您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

As of November 28, Mysteel's assessment for the benchmark 5,500 kcal per kg thermal coal at China's northern ports reached RMB 821per tonne (USD 116.8per tonne), down RMB 9per tonne from a week ago. The 5,000 kcal per kg and 4,500 kcal per kg NAR grades reached RMB 721per tonne and RMB 625per tonne, down RMB 16per tonne and RMB 13per tonne, respectively. All prices are on a FOB basis with 13per cent VAT included.

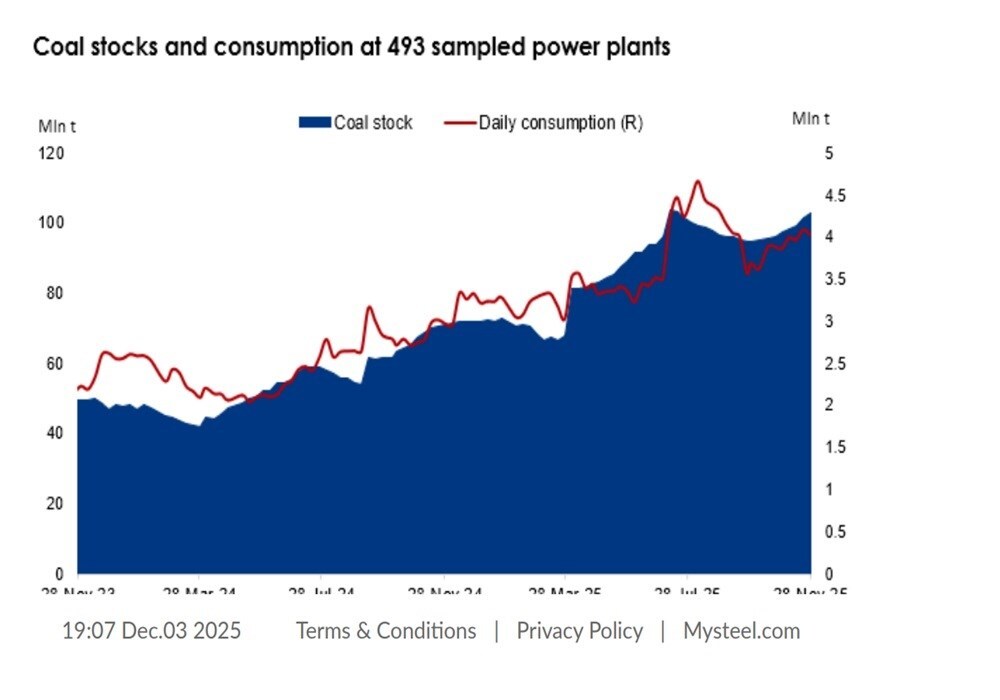

Last week, coal inventories continued to build at northern transfer ports, raising concerns that authorities will mandate traders to accelerate cargo offloading to release room for new arrivals. In fact, some ports have required traders to secure buyer contracts before approving new train transport schedules. As of Friday, the eight northern ports that Mysteel surveys had 25.29 million tonnes of coal in stock, up 2.9per cent on the week. The figure marked the highest inventory level at these ports since late July.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

With growing pressure to speed up sales, traders cut offers in search of buyers. However, anticipating further price corrections and sitting with comfortable inventories, buyers held back on purchasing immediately, locking the market activity in a standoff. Without a demand catalyst, portside coal prices are expected to fall another RMB 20-30per tonne before finding a koor, a source said.

…and so much more!

SIGN UP / LOGINResponses