您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Market Analysis: Supply-Demand Dynamics

Current market assessment reveals Indonesia's bauxite sector is in a critical transitional phase.The implementation of the 2023 export ban has successfully redirected bauxite from international markets to domestic processing, but the downstream alumina sector's development has progressed more slowly than anticipated. This has created a situation where approved bauxite supply significantly outpaces operational refinery capacity, presenting both challenges and opportunities for market participants.

Supply Side Assessment

The bauxite mining sector has demonstrated remarkable adaptability in responding to new market realities. Industry analysis indicates substantial progress in regulatory adaptation, with production levels adjusting strategically to domestic demand constraints.

Demand Side Reality

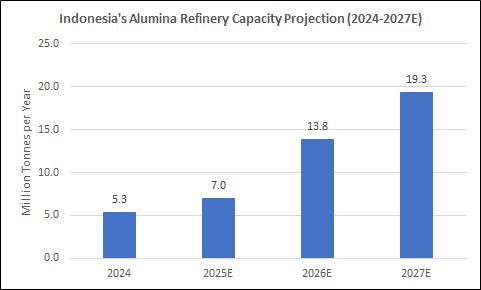

The alumina refinery sector faces significant commissioning challenges, with current operations substantially below initial projections. Market intelligence reveals that operational performance has failed to keep pace with supply-side adjustments.

Project Implementation Challenges

Market analysis identifies seven alumina refinery projects in Kalimantan facing critical implementation barriers, primarily centred around funding availability and investor confidence:

Total Estimated Impact:

Market Implications and Strategic Considerations

The current supply-demand configuration is creating significant market pressures that demand strategic attention. With domestic bauxite prices experiencing downward pressure due to surplus conditions, mining companies are facing compressed margins while simultaneously building inventory amid limited refinery offtake. The concentration of all seven stalled projects in Kalimantan presents regional development challenges, potentially affecting local economic growth and employment. Infrastructure development continues to progress ahead of demand requirements, creating both opportunities for future efficiency and current cost pressures. Strategic decisions made in the coming months will be crucial in determining whether this temporary surplus evolves into a sustained competitive advantage or becomes a drag on sector performance.

Forward Outlook and Projections

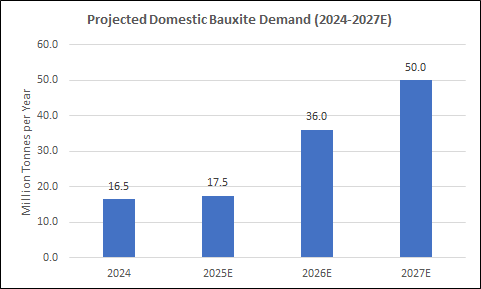

Industry analysis suggests a complex pathway ahead for market rebalancing. The 2026-2027 demand potential remains substantial at approximately 30 million tonnes, provided refinery projects can resolve current implementation delays. This projection is based on the planned 12 million tonnes per annum alumina capacity requiring 28.8 million tonnes of bauxite feedstock. Achieving this demand level will require supply expansion to 18-20 million tonnes to meet full downstream potential. Market rebalancing is estimated within 18-24 months, contingent upon successful resuscitation of stalled projects and continued regulatory support. The timing of this rebalancing will be critical for maximising Indonesia's position in the global aluminium value chain.

Conclusion

Indonesia's bauxite market transformation has reached a critical implementation phase where execution challenges threaten to delay the downstream vision. While regulatory frameworks have shown adaptability and the mining sector has demonstrated operational flexibility, project execution faces significant delays across seven major projects. The current supply surplus provides a strategic window of opportunity to address fundamental implementation challenges before projected demand fully materialises. The successful realisation of Indonesia's downstream ambition will depend on effectively bridging the funding gap through targeted financial solutions, enhanced project management capabilities, and strategic stakeholder coordination. Market analysis suggests that addressing these challenges promptly could position Indonesia to achieve its aluminium production goals by 2027-2028, leveraging the available bauxite supply and established mining capacity to become a significant player in the global aluminium market.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses