joint venture prospects, or future hotspots for resource acquisition, the report acts as a strategic roadmap to make informed decisions and identify emerging opportunities.

The report offers comprehensive regional coverage, focusing on key bauxite and alumina markets across Asia-Pacific (China, India, Australia, Indonesia), Africa (notably Guinea, Ghana), the Middle East, Europe, North America, and South America. It analyses region-specific production capacities, trade flows, investment trends, and policy developments—helping stakeholders understand both global dynamics and regional opportunities or risks.

Bauxite and alumina form the foundation of the aluminium industry, and developments in this upstream segment significantly influence downstream production, costs, and supply security. This report provides critical insights into raw material availability, pricing trends, and geopolitical risks—enabling manufacturers, traders, and policymakers to anticipate challenges, secure supply chains, and make informed strategic decisions across the aluminium ecosystem.

Definitely. While the report is data-rich and industry-specific, it’s structured in a clear, business-friendly format, combining charts, visuals, and explanatory summaries. Whether you're a strategic planner, investor, or industry newcomer, the insights are accessible, actionable, and tailored for real-world decision-making.

The report explores how sustainability pressures and decarbonisation goals are influencing mining, refining, and trade. It covers innovations in green refining, energy costs, carbon pricing, and the increasing need for cleaner technologies—critical for companies aligning their operations with ESG goals.