您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

India's aluminium ADC12 alloy ingot prices remained stable M-o-M in December 2025 supported by steady automotive demand and the typical year-end slowdown, which limited any further upward movement in prices.

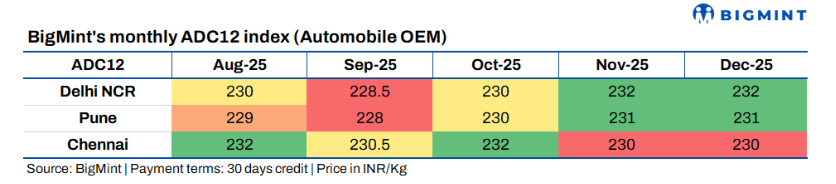

BigMint's monthly assessment for OEM-grade ADC12 showed slight price hikes across key regions:

These prices are based on 30-day payment terms.

The spread between scrap and semi-finished products saw a M-o-M increase of INR 42,000-45,000 per tonne (USD 465.16-498.38 per tonne) in both Delhi NCR and Chennai on lower domestic scrap prices and steady alloy prices due to firm auto demand.

Market insights

ADC12 offers across northern and western India were recorded in the range of INR 233,000-234,000 per tonne (USD 2,580.09-2,591.41 per tonne), while bids hovered between INR 231,000-232,000 per tonne (USD 2,558.19-2,569.27 per tonne) levels in the north and INR 230,000-231,000/t (USD 2,547.28-2,558.19) in the west. Meanwhile, offers in the south hovered between INR 231,000-232,000 per tonne and bids were heard between INR 229,000-230,000 per tonne (USD 2,536.11-2,547.28). Most OEMs are still finalising their December procurement contracts, with negotiations ongoing.

A secondary alloy producer said, "ADC12 demand stayed firm through November but is expected to ease slightly in December, largely due to the usual year-end slowdown and scheduled maintenance shutdowns at several automakers during this period."

Another ADC12 producer from south India informed that the spread between ADC12 and Tense has widened, supporting stronger profit margins for alloy makers. Most south-based producers are preferring domestic scrap--not only from Chennai but also from other parts of south India--in an effort to secure lower-priced material.

Domestic casting scrap prices have remained steady and are still lower than both north India's and Chennais average levels from two months ago. This price advantage has helped maintain healthy profit margins for alloy producers.

Alloy imports plunge Y-o-Y

Imports: India's ADC12 alloy market continued to witness a sharp contraction in imports during the first 10 months of 2025 (10MCY'25), with inbound volumes falling 51 per cent Y-o-Y. Total ADC12 imports stood at 10,250 tonnes, down significantly from 20,996 tonnes in 10MCY'24.

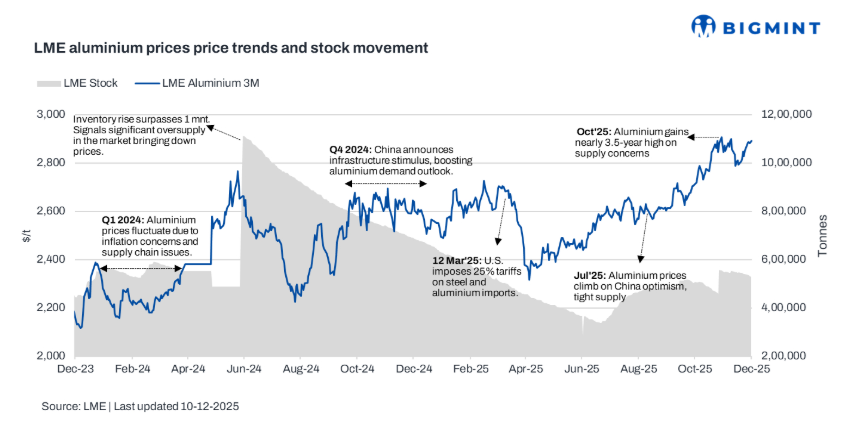

LME aluminium prices averaged at USD 2,885 per tonne in early December, marking a USD 40 per tonne or 1.5 per cent gain m-o-m from the previous month.

Meanwhile, LME aluminium inventories witnessed outflows in early December, with stocks down by 3 per cent at 530,786 tonnes against 547,261 tonnes in the previous month.

Aluminium prices strengthened as tightening supply aligned with improved demand signals. Chinese smelters approached government-imposed capacity limits thereby capping output potential, while SHFE inventories fell sharply, underscoring supply tightness.

Raw material price trends

In early December, prices of aluminium scrap remained rangebound m-o-m. US-origin Tense (6-7 per cent) scrap stood at USD 2,000 per tonne, down by USD 5 per tonne M-o-M, while UK-origin Wheels rose by USD 15 per tonne to USD 2,660 per tonne. Meanwhile, Zorba 95/5 from the UK stood at USD 2,270 per tonne CFR west coast, India, up by USD 20 per tonne M-o-M.

The firm LME trend--driven by supply disruptions and a bullish outlook in the global aluminium market--has kept imported scrap offers elevated, even as overall scrap prices remain largely rangebound.

India's overall aluminium scrap imports increased by 14 per cent to 1.65 million tonnes in 10MCY'25 from 1.44 million tonnes in 10MCY'24. Major importers also scaled up procurement amid a shortage of aluminium scrap during the initial months of the year, particularly following the imposition of US tariffs.

Most grades, except for Talk, witnessed an increase in arrivals in 10MCY'25 despite price volatility.

In the domestic market, Tense scrap prices gained INR 1,000 per tonne (USD 11.08 per tonne) M-o-M to INR 190,000 per tonne (USD 2,104.57) in Delhi, while in Chennai prices were assessed at INR 185,000 per tonne (USD 2,048.95) exw, steady M-o-M. The stability in domestic scrap prices followed improved scrap availability in the local market and stricter GST compliance enforcement, both of which contributed to downward pressure on prices particularly in the southern region.

Silicon price trends

According to BigMint's assessment, China's 553-grade silicon prices remained largely steady m-o-m at USD 1,360 per tonne CFR Mundra, driven by steady demand.

Outlook

The ADC12 market is expected to remain slow through the rest of December, with prices staying largely stable due to the typical year-end lull and maintenance shutdowns at several automakers. Despite firm auto demand, buying sentiments are expected to remain slow as participants await major automakers' January 2026 price settlements. Market activity is likely to pick up after the New Year.

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses