您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

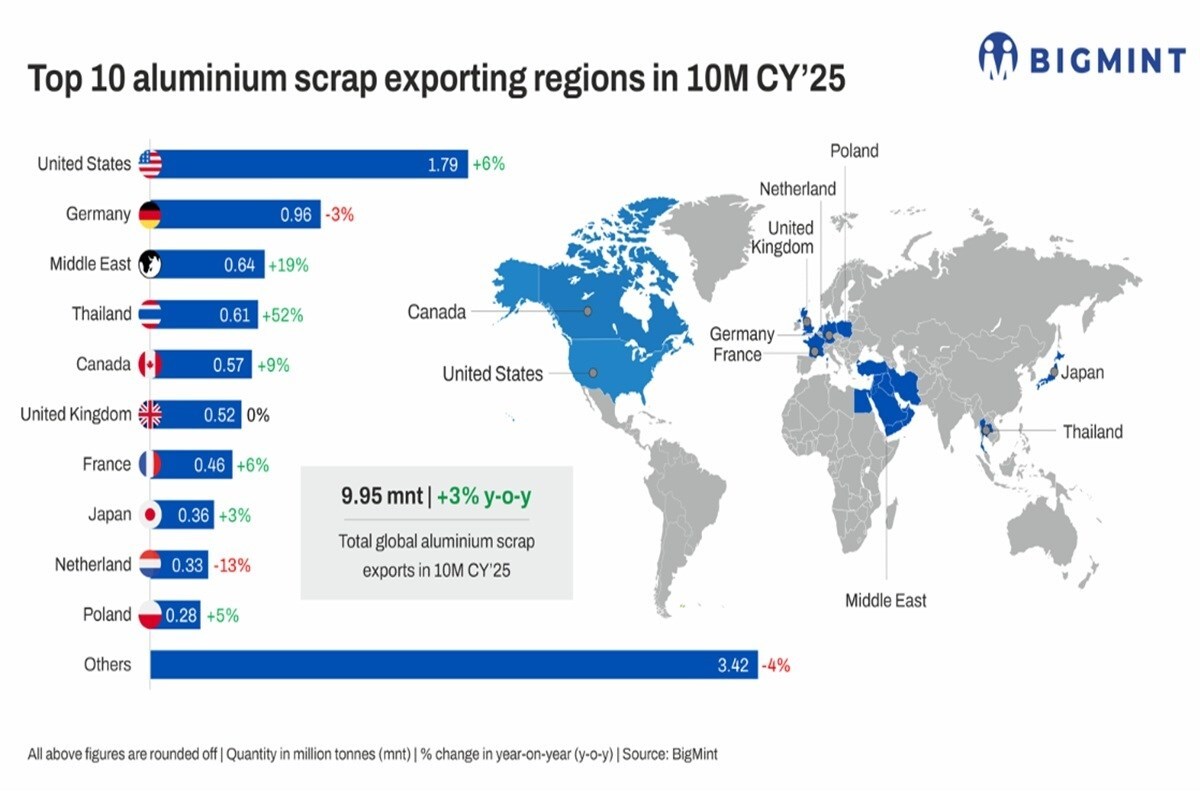

Global aluminium scrap trade volumes, including intra-European trade, increased by 3 per cent y-o-y in the first ten months of 2025 (10MCY'25). India remained the key demand driver, increasing its imports by 15 per cent to 1.65 mnt, especially from the EU, UK, and Middle East.

Total exports in 10MCY'25 stood at 9.95 million tonnes (mnt) compared to almost 9.68 mnt in 10MCY'24, as per provisional data available with BigMint.

Notably, the global aluminium scrap trade volume stood at 11.69 mnt in 2024 and is expected to increase to nearly 11.9 mnt in 2025.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

Why did global aluminium scrap trade pick up in 10MCY'25?

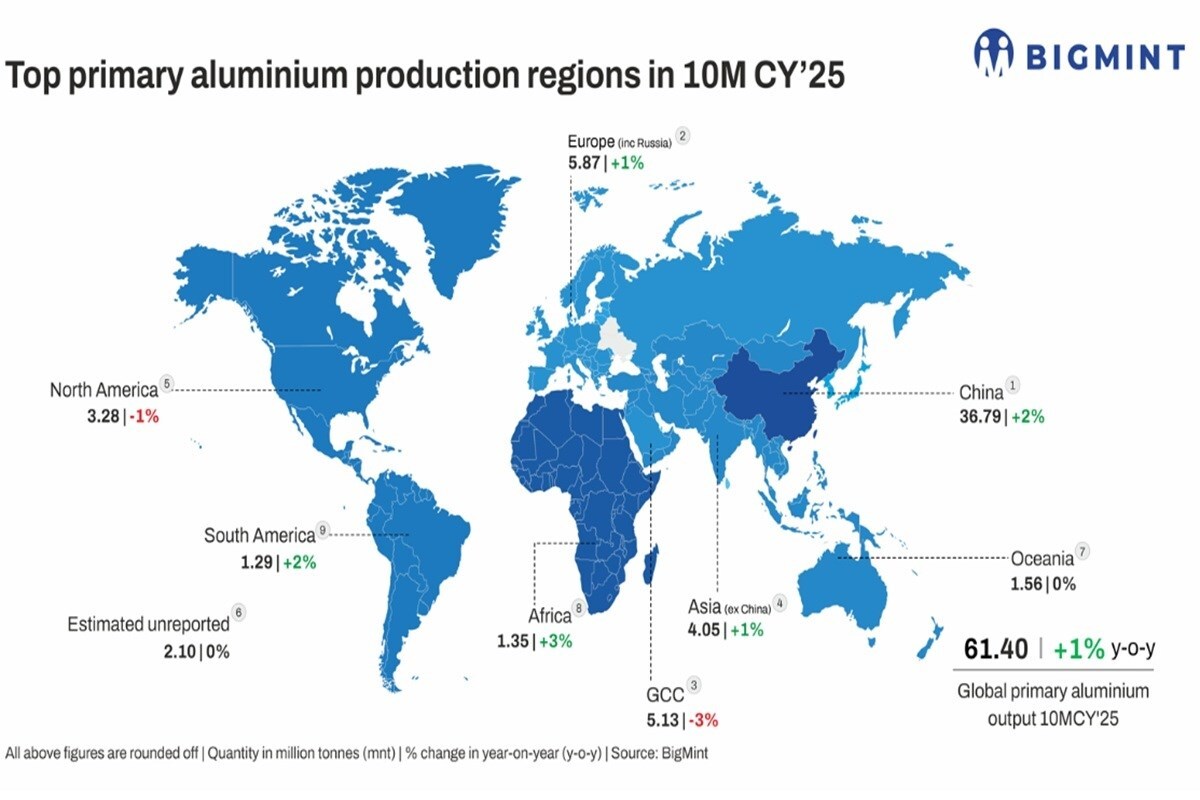

Global primary aluminium output stood at 61.40 mnt, marking a modest 1 per cent y-o-y rise.

China played a pivotal role in supporting global supply. Its primary aluminium production reached 36.79 mnt during January-October, up 2 per cent y-o-y. Improved smelter profitability encouraged stable operations, with average margins climbing to RMB 5,255 per tonneonne (tonne) ( USD 746 per tonne) in October, the highest since March 2022.

However, China's primary aluminium sector is approaching its government-imposed production cap of 45 mnt, while new smelter additions face mounting hurdles linked to power contracts, renewable energy availability, and carbon-compliance requirements. These constraints limit China's ability to expand primary supply meaningfully, reinforcing the importance of recycled aluminium and supporting global scrap trade over the medium term.

Read More: World Bank sees steady metals prices, with aluminium among the expected gainers in 2026 -27

Major exporting countries in 10MCY'25

The United States (US) remained the global leader in aluminium scrap exports. Volumes increased by 6 per cent y-o-y in 10MCY'25. Germany remained the second-largest exporter, with shipments decreasing 3 per cent y-o-y.

Other key exporters such as the Middle East and Thailand saw gains of 19 per cent and 52 per cent y-o-y, respectively. On the other hand, Canada's volumes jumped 9 per cent and the UK largely stable y-o-y in 10MCY'25.

Region-wise highlights

United States: Overall aluminium scrap exports from the US increased 6 per cent y-o-y in 10MCY'25 to 1.79 mnt from 1.69 mnt a year earlier, driven by weak domestic demand. Mills' appetite for recycled aluminium remained subdued, with wide price spreads discouraging transactions and most rolling mills either staying on the sidelines or offering levels unattractive to sellers. Meanwhile, elevated all-in aluminium prices drew a surge of recycled metal into the US, creating oversupply. This imbalance pushed surplus material into export markets as domestic absorption remained limited.

Thailand was the largest export destination for the US, with volumes surging 41 per cent y-o-y to 0.38 mnt in 10MCY'25 from the previous year's 0.27 mnt. The significant increase was driven by strong procurement from Thai polishing and flotation plants, smooth clearance procedures, and well-coordinated financing backed by large Chinese enterprises. These factors reinforced buyer confidence and boosted downstream flows into China. Notably, Thailand's exports jumped 52 per cent, as China raised its intake by a significant 69 per cent y-o-y to 0.47 mnt.

In contrast, aluminium scrap exports to India declined 3 per cent y-o-y to 0.34 mnt in 10MCY'25 from 0.35 mnt. Shipments from the US fell as higher tariffs -- raised from 25 per cent to 50 per cent in June 2025 -- made US-origin material less viable for Indian buyers.

Meanwhile, US exports to Malaysiadeclined by 17 per cent y-o-y to 0.25 mnt. Malaysia faced shipment disruptions not just from the US but also from most supplying countries as tighter inspection measures led to port congestion and longer clearance times.

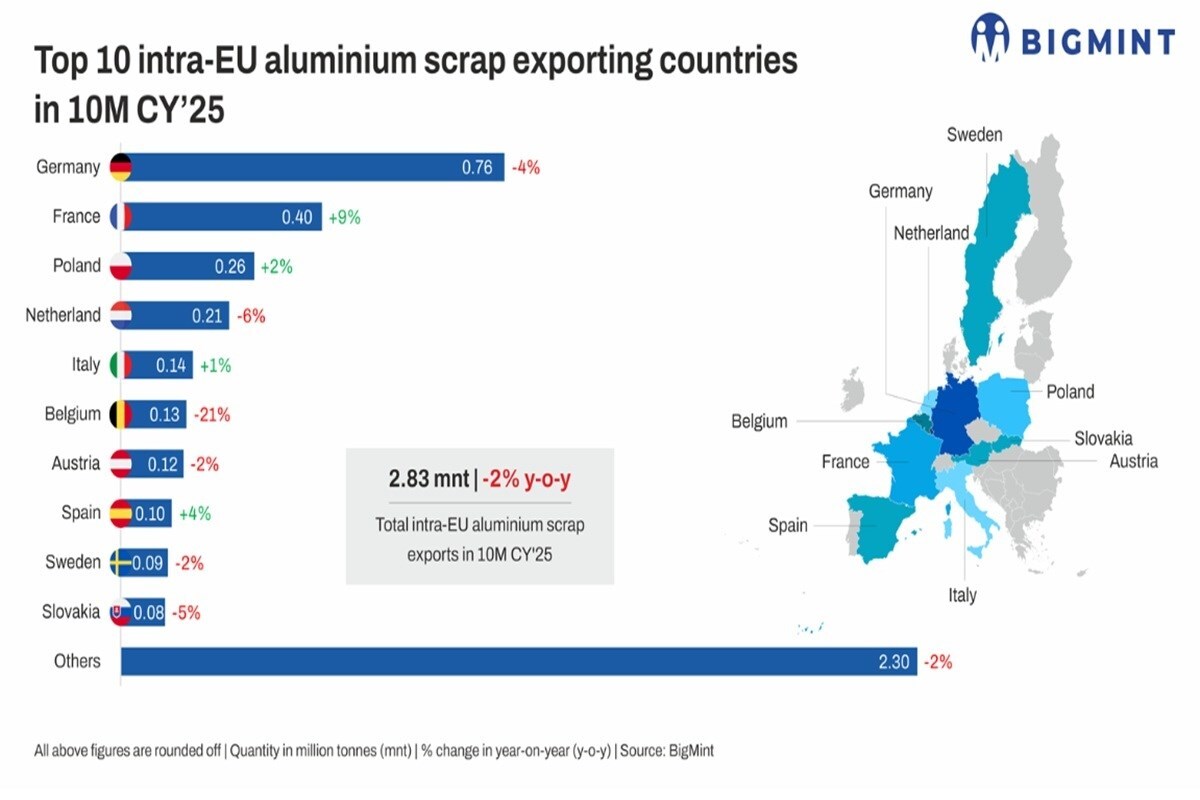

EU-27: Within the EU-27, export and intra-bloc trade dynamics weakened amid sluggish industrial activity. The intra-EU scrap trade volume fell 2 per cent y-o-y to 2.83 mnt, reflecting weak demand from automotive and construction sectors, regulatory uncertainty, and growing caution among recyclers.

Overall EU-27 exports to the rest of the world remained broadly steady at 1.04 mnt, even as volumes from major suppliers such as the Netherlands (-13.1 per cent to 0.33 mnt) and Belgium (-16.2 per cent to 0.26 mnt) declined. Germany, the region's largest exporter, shipped 0.96 mnt in 10MCY'25, down 3 per cent y-o-y, as weak industrial output, subdued investment, and a soft growth outlook curtailed scrap generation.

At the policy level, the EU-27 intensified efforts in 2025 to curb so-called "scrap leakage". The bloc generates around 5 mnt of aluminium scrap annually but lacks sufficient domestic processing capacity due to environmental constraints, labour shortages, and technological limitations. While a full export ban remains unlikely, proposals such as tighter reporting requirements, quotas, or export tariffs are expected to reshape trade flows.

The upcoming full implementation of the Carbon Border Adjustment Mechanism (CBAM) in 2026 further complicates the outlook. Higher carbon costs for primary aluminium are likely to lift domestic demand for low-carbon and recycled metal within the EU-27, potentially tightening export availability.

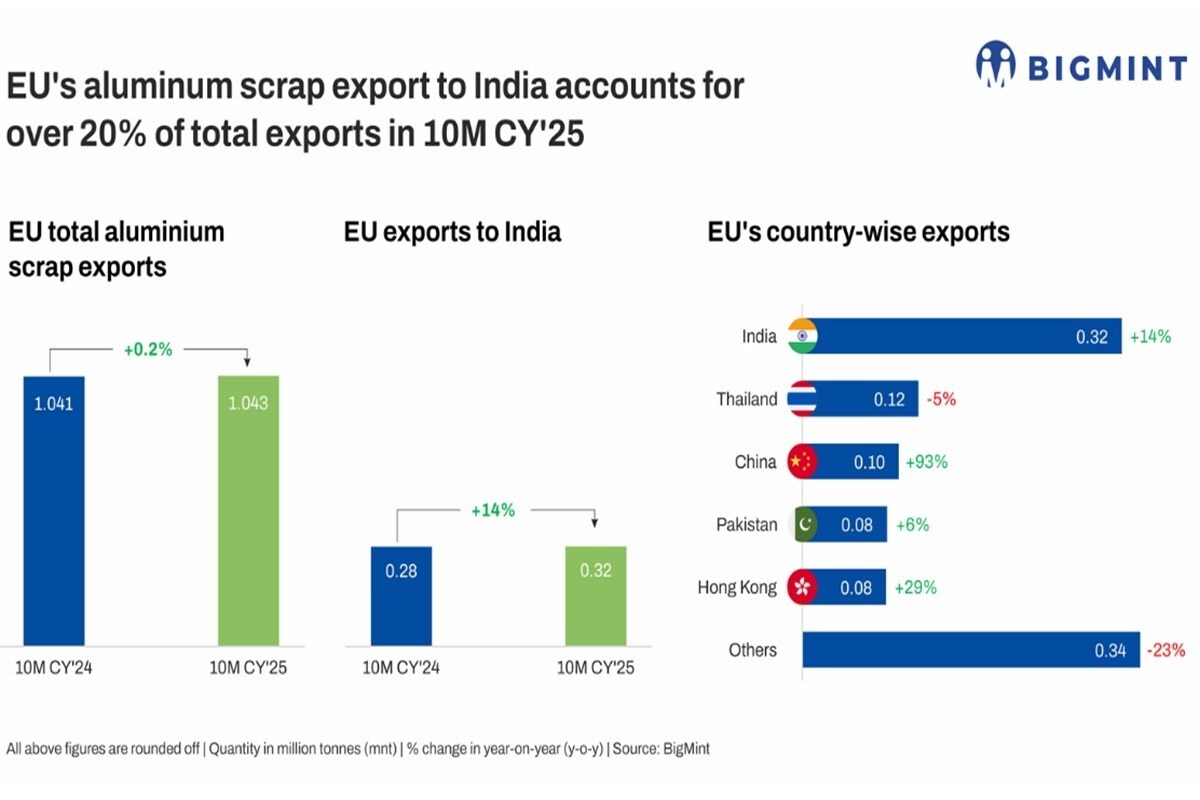

India, which was the leading importer of EU-origin aluminium scrap and whose intake was up 14 per cent y-o-y to 0.32 mnt in 10MCY'25, remains particularly exposed to these evolving regulatory and supply-side risks. Following the US tariffs, the cost of US scrap rose sharply, making it less competitive for Indian buyers. Given that India depends on imports for approximately 85 per cent of its aluminium scrap, this price spike created an urgent need to diversify supply sources.

To bridge the gap, India increasingly turned to alternative suppliers, including the EU-27, to ensure continuity of raw material availability while mitigating dependence on any single market.

Middle East: Aluminium scrap exports from the Middle East remained robust at 0.64mnt in 10MCY'25, a 19 per cent increase from 0.54mnt in 10MCY'24. India remained the largest importer, accounting for nearly 30 per cent of the region's total shipments, with intake rising 17 per cent y-o-y to 0.37 mnt. Proximity and the need to compensate for reduced US scrap supplies drove this growth, helping India maintain steady feedstock for its downstream aluminium industry amid global supply shifts.

Canada: Canada's scrap exportsincreased by 9 per cent y-o-y to 0.57 mnt, led by a 15 per cent rise in shipments to the US, which totalled 0.39 mnt. Following the introduction of US tariffs, which targeted only semi-finished and finished aluminium products while excluding scrap, US aluminium producers began relying more on internal scrap supplies while also importing scrap from Canada and Mexico during the initialphase of the tariffs.

Must read: Key industry individuals share their thoughts on the trending topics

The surge in scrap availability in the US market, however, led to a temporary moderation in domestic demand, as abundant supply eased pressure on local consumption. At the same time, US scrap exports experienced a slight uptick, driven by higher price realizations from certain Asian markets that were willing to pay a premium for quality aluminium scrap.

UK: Aluminium scrap exports from the UK remained largely steady in 10MCY'25, with only a minor 0.2 per cent decline to 0.52 mnt. The market faced a challenging year due to evolving environmental regulations, export pressures, and shifts in material handling requirements.

Despite these headwinds, mid-year price increases in aluminium encouraged material to flow back into yards, supporting export volumes. However, margin pressures, cautious consumer and exporter activity, and the uncertainty caused by events such as Unimetals Recycling's liquidation limited significant growth in exports.

Outlook

Global aluminium scrap trade is entering a phase of heightened uncertainty as 2025 ends. EU export controls, US tariffs, and regulatory changesin the Middle East areexpected toreshapesupply flows in 2026. India remainsa primary importer, but rising policy-driven risks may tighten availability and push prices upward. Additionally, rising demand from China is expected to be a significant factor, especially asthe government has outlined plans to recycle morethan 15 mntof aluminium output, as per media reports.

Note: This article has been issued by Bigmint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses