Prices of aluminium (non-OEM) ADC12 alloyed ingots remained stable w-o-w across both northern and southern regions in India, largely due to ongoing sluggish demand in the automotive sector and a weakened export market.

{alcircleadd}

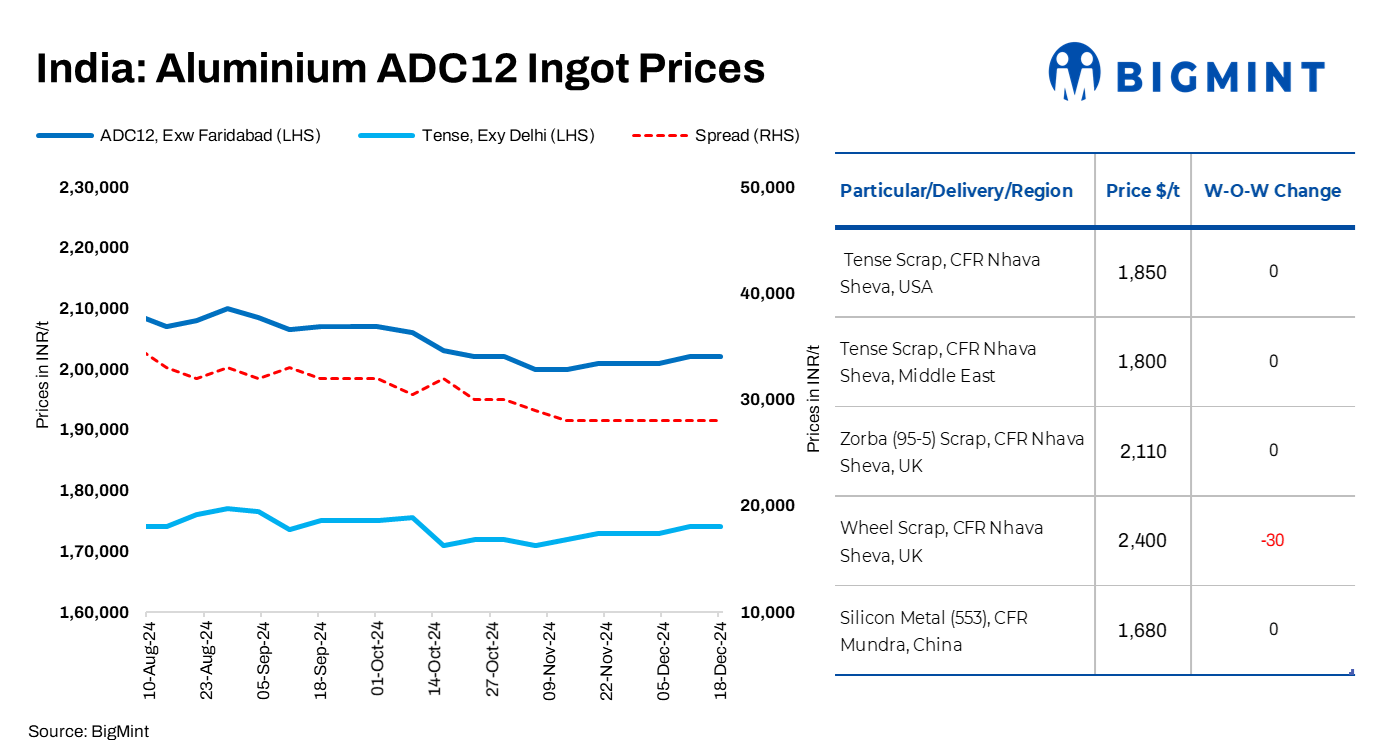

BigMint's weekly assessments for ADC12 (non-OEM) grade stood at INR 202,000/tonne (t) in Delhi and INR 203,000/tonne in Chennai, stable w-o-w.

At the time of reporting, three-month aluminium futures on the LME stood at $2,533/tonne, dropping by 3 per cent compared to the previous week's levels of around $2,601/tonne. Meanwhile, stocks at LME-registered warehouses were at 670,025 tonnes, falling by 1 per cent from 677,600 tonnes in the previous week.

The scrap-to-semi-finished spread for ADC12 non-OEM remained steady at INR 28,000-29,000/tonne w-o-w.

Major automaker cuts prices for Jan settlements

A leading automobile manufacturer reduced its ADC12 prices for January 2025 settlements by INR 1,000/tonne, setting at INR 208,000/tonne- the lowest level in 10 months. The last comparable price was recorded in March 2024. The reduction reflects weak demand in the automotive sector.

A source told BigMint, "The market has not fully absorbed the recent price cut announced by a prominent manufacturer. With the year-end slowdown, market activity has been sluggish, and fewer trades are taking place as buyers hold off, waiting for the new year to establish clearer price expectations."

Imported raw material prices stable w-o-w

Prices of the basic raw material for aluminium alloys, that is, scrap, remained largely stable w-o-w. BigMint's assessment for tense scrap originating from the UAE was at $1,800/tonne CFR Nhava Sheva, which is stable w-o-w. Meanwhile, Zorba 95/5 from the UK stood at $2,110/tonne CFR west coast, India, steady w-o-w.

Domestic scrap remains steady

In the domestic market, Tense scrap prices in both Delhi and Chennai remained stable w-o-w, while other grades also remained steady. According to BigMint's assessment, domestic Tense scrap stood at INR 174,000/tonne ex-Delhi-NCR and INR 175,000/tonne ex-Chennai.

China's silicon prices stable

According to BigMint's assessment, prices of China's 553-grade silicon remained stable w-o-w at $1,680/t CFR Mundra. Freights were at around $2,000-2,300/tonne for a single container from China to Mundra.

Prices of silicon remained stable w-o-w despite weak demand in the domestic alloyed ingot market. Additionally, alloyed ingot manufacturers claim to have sufficient inventories of silicon, which further kept prices stagnant.

Export market

The demand for ADC12 in Japan has shown some improvement, with recent deals reported in the $2,440-2,450/t bracket. However, demand remains cautious, as Japanese buyers are holding sufficient stocks for the December period and anticipate a shortage going forward.

Shipment prices from the UAE to Japan are currently at $2,440-2,450/tonne. Meanwhile, UAE shipments to India's west coast are slightly lower, at $2400-2420/tonne.

Outlook

A downward price trend is expected in the coming weeks, as the recent price cut and year-end slowdown weigh on the market. Participants are awaiting fresh signals in the new year to gauge pricing trends.

Image credit: IndiaMart

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

Responses