您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

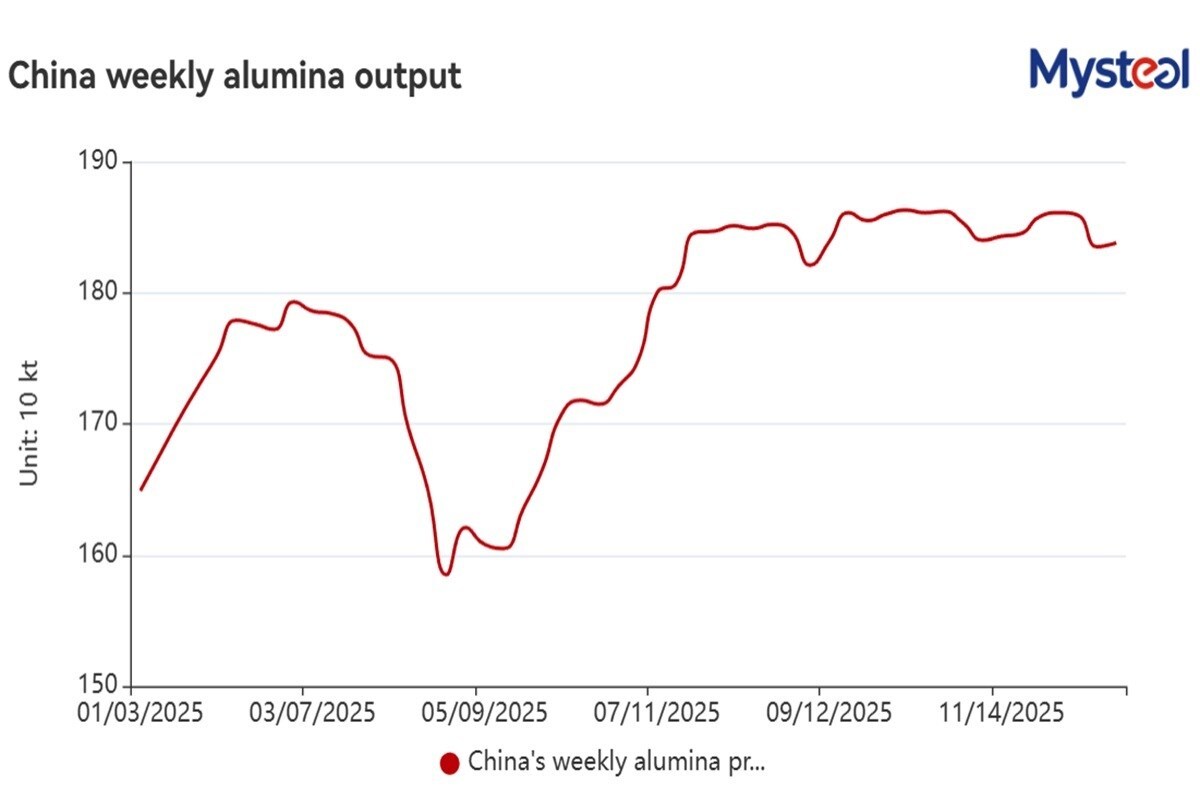

According to Mysteel's weekly survey, total smelter-grade alumina output among the 44 Chinese alumina refiners under Mysteel tracking ticked up marginally by 0.2 per cent on a week to 1.84 million tonnes during the December 19-25 week.

During the same week, the average capacity utilisation rate across the same 44 producers rose slightly to 85.14 per cent, up 0.14 percentage points from the previous week. The increase stemmed from the fact that many producers maintained relatively high operating rates while engaged in price negotiations for next year's long-term contracts, market sources learned. Some talks were deadlocked, with alumina producers on the verge of losses holding firm on prices while primary aluminium smelters pushed for lower procurement prices.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

Alumina inventories mounted further last week. As of December 25, total stocks across China's ten major ports, 44 refiners, 89 smelters, and rail yards or in transit under Mysteel's monitoring had increased by 1.1 per cent from a week earlier to 5.2 million tonnes, setting a new record high since Mysteel began tracking the data in January 2022.

…and so much more!

SIGN UP / LOGINResponses