您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

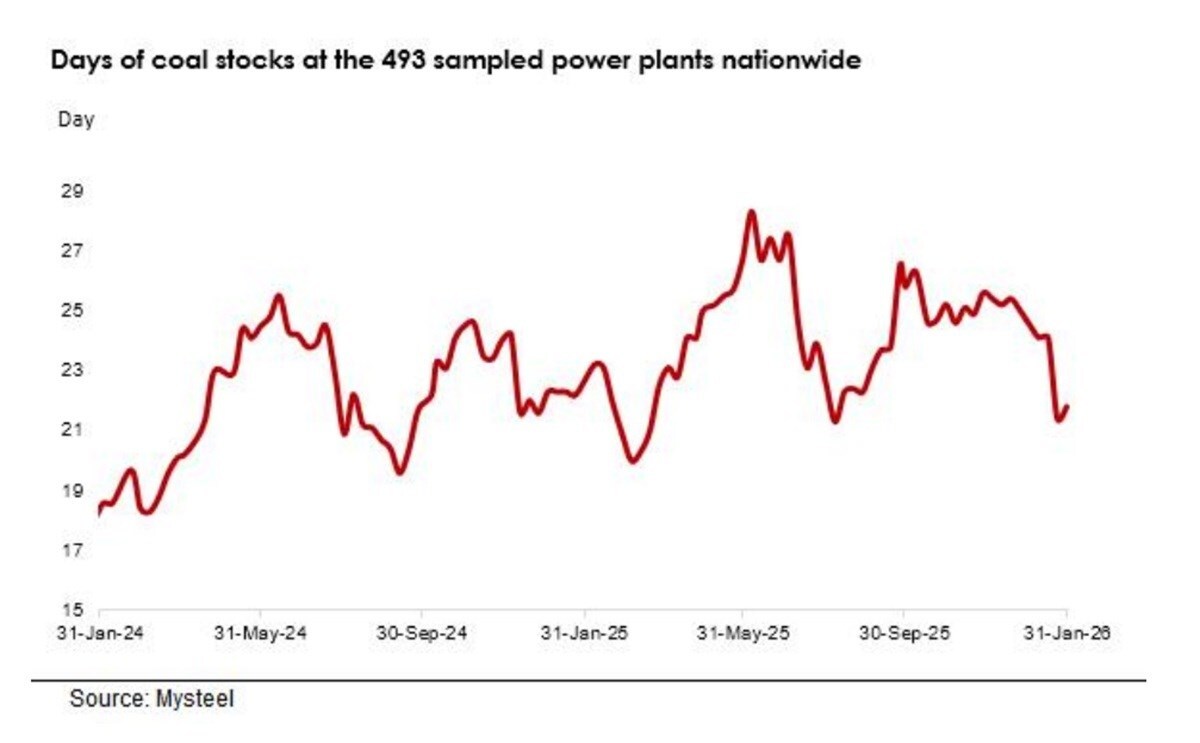

In January, spot prices at northern ports showed only mild volatility. The benchmark 5,500 kcal per kg NAR coal opened the month at RMB 690 per tonne (USD 99.5 per tonne), rose to RMB 706 per tonne in mid-January, then retreated to RMB 693 per tonne before closing at RMB 699 per tonne on January 30, according to Mysteel assessments.

{alcircleadd}To know more about the global primary aluminium industry 2026 outlook, book the report “Global ALuminium Industry Outlook 2026".

Earlier in the month, colder weather lifted coal burn at some coastal electricity utilities, prompting stronger spot buying at northern ports. At the same time, reduced rail inflows from northern coal fields led to inventory drawdowns at ports, lending temporary support to prices. As temperatures rebounded and demand softened, prices eased again, though relatively tight supply conditions helped stabilise the market toward month-end.

Read More: MYSTEEL: China's coking coal market to see mild recovery in 2026

Responses