您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Primary aluminium imports: According to data from the General Administration of Customs, in July 2025, China's primary aluminium imports were approximately 248,300 tonnes, up 29.1 per cent M-o-M and 91.2 per cent Y-o-Y. From January-July, the total cumulative imports of primary aluminium were about 1.4983 million tonnes, up 11.1 per cent Y-o-Y.

Primary aluminium exports: According to data from the General Administration of Customs, in July 2025, China's primary aluminium exports were approximately 41,000 tonnes, up 108.9 per cent M-o-M and 116.7 per cent Y-o-Y; from January-July, the total cumulative exports of primary aluminium were about 127,700 tonnes, up 170.5 per cent Y-o-Y.

Net primary aluminium imports: In July 2025, China's net primary aluminium imports were 207,300 tonnes, up 20.0 per cent M-o-M and 86.8 per cent Y-o-Y. From January-July, the total cumulative net imports of primary aluminium were about 1.3706 million tonnes, up 5.3 per cent Y-o-Y.

(The above import and export data are based on HS codes 76011090, 76011010)

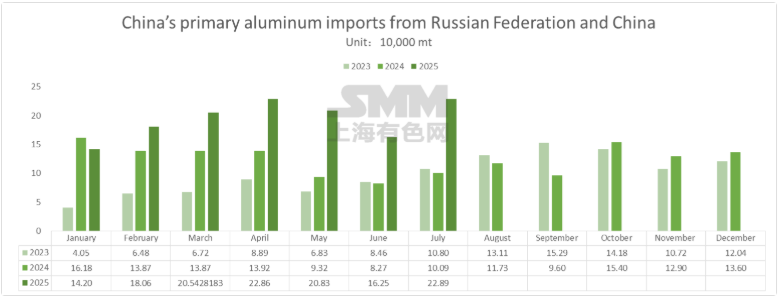

From the perspective of import source countries, in July 2025, the main sources of China's primary aluminium imports were the Russian Federation, Indonesia, India, Australia, Malaysia, Oman, and other countries and regions. Among them, imports from Russia in July were about 190,800 tonnes, up 17.5 per cent M-o-M, accounting for 76.8 per cent of the July imports. Currently, overseas primary aluminium imports are in a loss-making state, with import losses fluctuating around RMB 1,400 per tonne. Overseas demand is weak, and more overseas supplies are entering China. From the perspective of the China's spot market, August is in the transition period between the off-season and peak season. Some sectors have gradually shown signs of recovery. The SMM downstream leading enterprises' operating rate rebounded, but consumption remains in the off-season. Social inventory of aluminium ingots continues to build up, and aluminium prices remain relatively firm. Downstream procurement is mainly just-in-time, with weak restocking intentions. Primary aluminium imports are still mainly through long-term contracts.

From the perspective of trade modes: In terms of primary aluminium import trade modes in July, ordinary trade decreased by another 19 per cent M-o-M, mainly due to the ongoing off-season domestically, with moderate absorption of imported primary aluminium. The total imports via Entrepot Trade by Customs Special Control Area and bonded supervision trial entry-exit goods increased by 49.4 per cent M-o-M. For exports, 99.8 per cent of the primary aluminium exports in July were through Entrepot Trade by Customs Special Control Area and bonded supervision trial entry-exit goods, indicating that the majority were re-exports.

SMM brief comment: LME outperforms SHFE in aluminium prices, with the China's import window closed and import losses fluctuating around RMB 1400 per tonne. Coupled with weak demand during the traditional off-season domestically, there is a continuous inventory buildup of aluminium ingot, leading to moderate enthusiasm for import trade, mainly focusing on the execution of long-term contracts. It is expected that net imports of aluminium in August will remain at a low level.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses