您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

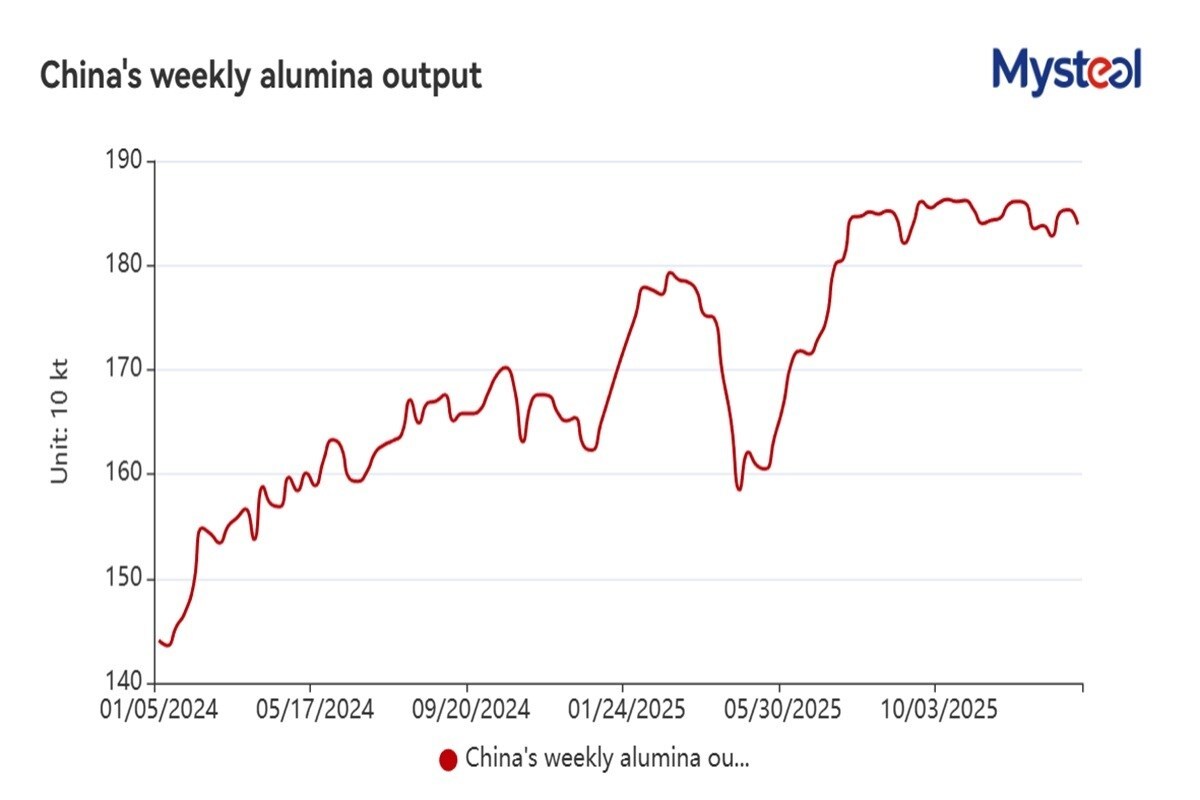

China's alumina output edged down last week as several producers in Henan and Guizhou provinces and in the Guangxi autonomous region scaled back production to carry out 10-14 days of maintenance, either to curb atmospheric pollution or to control operating costs.News of the production curtailments provided brief support to the alumina futures market late last week. The most-traded May 2026 alumina contract on the Shanghai Futures Exchange jumped 1.8 per cent during Thursday's daytime trading session from the prior day's settlement price.

{alcircleadd}To know the aluminium market outlook for 2026 and beyond, get an access to our report: Global Aluminium Industry Outlook 2026

In contrast, spot alumina prices continued to weaken over the same week, mainly weighed down by steady inventory accumulation. Mysteel assessed the national average spot price for smelter-grade alumina with a purity above 98.6 per cent at RMB 2,655 per tonne (USD 382 per tonne) on January 22, down 0.6 per cent from a week earlier.

Read More: GACC: China's 2025 alumina exports surge 43 per cent y-o-y

Responses