您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The national weighted average full cost for alumina in September was approximately RMB 3,002 per tonne, up RMB 15 per tonne month-on-month. The weighted average cash cost was approximately RMB 2,832 per tonne.

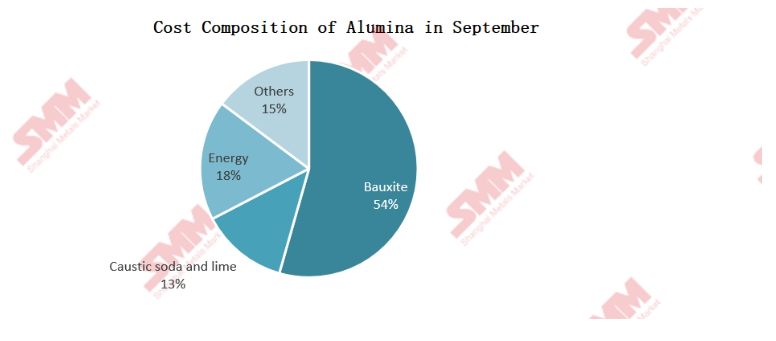

Cost Breakdown Analysis:

Bauxite market: The spot price for imported bauxite from Guinea fluctuated within the range of USD 73 to USD 75 per tonne throughout September, settling at an average of USD 74 per tonne. Prices for Australian bauxite remained largely stable. Overall, cost support from the bauxite market is weakening. While domestic bauxite supply in China tightened due to factors like safety inspections and commemorative events, the impact on prices was minimal. In contrast, imported bauxite prices have begun to soften, showing a slight downward trend. This is attributed to persistently high port inventories and mounting financial pressure on alumina producers, many of whom are operating at a loss.

Looking ahead to October, domestic bauxite supply is expected to remain constrained, though prices are forecast to be flat. For imports, shipment volumes remain sufficient. Even considering the seasonal rainy season in Guinea, no major supply shortfall is anticipated. With alumina plants maintaining high raw material inventories and buyers actively seeking price reductions to protect their margins, market sentiment continues to resist high-priced bauxite. Consequently, long-term contract prices for the fourth quarter are projected to fall compared to the previous quarter. In summary, SMM's comprehensive analysis indicates that bauxite raw material costs for alumina production are expected to trend downward. It is essential to monitor changes in port inventories and the procurement strategies of major alumina plants.

Caustic Soda Market: The domestic caustic soda market exhibited mixed trends in September. Long-term contract prices rose in the Shanxi, Henan, and Guangxi regions, increasing local production costs. However, prices in the key Shandong region declined.

Entering October, the market is showing clearer signs of downward pressure. Long-term contract prices in Shanxi have decreased by RMB 200 per tonne, with prices in Henan expected to follow suit with a drop of RMB 100-200 per tonne. Prices in Guangxi are stable, while prices in Shandong have continued their downward trend from the previous period. The average price for October is expected to be lower than September's level. Overall, caustic soda prices are facing widespread pressure, and the cost of caustic soda for alumina production is expected to trend lower.

Overall Cost Forecast:

In summary, SMM predicts a slight decrease in the national weighted average full cost of alumina production in October. The cost is projected to operate within a range of RMB 2,930 to 3,030 per tonne, with the cash cost expected to be between RMB 2,750 and 2,850 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses